| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3913905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4001100000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907700000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Natural Polymer Lubricants, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Natural Polymer Lubricants

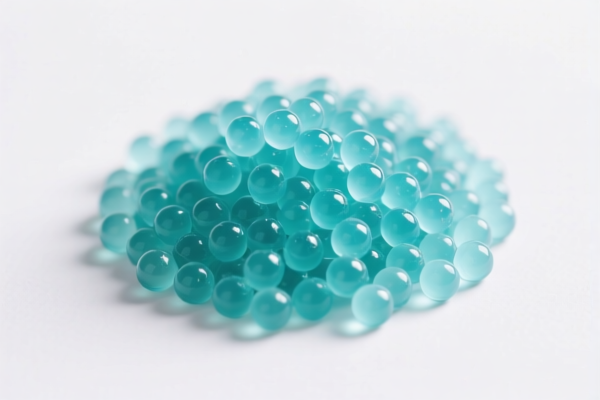

📦 HS CODE: 3913905000

Product Description: Natural polymer particles

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to natural polymer particles, which may include raw materials used in lubricant production.

📦 HS CODE: 4001100000

Product Description: Natural rubber emulsion lubricant

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 30.0%

- Note: This is a lubricant made from natural rubber in emulsion form. The base rate is zero, but a 30% special tariff applies after April 11, 2025.

📦 HS CODE: 3907210000

Product Description: Polyether lubricant

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is a synthetic lubricant based on polyether, commonly used in industrial applications.

📦 HS CODE: 3902900010

Product Description: Polybutene resin lubricant

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is a lubricant derived from polybutene resin, often used in high-performance applications.

📦 HS CODE: 3907700000

Product Description: Polylactic acid (PLA) resin lubricant

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is a biodegradable lubricant made from polylactic acid, suitable for eco-friendly applications.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff applies to several of these products after this date. Ensure your import timeline accounts for this.

- Anti-Dumping Duties: Not specified in the data, but always verify if your product is subject to anti-dumping or countervailing duties.

- Certifications Required: Confirm if your product requires any specific certifications (e.g., REACH, RoHS, or environmental compliance) depending on the destination country.

- Material Verification: Ensure the product description and HS code match the actual material and application (e.g., whether it's a finished lubricant or raw material).

- Unit Price Check: Tariff calculations depend on the declared value, so verify the unit price and total value of the shipment.

✅ Proactive Advice:

- Double-check the HS code with customs authorities or a classification expert to avoid misclassification penalties.

- Monitor policy updates after April 11, 2025, as additional tariffs may change.

- Consult a customs broker for accurate duty calculation and compliance support.

Let me know if you need help with HS code verification or customs documentation! Here is the structured classification and tariff information for Natural Polymer Lubricants, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Natural Polymer Lubricants

📦 HS CODE: 3913905000

Product Description: Natural polymer particles

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to natural polymer particles, which may include raw materials used in lubricant production.

📦 HS CODE: 4001100000

Product Description: Natural rubber emulsion lubricant

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 30.0%

- Note: This is a lubricant made from natural rubber in emulsion form. The base rate is zero, but a 30% special tariff applies after April 11, 2025.

📦 HS CODE: 3907210000

Product Description: Polyether lubricant

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is a synthetic lubricant based on polyether, commonly used in industrial applications.

📦 HS CODE: 3902900010

Product Description: Polybutene resin lubricant

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is a lubricant derived from polybutene resin, often used in high-performance applications.

📦 HS CODE: 3907700000

Product Description: Polylactic acid (PLA) resin lubricant

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is a biodegradable lubricant made from polylactic acid, suitable for eco-friendly applications.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff applies to several of these products after this date. Ensure your import timeline accounts for this.

- Anti-Dumping Duties: Not specified in the data, but always verify if your product is subject to anti-dumping or countervailing duties.

- Certifications Required: Confirm if your product requires any specific certifications (e.g., REACH, RoHS, or environmental compliance) depending on the destination country.

- Material Verification: Ensure the product description and HS code match the actual material and application (e.g., whether it's a finished lubricant or raw material).

- Unit Price Check: Tariff calculations depend on the declared value, so verify the unit price and total value of the shipment.

✅ Proactive Advice:

- Double-check the HS code with customs authorities or a classification expert to avoid misclassification penalties.

- Monitor policy updates after April 11, 2025, as additional tariffs may change.

- Consult a customs broker for accurate duty calculation and compliance support.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.