| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5602210000 | Doc | 49.5¢/kg + 7.5%+55.0% | CN | US | 2025-05-12 |

| 5602109010 | Doc | 65.6% | CN | US | 2025-05-12 |

| 5603941010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5603941090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6201401510 | Doc | 49.7¢/kg + 19.7%+37.5% | CN | US | 2025-05-12 |

| 6203410110 | Doc | 45.1% | CN | US | 2025-05-12 |

| 6203410120 | Doc | 45.1% | CN | US | 2025-05-12 |

| 6202204011 | Doc | 36¢/kg + 16.3%+37.5% | CN | US | 2025-05-12 |

| 6202401510 | Doc | 43.5¢/kg + 19.7%+37.5% | CN | US | 2025-05-12 |

| 6204610510 | Doc | 45.1% | CN | US | 2025-05-12 |

| 6204630810 | Doc | 51.1% | CN | US | 2025-05-12 |

| 5801100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5802300020 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5802300090 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5809000000 | Doc | 69.9% | CN | US | 2025-05-12 |

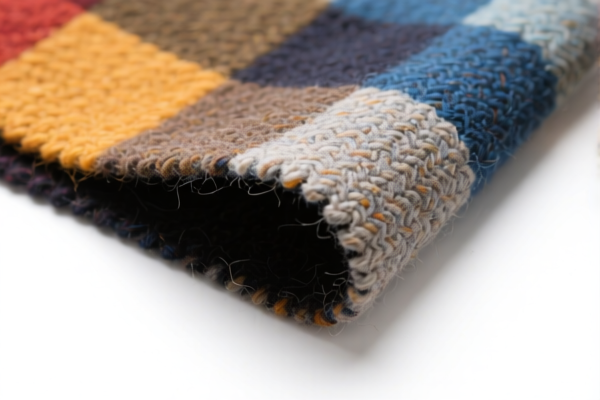

Customs Compliance Analysis for Mixed Wool Waterproof Fabric

Based on the provided product description and HS codes, the Mixed Wool Waterproof Fabric likely falls under HS Code 5602210000 or 5602109010, depending on the specific construction and composition of the fabric. Below is a structured analysis of the applicable tariffs and compliance considerations.

🔍 HS Code 5602210000

Description: Felt, not impregnated, coated, covered or laminated, of wool or fine animal hair

Tariff Details:

- Base Tariff: 49.5¢/kg + 7.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 49.5¢/kg + 7.5% + 55.0% = 62.5% (approx.)

🔍 HS Code 5602109010

Description: Needleloom felt and stitchbonded fiber fabrics, of wool or fine animal hair

Tariff Details:

- Base Tariff: 10.6%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 10.6% + 25.0% + 30.0% = 65.6%

⚠️ Important Notes on Tariff Changes

📅 April 11, 2025 Special Tariff

- Applies to all listed HS codes.

- Tariff Increase: 30.0% added after April 11, 2025.

- Impact: This will significantly increase the total import cost, especially for products with lower base tariffs.

📉 Additional Tariffs (25.0%)

- Already in effect for all listed HS codes.

- Purpose: General import duties or trade policy measures.

📌 Proactive Compliance Advice

✅ Verify the Following Before Importing

- Material Composition: Confirm that the fabric is 100% wool or fine animal hair, or contains 36% or more by weight of wool/fine animal hair (if applicable to other HS codes).

- Fabric Construction: Determine if it is felt, nonwoven, woven pile, or tufted to ensure correct HS code classification.

- Waterproofing Treatment: If the fabric is waterproof, ensure it is not classified under a different heading (e.g., 6201, 6202, 6203, 6204) that may apply to garments.

- Unit Price and Weight: Tariffs with ¢/kg components require accurate weight per unit for proper calculation.

📋 Certifications and Documentation

- Import License: Required for certain textiles, especially if subject to anti-dumping duties or special tariffs.

- Product Certification: Ensure the fabric meets safety, environmental, and labeling standards (e.g., REACH, CPSIA, etc.).

- Origin Documentation: If importing from a non-preferential country, ensure origin certificates are available to avoid higher tariffs.

📊 Summary of Key Tax Rate Changes

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tariff |

|---|---|---|---|---|

| 5602210000 | 49.5¢/kg + 7.5% | 25.0% | 30.0% | 49.5¢/kg + 62.5% |

| 5602109010 | 10.6% | 25.0% | 30.0% | 65.6% |

| 5603941010 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5603941090 | 0.0% | 25.0% | 30.0% | 55.0% |

| 6201401510 | 49.7¢/kg + 19.7% | 7.5% | 30.0% | 49.7¢/kg + 37.5% |

| 6203410110 | 7.6% | 7.5% | 30.0% | 45.1% |

| 6202204011 | 36¢/kg + 16.3% | 7.5% | 30.0% | 36¢/kg + 37.5% |

| 6202401510 | 43.5¢/kg + 19.7% | 7.5% | 30.0% | 43.5¢/kg + 37.5% |

| 6204610510 | 7.6% | 7.5% | 30.0% | 45.1% |

| 6204630810 | 13.6% | 7.5% | 30.0% | 51.1% |

| 5801100000 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5802300020 | 6.2% | 25.0% | 30.0% | 61.2% |

| 5802300090 | 6.2% | 25.0% | 30.0% | 61.2% |

| 5809000000 | 14.9% | 25.0% | 30.0% | 69.9% |

🛑 Critical Reminder

- April 11, 2025 is a critical date for tariff changes. Ensure your import timeline is planned accordingly.

- If the fabric is used in garments, consider garment-specific HS codes (e.g., 6201, 6202, 6203, 6204) and their different tariff structures.

- Double-check the material composition and fabric type to avoid misclassification and customs penalties.

Let me know if you need help with HS code verification, tariff calculation, or customs documentation.

Customs Compliance Analysis for Mixed Wool Waterproof Fabric

Based on the provided product description and HS codes, the Mixed Wool Waterproof Fabric likely falls under HS Code 5602210000 or 5602109010, depending on the specific construction and composition of the fabric. Below is a structured analysis of the applicable tariffs and compliance considerations.

🔍 HS Code 5602210000

Description: Felt, not impregnated, coated, covered or laminated, of wool or fine animal hair

Tariff Details:

- Base Tariff: 49.5¢/kg + 7.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 49.5¢/kg + 7.5% + 55.0% = 62.5% (approx.)

🔍 HS Code 5602109010

Description: Needleloom felt and stitchbonded fiber fabrics, of wool or fine animal hair

Tariff Details:

- Base Tariff: 10.6%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 10.6% + 25.0% + 30.0% = 65.6%

⚠️ Important Notes on Tariff Changes

📅 April 11, 2025 Special Tariff

- Applies to all listed HS codes.

- Tariff Increase: 30.0% added after April 11, 2025.

- Impact: This will significantly increase the total import cost, especially for products with lower base tariffs.

📉 Additional Tariffs (25.0%)

- Already in effect for all listed HS codes.

- Purpose: General import duties or trade policy measures.

📌 Proactive Compliance Advice

✅ Verify the Following Before Importing

- Material Composition: Confirm that the fabric is 100% wool or fine animal hair, or contains 36% or more by weight of wool/fine animal hair (if applicable to other HS codes).

- Fabric Construction: Determine if it is felt, nonwoven, woven pile, or tufted to ensure correct HS code classification.

- Waterproofing Treatment: If the fabric is waterproof, ensure it is not classified under a different heading (e.g., 6201, 6202, 6203, 6204) that may apply to garments.

- Unit Price and Weight: Tariffs with ¢/kg components require accurate weight per unit for proper calculation.

📋 Certifications and Documentation

- Import License: Required for certain textiles, especially if subject to anti-dumping duties or special tariffs.

- Product Certification: Ensure the fabric meets safety, environmental, and labeling standards (e.g., REACH, CPSIA, etc.).

- Origin Documentation: If importing from a non-preferential country, ensure origin certificates are available to avoid higher tariffs.

📊 Summary of Key Tax Rate Changes

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tariff |

|---|---|---|---|---|

| 5602210000 | 49.5¢/kg + 7.5% | 25.0% | 30.0% | 49.5¢/kg + 62.5% |

| 5602109010 | 10.6% | 25.0% | 30.0% | 65.6% |

| 5603941010 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5603941090 | 0.0% | 25.0% | 30.0% | 55.0% |

| 6201401510 | 49.7¢/kg + 19.7% | 7.5% | 30.0% | 49.7¢/kg + 37.5% |

| 6203410110 | 7.6% | 7.5% | 30.0% | 45.1% |

| 6202204011 | 36¢/kg + 16.3% | 7.5% | 30.0% | 36¢/kg + 37.5% |

| 6202401510 | 43.5¢/kg + 19.7% | 7.5% | 30.0% | 43.5¢/kg + 37.5% |

| 6204610510 | 7.6% | 7.5% | 30.0% | 45.1% |

| 6204630810 | 13.6% | 7.5% | 30.0% | 51.1% |

| 5801100000 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5802300020 | 6.2% | 25.0% | 30.0% | 61.2% |

| 5802300090 | 6.2% | 25.0% | 30.0% | 61.2% |

| 5809000000 | 14.9% | 25.0% | 30.0% | 69.9% |

🛑 Critical Reminder

- April 11, 2025 is a critical date for tariff changes. Ensure your import timeline is planned accordingly.

- If the fabric is used in garments, consider garment-specific HS codes (e.g., 6201, 6202, 6203, 6204) and their different tariff structures.

- Double-check the material composition and fabric type to avoid misclassification and customs penalties.

Let me know if you need help with HS code verification, tariff calculation, or customs documentation.

Customer Reviews

No reviews yet.