| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4016910000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 7323999080 | Doc | 83.4% | CN | US | 2025-05-12 |

HS Code Analysis for "NON SLIP MAT" – A Comprehensive Guide

Based on the provided data, here's a breakdown of the potential HS codes for your "NON SLIP MAT" declaration, along with detailed explanations to help you determine the most accurate classification.

Understanding HS Codes:

The Harmonized System (HS) code is a globally standardized system of names and numbers used to classify traded products. It's crucial for accurate customs declarations, determining applicable duties and taxes, and ensuring smooth import/export processes. The first six digits are generally standardized internationally, while additional digits are specific to each country.

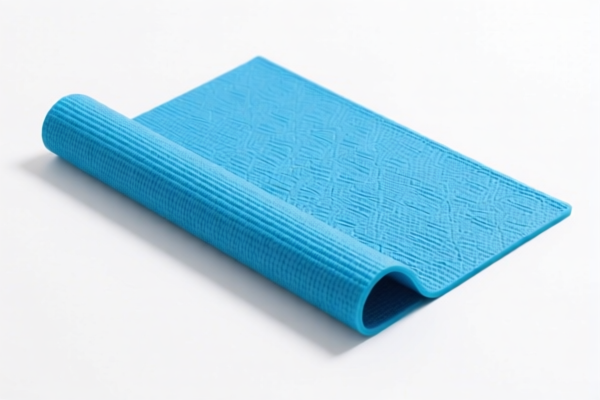

1. HS Code: 4016.91.00.00 – Vulcanized Rubber Mats (Other than Hard Rubber)

- Chapter 40: Rubber and articles thereof. This chapter covers natural, synthetic, or reclaimed rubber products.

- 4016: Other articles of vulcanized rubber other than hard rubber. This specifies products made from vulcanized rubber, excluding hard rubber. Vulcanization is a process that improves the strength and elasticity of rubber.

- 4016.91: Other. This further narrows down the category to "other" articles within the 4016 classification.

-

4016.91.00.00: Floor coverings and mats. This is the most specific classification for mats made from vulcanized rubber.

-

Tax Details:

- Basic Duty: 2.7%

- Additional Duty: 25.0% (Currently)

- Additional Duty (Post April 2, 2025): 30.0%

- Total Tax: 57.7%

-

Considerations: This code is suitable if your mat is primarily made of vulcanized rubber (e.g., natural rubber, styrene-butadiene rubber). Please verify the rubber composition to confirm.

-

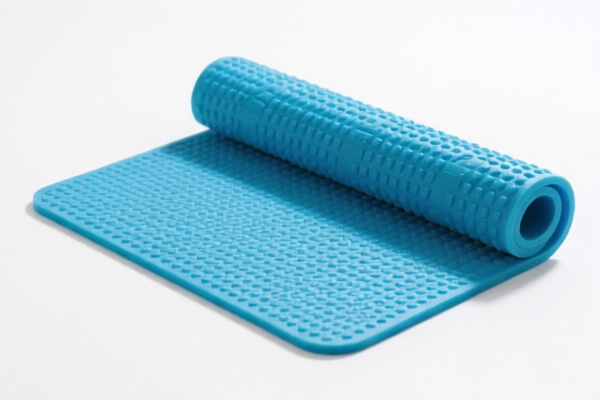

2. HS Code: 3918.10.20.00 – Plastics Floor Coverings

- Chapter 39: Plastics and articles thereof. This chapter covers a wide range of plastic materials and products.

- 3918: Floor coverings of plastics, whether or not self-adhesive, in rolls or in the form of tiles; wall or ceiling coverings of plastics. This specifically targets plastic floor coverings.

- 3918.10: Of polymers of vinyl chloride. This narrows the category to floor coverings made from PVC (Polyvinyl Chloride).

-

3918.10.20.00: Floor coverings: Other. This is the most specific classification for PVC floor coverings.

-

Tax Details:

- Basic Duty: 5.3%

- Additional Duty: 25.0% (Currently)

- Additional Duty (Post April 2, 2025): 30.0%

- Total Tax: 60.3%

-

Considerations: This code is appropriate if your mat is made of PVC or other vinyl polymers. Confirm the plastic composition of the mat.

-

3. HS Code: 7323.99.90.80 – Iron or Steel Mats

- Chapter 73: Iron or steel articles. This chapter covers products made from iron or steel.

- 7323: Table, kitchen or other household articles and parts thereof, of iron or steel; iron or steel wool; pot scourers and scouring or polishing pads, gloves and the like, of iron or steel.

- 7323.99: Other. This covers other articles within the 7323 classification.

-

7323.99.90.80: Other: Other: Not coated or plated with precious metal: Other: Other. This is a very broad classification for other iron or steel household articles.

-

Tax Details:

- Basic Duty: 3.4%

- Additional Duty: 25.0% (Currently)

- Additional Duty (Post April 2, 2025): 30.0% (for steel/aluminum products)

- Total Tax: 83.4%

-

Considerations: This code is only applicable if your mat is primarily made of iron or steel. This is less likely for a typical "non-slip mat" but included for completeness. Verify the material composition.

-

Recommendations & Next Steps:

- Material Composition: The most crucial step is to accurately determine the primary material of your mat. Is it rubber, plastic (specifically PVC), or iron/steel?

- Single Material vs. Composite: If the mat is made of multiple materials, determine the dominant material by weight or volume. The HS code should reflect the primary component.

- Certification: Depending on the material and intended use, you may need specific certifications (e.g., REACH compliance for plastics, safety certifications). Please inquire about required certifications based on your final HS code selection.

- Declare the correct single price: The price of the product will affect the tax rate.

- Consult with a Customs Broker: For complex cases or if you are unsure about the correct classification, it's highly recommended to consult with a licensed customs broker in China. They can provide expert guidance and ensure compliance with all import regulations.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. HS code classifications can be complex and subject to interpretation. Always verify the correct code with the relevant customs authorities or a qualified customs broker.

Customer Reviews

The information on material composition and classification was spot-on. I wish the site had a search function for HS codes, but the content is still very useful.

This site is a lifesaver for figuring out HS codes. The analysis of the 7323.99.90.80 code for steel mats was thorough and easy to understand.

The explanation of the 3918.10.20.00 code was very helpful. I was looking for PVC mats and this clarified everything I needed.

Detailed breakdown of HS code 4016.91.00.00 for vulcanized rubber mats. Great for understanding the tax rates and classification rules.