| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4001100000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3909505000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3913905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3812399000 | Doc | 60.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Natural Polymer Defoamers, based on the provided HS codes and tax details:

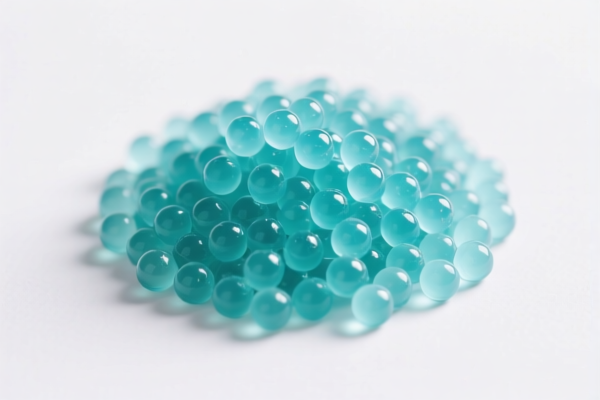

📦 Product Classification: Natural Polymer Defoamers

🔢 HS CODE: 4001100000

Description: Natural rubber emulsion defoamer, containing natural rubber emulsion

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Note: This product is classified under natural rubber emulsions, which are subject to the special tariff after April 11, 2025.

🔢 HS CODE: 3909505000

Description: Polyurethane defoamer, belongs to polyurethane products

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.3%

- Note: This product is a synthetic polymer-based defoamer, subject to both standard and special tariffs after April 11, 2025.

🔢 HS CODE: 3913905000

Description: Natural polymer particles, other natural or modified natural polymers not elsewhere specified

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This category includes natural polymer particles, which may be used in defoamers. Be sure to confirm the exact composition.

🔢 HS CODE: 3907995050

Description: Polyester resin defoamer, belongs to other polyester products

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This is a synthetic resin-based defoamer, subject to the same additional and special tariffs.

🔢 HS CODE: 3812399000

Description: Plastic defoamer, belongs to antioxidants and other composite stabilizers for rubber or plastic

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

- Note: This product is a stabilizer used in plastics, which may also be used as a defoamer.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the defoamer (e.g., whether it is natural rubber, polyurethane, polyester, or plastic-based) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may use this to determine the correct tariff.

✅ Proactive Advice:

- If your product contains multiple components, consider customs classification consultation to avoid misclassification.

- Keep updated records of product specifications and supplier documentation for customs compliance.

- If importing after April 11, 2025, budget for the 30.0% additional tariff on all applicable products.

Let me know if you need help with HS code verification or customs documentation! Here is the structured classification and tariff information for Natural Polymer Defoamers, based on the provided HS codes and tax details:

📦 Product Classification: Natural Polymer Defoamers

🔢 HS CODE: 4001100000

Description: Natural rubber emulsion defoamer, containing natural rubber emulsion

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Note: This product is classified under natural rubber emulsions, which are subject to the special tariff after April 11, 2025.

🔢 HS CODE: 3909505000

Description: Polyurethane defoamer, belongs to polyurethane products

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.3%

- Note: This product is a synthetic polymer-based defoamer, subject to both standard and special tariffs after April 11, 2025.

🔢 HS CODE: 3913905000

Description: Natural polymer particles, other natural or modified natural polymers not elsewhere specified

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This category includes natural polymer particles, which may be used in defoamers. Be sure to confirm the exact composition.

🔢 HS CODE: 3907995050

Description: Polyester resin defoamer, belongs to other polyester products

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This is a synthetic resin-based defoamer, subject to the same additional and special tariffs.

🔢 HS CODE: 3812399000

Description: Plastic defoamer, belongs to antioxidants and other composite stabilizers for rubber or plastic

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

- Note: This product is a stabilizer used in plastics, which may also be used as a defoamer.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the defoamer (e.g., whether it is natural rubber, polyurethane, polyester, or plastic-based) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may use this to determine the correct tariff.

✅ Proactive Advice:

- If your product contains multiple components, consider customs classification consultation to avoid misclassification.

- Keep updated records of product specifications and supplier documentation for customs compliance.

- If importing after April 11, 2025, budget for the 30.0% additional tariff on all applicable products.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.