| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907700000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

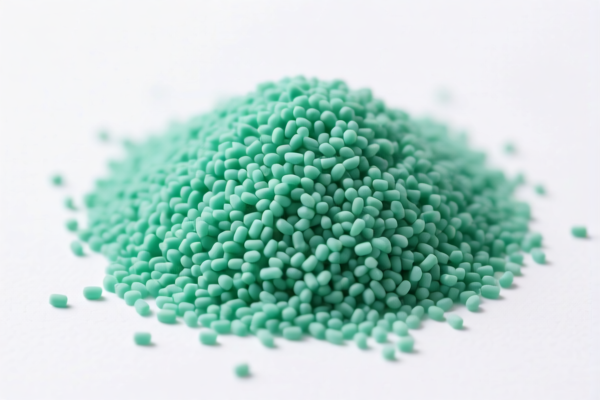

Product Name: Milky White Polystyrene Resin

Classification: Based on the provided HS codes, the most likely classification for "Milky White Polystyrene Resin" is 3903110000 ("Polystyrene foam resin"). However, depending on the specific application and form, other codes may also be applicable. Below is a detailed breakdown of the HS codes and their associated tariff information:

🔍 HS Code Classification Overview

- HS Code: 3903110000

- Description: Polystyrene foam resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most likely code for "Milky White Polystyrene Resin" if it is used for foam applications.

-

HS Code: 3903905000

- Description: Polystyrene injection molding grade resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: If the resin is intended for injection molding, this code may be more appropriate.

-

HS Code: 3907700000

- Description: Polylactic acid resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for biodegradable polylactic acid (PLA) resin, not applicable to polystyrene.

-

HS Code: 3904100000

- Description: Emulsion-type PVC resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for PVC resin in emulsion form, not polystyrene.

-

HS Code: 3907995010

- Description: PBT white resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PBT (polybutylene terephthalate) resin, not polystyrene.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties listed for these HS codes. However, this may change depending on trade policies and import origin.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed polystyrene and not another type of resin (e.g., PVC, PLA, PBT), as this will determine the correct HS code. -

Check Unit Price and Certification Requirements:

Some HS codes may require specific certifications (e.g., RoHS, REACH) depending on the end-use and country of import. -

Plan for Tariff Increases:

If importing after April 11, 2025, be prepared for a 30.0% additional tariff, which could significantly impact your total cost. -

Consult with Customs Broker or Trade Compliance Officer:

For complex or high-value shipments, it is advisable to seek professional assistance to ensure correct classification and compliance.

Let me know if you need help determining the most accurate HS code based on your product's specifications.

Product Name: Milky White Polystyrene Resin

Classification: Based on the provided HS codes, the most likely classification for "Milky White Polystyrene Resin" is 3903110000 ("Polystyrene foam resin"). However, depending on the specific application and form, other codes may also be applicable. Below is a detailed breakdown of the HS codes and their associated tariff information:

🔍 HS Code Classification Overview

- HS Code: 3903110000

- Description: Polystyrene foam resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most likely code for "Milky White Polystyrene Resin" if it is used for foam applications.

-

HS Code: 3903905000

- Description: Polystyrene injection molding grade resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: If the resin is intended for injection molding, this code may be more appropriate.

-

HS Code: 3907700000

- Description: Polylactic acid resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for biodegradable polylactic acid (PLA) resin, not applicable to polystyrene.

-

HS Code: 3904100000

- Description: Emulsion-type PVC resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for PVC resin in emulsion form, not polystyrene.

-

HS Code: 3907995010

- Description: PBT white resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PBT (polybutylene terephthalate) resin, not polystyrene.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties listed for these HS codes. However, this may change depending on trade policies and import origin.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed polystyrene and not another type of resin (e.g., PVC, PLA, PBT), as this will determine the correct HS code. -

Check Unit Price and Certification Requirements:

Some HS codes may require specific certifications (e.g., RoHS, REACH) depending on the end-use and country of import. -

Plan for Tariff Increases:

If importing after April 11, 2025, be prepared for a 30.0% additional tariff, which could significantly impact your total cost. -

Consult with Customs Broker or Trade Compliance Officer:

For complex or high-value shipments, it is advisable to seek professional assistance to ensure correct classification and compliance.

Let me know if you need help determining the most accurate HS code based on your product's specifications.

Customer Reviews

No reviews yet.