| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911901500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907300000 | Doc | 61.1% | CN | US | 2025-05-12 |

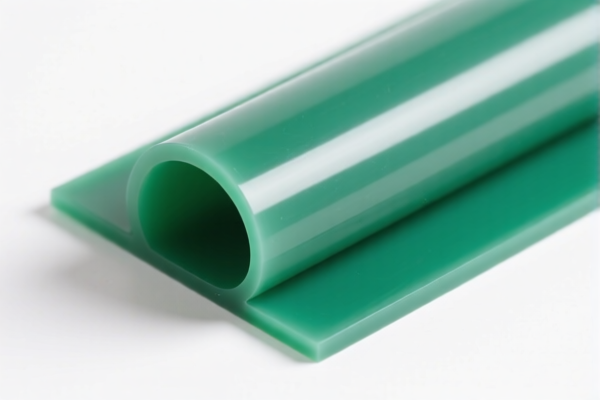

Here is the structured analysis and classification for the Modified Thermoplastic Resin product based on the provided HS codes and tariff details:

🔍 HS Code Classification Overview

1. HS Code: 3911901500

Product Description: Modified aromatic thermoplastic resin

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

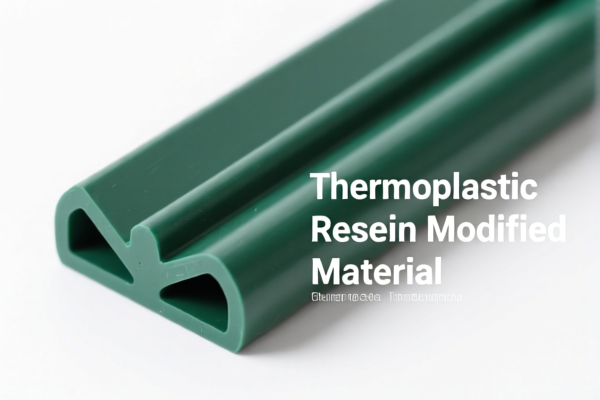

2. HS Code: 3911902500

Product Description: Modified thermoplastic elastomer

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

3. HS Code: 3911902500

Product Description: Modified polyester resin

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

4. HS Code: 3907995050

Product Description: Modified polyester resin

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

5. HS Code: 3907300000

Product Description: Modified epoxy resin

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

⚠️ Important Notes and Recommendations

- April 11 Special Tariff: Applies to all products listed above after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: May apply depending on the origin of the product and specific trade policies. Verify if the product is subject to any anti-dumping measures.

- Material and Certification Requirements: Confirm the exact chemical composition and whether any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product.

- Unit Price and Classification: Ensure the product is correctly classified under the appropriate HS code based on its specific formulation and end-use.

✅ Proactive Advice

- Verify the exact product composition to ensure correct HS code classification.

- Check the origin of the product to determine if additional tariffs or anti-dumping duties apply.

- Review the April 11, 2025, policy update to adjust your import strategy accordingly.

- Consult with customs brokers or trade compliance experts for complex or high-value shipments.

Let me know if you need help with HS code verification or tariff calculation for a specific shipment. Here is the structured analysis and classification for the Modified Thermoplastic Resin product based on the provided HS codes and tariff details:

🔍 HS Code Classification Overview

1. HS Code: 3911901500

Product Description: Modified aromatic thermoplastic resin

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

2. HS Code: 3911902500

Product Description: Modified thermoplastic elastomer

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

3. HS Code: 3911902500

Product Description: Modified polyester resin

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

4. HS Code: 3907995050

Product Description: Modified polyester resin

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

5. HS Code: 3907300000

Product Description: Modified epoxy resin

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This product is subject to the April 11 Special Tariff and anti-dumping duties if applicable.

⚠️ Important Notes and Recommendations

- April 11 Special Tariff: Applies to all products listed above after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: May apply depending on the origin of the product and specific trade policies. Verify if the product is subject to any anti-dumping measures.

- Material and Certification Requirements: Confirm the exact chemical composition and whether any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product.

- Unit Price and Classification: Ensure the product is correctly classified under the appropriate HS code based on its specific formulation and end-use.

✅ Proactive Advice

- Verify the exact product composition to ensure correct HS code classification.

- Check the origin of the product to determine if additional tariffs or anti-dumping duties apply.

- Review the April 11, 2025, policy update to adjust your import strategy accordingly.

- Consult with customs brokers or trade compliance experts for complex or high-value shipments.

Let me know if you need help with HS code verification or tariff calculation for a specific shipment.

Customer Reviews

No reviews yet.