| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4820102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4911998000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9604000000 | Doc | 42.4% | CN | US | 2025-05-12 |

| 9604000000 | Doc | 42.4% | CN | US | 2025-05-12 |

| 9620005500 | Doc | 58.3% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your declared goods. Here's a structured analysis to help you understand the classification and potential costs.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits are used for more specific categorization at the country level. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of the product.

- Heading (First 4 digits): More specific grouping within the chapter.

- Subheading (First 6 digits): Even more detailed classification.

- Additional Digits: Country-specific refinement.

Analysis of Your Declared Goods

Here's a breakdown of each item, its HS code, and the associated taxes. I'll also provide some notes and recommendations.

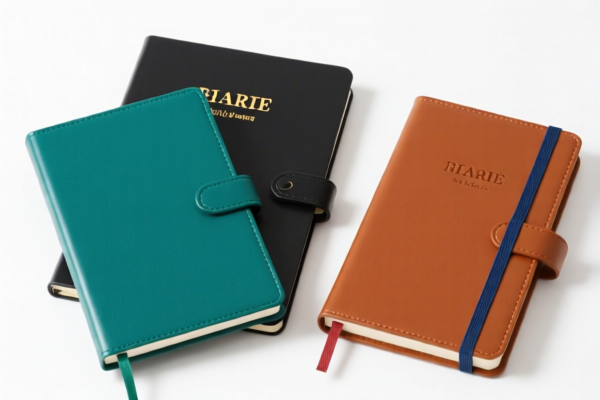

1. Registers, account books, notebooks, order books, receipt books, letter pads, memorandum pads, diaries and similar articles: Diaries, notebooks and address books, bound; memorandum pads, letter pads and similar articles

- HS Code: 4820.10.20.10

- Chapter: 48 (Paper and paperboard; articles of paper pulp, paper, paperboard, cellulose wadding or fibres)

- Heading: 4820 (Registers, account books, notebooks, order books, receipt books, letter pads, memorandum pads, diaries and similar articles)

- Subheading: 4820.10 (Diaries, notebooks and address books, bound; memorandum pads, letter pads and similar articles)

- Tax:

- Basic Duty: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

- Total Tax: 55.0%

- Notes: This classification covers bound paper-based stationery. Ensure the items primarily consist of paper. If they contain significant non-paper components (e.g., plastic covers, electronic elements), the classification might be different.

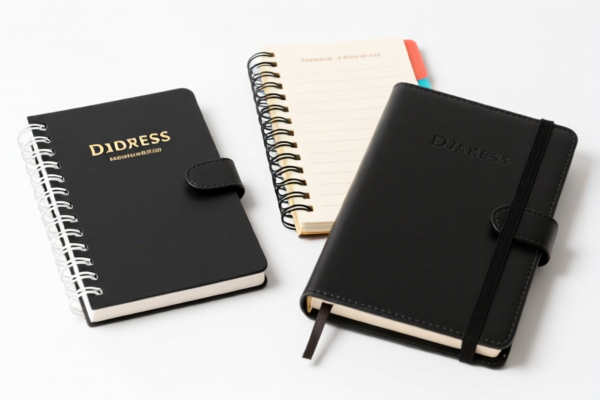

2. Other printed matter, including printed pictures and photographs: Other: Other: Other: Other

- HS Code: 4911.99.80.00

- Chapter: 49 (Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans)

- Heading: 4911 (Other printed matter, including printed pictures and photographs)

- Subheading: 4911.99 (Other)

- Tax:

- Basic Duty: 0.0%

- Additional Tariff: 7.5%

- Tariff after April 2, 2025: 30.0%

- Total Tax: 37.5%

- Notes: This is a broad "catch-all" category for printed materials not specifically covered elsewhere. The description is very general. Be prepared to provide detailed information about the content and purpose of these printed items to customs.

3. Hand sieves and hand riddles

- HS Code: 9604.00.00.00

- Chapter: 96 (Miscellaneous manufactured articles)

- Heading: 9604 (Brushes, sweepers, brooms, mops, feather dusters, shoe brushes, and similar articles)

- Tax:

- Basic Duty: 4.9%

- Additional Tariff: 7.5%

- Tariff after April 2, 2025: 30.0%

- Total Tax: 42.4%

- Notes: This classification seems appropriate for hand sieves and riddles, assuming they are primarily used for household or similar purposes.

4. Hand sieves and hand riddles (Duplicate)

- HS Code: 9604.00.00.00

- Tax: Same as above.

- Notes: This is a duplicate entry. Ensure you don't double-declare the same items.

5. Monopods, bipods, tripods and similar articles: Other: Of wood

- HS Code: 9620.00.55.00

- Chapter: 96 (Miscellaneous manufactured articles)

- Heading: 9620 (Articles of wood)

- Tax:

- Basic Duty: 3.3%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

- Total Tax: 58.3%

- Notes: This classification is appropriate for wooden tripods and similar articles. Crucially, the material (wood) is a key factor here. If these items contain significant non-wood components (e.g., metal legs, plastic parts), the classification might change.

Important Recommendations:

- Material Verification: For items 3 and 5, carefully verify the primary material composition. If non-wood or non-paper components are significant, consult with a customs broker to determine the correct HS code.

- Detailed Descriptions: Provide detailed descriptions of all items to customs, including their intended use, materials, and construction.

- Invoices and Packing Lists: Ensure your invoices and packing lists accurately reflect the contents of each shipment.

- April 2, 2025 Tariff Changes: Be aware of the tariff changes scheduled for April 2, 2025. Factor these changes into your cost calculations.

- Consider a Customs Broker: For complex shipments or if you are unsure about the correct HS code, it is highly recommended to consult with a licensed customs broker. They can provide expert guidance and ensure compliance with all applicable regulations.

- Country of Origin: Confirm the country of origin for each item, as this can affect tariff rates and other import requirements.

Disclaimer: I am an AI chatbot and cannot provide definitive customs advice. This information is for general guidance only. Always consult with a licensed customs broker or relevant government authorities for accurate and up-to-date regulations.

Customer Reviews

The duplicate entry for 9604000000 was a bit confusing. Still, the overall information on HS codes and tariffs was very useful for my business.

I found the explanation of the 37.5% tariff for 4911998000 very clear. It's exactly what I needed for my printed material export to the US.

The information on HS code 9604000000 was helpful, but I wish there were more examples of how to determine if an item is primarily made of wood or paper.

Great breakdown of the HS code 4820102010 for notebooks. The detailed explanation of the 55% tariff rate helped me understand the costs better.