| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4001100000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4008111000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4503902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008194000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4501100000 | Doc | 55.0% | CN | US | 2025-05-12 |

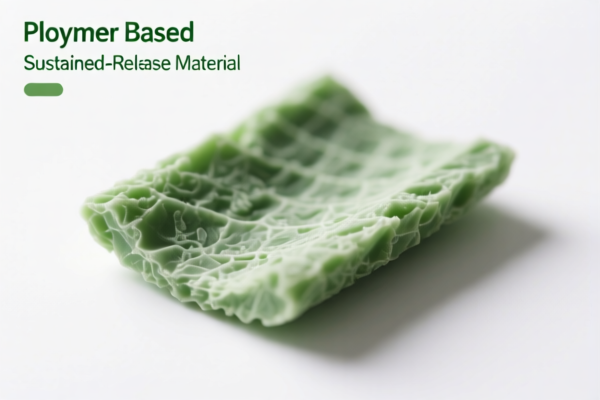

Product Name: Natural Polymer Based Sustained Release Material

Classification HS Codes and Tax Information:

- HS CODE: 4001100000

- Description: Natural rubber emulsion sustained release material, matching the description "Natural rubber emulsion."

- Total Tax Rate: 30.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is most suitable if the product is in emulsion form and not processed further.

-

HS CODE: 4008111000

- Description: Natural rubber buffer pads, highly matching the description "Sulfurized rubber sheets, plates, strips, rods, and profiles, other than hard rubber: cellular rubber: sheets, plates, and strips: natural rubber."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for processed natural rubber products like buffer pads.

-

HS CODE: 4503902000

- Description: Natural cork buffer pads, matching the description "Other natural cork products: discs, sheets, and washers."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Suitable for cork-based buffer materials.

-

HS CODE: 4008194000

- Description: Natural rubber block materials for buffering, matching the description "Sulfurized rubber sheets, plates, strips, rods, and profiles, other than hard rubber: other natural rubber products."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for block or sheet forms of natural rubber used in buffering.

-

HS CODE: 4501100000

- Description: Natural cork packaging buffer material, matching the description "Natural cork, unprocessed or simply processed."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: For raw or minimally processed natural cork used as packaging material.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- Base tariff remains at 0.0% for all.

- Additional tariffs (25.0%) are already in effect for all except 4001100000.

Proactive Advice:

- Verify the material composition (e.g., whether it is in emulsion form, processed, or raw).

- Check the unit price and whether it falls under a different classification due to processing or application.

- Confirm required certifications (e.g., environmental, safety, or import permits).

- Review the product's end use to ensure correct HS code selection.

-

Monitor policy updates after April 11, 2025, as the additional 30.0% tariff may significantly impact costs. Product Name: Natural Polymer Based Sustained Release Material

Classification HS Codes and Tax Information: -

HS CODE: 4001100000

- Description: Natural rubber emulsion sustained release material, matching the description "Natural rubber emulsion."

- Total Tax Rate: 30.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is most suitable if the product is in emulsion form and not processed further.

-

HS CODE: 4008111000

- Description: Natural rubber buffer pads, highly matching the description "Sulfurized rubber sheets, plates, strips, rods, and profiles, other than hard rubber: cellular rubber: sheets, plates, and strips: natural rubber."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for processed natural rubber products like buffer pads.

-

HS CODE: 4503902000

- Description: Natural cork buffer pads, matching the description "Other natural cork products: discs, sheets, and washers."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Suitable for cork-based buffer materials.

-

HS CODE: 4008194000

- Description: Natural rubber block materials for buffering, matching the description "Sulfurized rubber sheets, plates, strips, rods, and profiles, other than hard rubber: other natural rubber products."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for block or sheet forms of natural rubber used in buffering.

-

HS CODE: 4501100000

- Description: Natural cork packaging buffer material, matching the description "Natural cork, unprocessed or simply processed."

- Total Tax Rate: 55.0%

- Tax Details:

- Base tariff: 0.0%

- Additional tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: For raw or minimally processed natural cork used as packaging material.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- Base tariff remains at 0.0% for all.

- Additional tariffs (25.0%) are already in effect for all except 4001100000.

Proactive Advice:

- Verify the material composition (e.g., whether it is in emulsion form, processed, or raw).

- Check the unit price and whether it falls under a different classification due to processing or application.

- Confirm required certifications (e.g., environmental, safety, or import permits).

- Review the product's end use to ensure correct HS code selection.

- Monitor policy updates after April 11, 2025, as the additional 30.0% tariff may significantly impact costs.

Customer Reviews

No reviews yet.