| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5407910510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5515990520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516310510 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5408310510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 6211496030 | Doc | 49.5% | CN | US | 2025-05-12 |

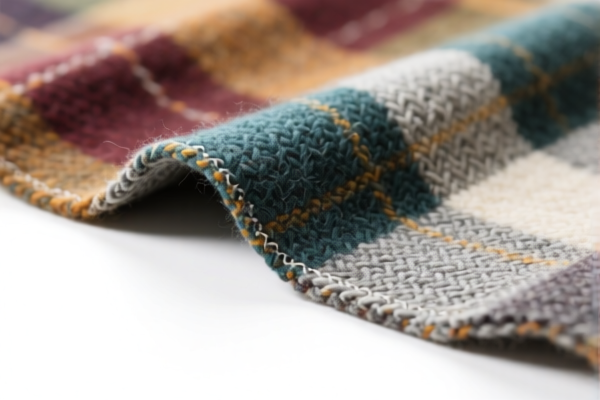

Product Name: Mixed Carded Wool Interlining Fabric

Classification HS Code Analysis and Tax Overview:

✅ HS CODE: 5407910510

Description:

- Applicable to wool-blend interlining fabric containing 36% or more of wool or fine animal hair, unbleached or bleached.

Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5515990520

Description:

- Applicable to wool-blend fabric for clothing interlining, containing 36% or more of wool or fine animal hair, carded woven fabric.

Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5516310510

Description:

- Applicable to wool-blend fabric for clothing interlining, containing 36% or more of wool or fine animal hair, unbleached and uncarded.

Tariff Summary:

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 74.8%

✅ HS CODE: 5408310510

Description:

- Applicable to wool-blend lining fabric with synthetic fibers blended with wool.

Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 6211496030

Description:

- Applicable to wool-blend shirts, classified as women's or girls' clothing made of wool or fine animal hair.

Tariff Summary:

- Base Tariff: 12.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 49.5%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025 for most of the above HS codes. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the fabric (e.g., wool percentage, whether it is carded or uncarded, bleached or unbleached) to ensure correct HS code classification. -

Certifications Required:

Check if import permits, textile certifications, or origin documentation are required for the product, especially if it is being imported into countries with strict textile regulations. -

Unit Price and Classification:

The unit price may affect the classification and applicable tariffs. Ensure that the product is not misclassified as a finished garment (e.g., HS 6211496030) if it is intended for interlining use.

📌 Proactive Advice:

- Consult a customs broker or HS code expert for confirmation, especially if the product is close to the boundary of multiple classifications.

- Keep detailed documentation of fabric composition, processing, and intended use to support customs declarations.

Product Name: Mixed Carded Wool Interlining Fabric

Classification HS Code Analysis and Tax Overview:

✅ HS CODE: 5407910510

Description:

- Applicable to wool-blend interlining fabric containing 36% or more of wool or fine animal hair, unbleached or bleached.

Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5515990520

Description:

- Applicable to wool-blend fabric for clothing interlining, containing 36% or more of wool or fine animal hair, carded woven fabric.

Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5516310510

Description:

- Applicable to wool-blend fabric for clothing interlining, containing 36% or more of wool or fine animal hair, unbleached and uncarded.

Tariff Summary:

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 74.8%

✅ HS CODE: 5408310510

Description:

- Applicable to wool-blend lining fabric with synthetic fibers blended with wool.

Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 6211496030

Description:

- Applicable to wool-blend shirts, classified as women's or girls' clothing made of wool or fine animal hair.

Tariff Summary:

- Base Tariff: 12.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 49.5%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025 for most of the above HS codes. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the fabric (e.g., wool percentage, whether it is carded or uncarded, bleached or unbleached) to ensure correct HS code classification. -

Certifications Required:

Check if import permits, textile certifications, or origin documentation are required for the product, especially if it is being imported into countries with strict textile regulations. -

Unit Price and Classification:

The unit price may affect the classification and applicable tariffs. Ensure that the product is not misclassified as a finished garment (e.g., HS 6211496030) if it is intended for interlining use.

📌 Proactive Advice:

- Consult a customs broker or HS code expert for confirmation, especially if the product is close to the boundary of multiple classifications.

- Keep detailed documentation of fabric composition, processing, and intended use to support customs declarations.

Customer Reviews

No reviews yet.