| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5408311000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5514303920 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5211590090 | Doc | 63.1% | CN | US | 2025-05-12 |

| 5407830030 | Doc | 63.5% | CN | US | 2025-05-12 |

| 5210496010 | Doc | 65.4% | CN | US | 2025-05-12 |

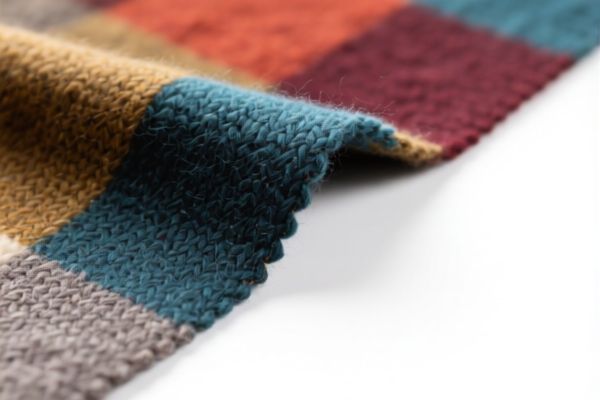

Here is the structured classification and tariff information for the Mixed Wool Stain Resistant Fabric based on the provided HS codes and tax details:

🔍 HS CODE: 5408311000

Product Description: Wool Mixed Fabric with Stain Resistance

Total Tax Rate: 67.0%

Tax Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5514303920

Product Description: Mixed Jacquard Stain Resistant Fabric

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5211590090

Product Description: Printed Mixed Stain Resistant Fabric

Total Tax Rate: 63.1%

Tax Breakdown:

- Base Tariff: 8.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5407830030

Product Description: Printed Mixed Stain Resistant Fabric

Total Tax Rate: 63.5%

Tax Breakdown:

- Base Tariff: 8.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5210496010

Product Description: Oxford Style Mixed Stain Resistant Fabric

Total Tax Rate: 65.4%

Tax Breakdown:

- Base Tariff: 10.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All listed products are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- Anti-dumping duties: Not applicable for these textile products.

- Certifications: Ensure the fabric meets any required certifications (e.g., stain resistance standards, textile safety regulations) for import compliance.

- Material Verification: Confirm the exact composition of the fabric (e.g., wool content, fiber types) to ensure correct HS code classification.

- Unit Price: Verify the unit price and total value for accurate duty calculation.

✅ Proactive Advice:

- Double-check the fabric composition and finish (e.g., printed, jacquard, oxford) to match the correct HS code.

- Keep updated records of product specifications and certifications.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with duty calculation or HS code verification for a specific product. Here is the structured classification and tariff information for the Mixed Wool Stain Resistant Fabric based on the provided HS codes and tax details:

🔍 HS CODE: 5408311000

Product Description: Wool Mixed Fabric with Stain Resistance

Total Tax Rate: 67.0%

Tax Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5514303920

Product Description: Mixed Jacquard Stain Resistant Fabric

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5211590090

Product Description: Printed Mixed Stain Resistant Fabric

Total Tax Rate: 63.1%

Tax Breakdown:

- Base Tariff: 8.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5407830030

Product Description: Printed Mixed Stain Resistant Fabric

Total Tax Rate: 63.5%

Tax Breakdown:

- Base Tariff: 8.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5210496010

Product Description: Oxford Style Mixed Stain Resistant Fabric

Total Tax Rate: 65.4%

Tax Breakdown:

- Base Tariff: 10.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All listed products are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- Anti-dumping duties: Not applicable for these textile products.

- Certifications: Ensure the fabric meets any required certifications (e.g., stain resistance standards, textile safety regulations) for import compliance.

- Material Verification: Confirm the exact composition of the fabric (e.g., wool content, fiber types) to ensure correct HS code classification.

- Unit Price: Verify the unit price and total value for accurate duty calculation.

✅ Proactive Advice:

- Double-check the fabric composition and finish (e.g., printed, jacquard, oxford) to match the correct HS code.

- Keep updated records of product specifications and certifications.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with duty calculation or HS code verification for a specific product.

Customer Reviews

No reviews yet.