| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3913905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4001100000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3810100000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 3824994190 | Doc | 59.6% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Natural Polymer Surfactants, based on the provided HS codes and tax details:

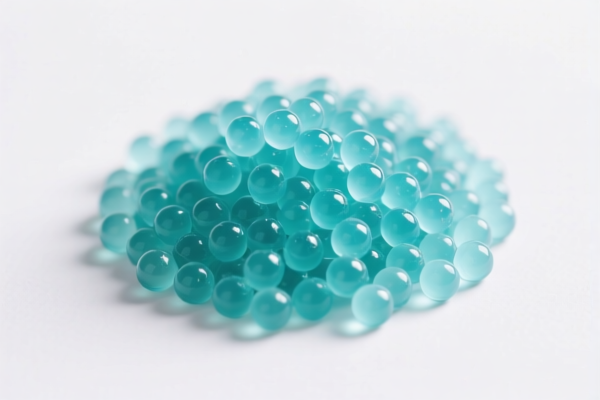

📦 Product Classification: Natural Polymer Surfactants

🔢 HS CODE: 3913905000

Description: Natural polymer particles or flakes, in primary form, not elsewhere specified.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to raw natural polymer materials in particle or flake form.

🔢 HS CODE: 4001100000

Description: Natural rubber emulsion surfactants, mainly composed of natural rubber emulsion.

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Note: This is a lower tax rate, but be aware of the 30% additional tariff after April 11, 2025.

🔢 HS CODE: 3907210000

Description: Polyether surfactants or raw materials, classified under polyether.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This is a synthetic surfactant category, but still falls under the broader "natural polymer surfactants" classification.

🔢 HS CODE: 3810100000

Description: Metal surfactants, classified as metal surface treatment chemicals.

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

- Note: This is a specialized category for metal-based surfactants.

🔢 HS CODE: 3824994190

Description: Plant-based fat surfactants, including animal or plant fats and their mixtures.

- Base Tariff Rate: 4.6%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.6%

- Note: This is a plant-derived surfactant category, with a slightly lower base rate.

⚠️ Important Reminders:

- April 11, 2025, Tariff Adjustment: All the above products are subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition and form of the product (e.g., emulsion, powder, liquid) to ensure correct HS code classification.

- Certifications Required: Some surfactants may require environmental or safety certifications (e.g., REACH, RoHS, etc.), depending on the destination country.

- Unit Price and Packaging: Be clear on unit price and packaging type, as this can affect customs valuation and duty calculation.

✅ Proactive Advice:

- Double-check the product’s chemical structure and intended use to ensure the correct HS code is applied.

- Consult with a customs broker or tax authority if the product is a blend or derivative of multiple materials.

- Keep updated records of product specifications and documentation to avoid delays in customs clearance.

Let me know if you need help with HS code selection or tariff calculation for a specific product. Here is the structured classification and tariff information for Natural Polymer Surfactants, based on the provided HS codes and tax details:

📦 Product Classification: Natural Polymer Surfactants

🔢 HS CODE: 3913905000

Description: Natural polymer particles or flakes, in primary form, not elsewhere specified.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to raw natural polymer materials in particle or flake form.

🔢 HS CODE: 4001100000

Description: Natural rubber emulsion surfactants, mainly composed of natural rubber emulsion.

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Note: This is a lower tax rate, but be aware of the 30% additional tariff after April 11, 2025.

🔢 HS CODE: 3907210000

Description: Polyether surfactants or raw materials, classified under polyether.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This is a synthetic surfactant category, but still falls under the broader "natural polymer surfactants" classification.

🔢 HS CODE: 3810100000

Description: Metal surfactants, classified as metal surface treatment chemicals.

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

- Note: This is a specialized category for metal-based surfactants.

🔢 HS CODE: 3824994190

Description: Plant-based fat surfactants, including animal or plant fats and their mixtures.

- Base Tariff Rate: 4.6%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.6%

- Note: This is a plant-derived surfactant category, with a slightly lower base rate.

⚠️ Important Reminders:

- April 11, 2025, Tariff Adjustment: All the above products are subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition and form of the product (e.g., emulsion, powder, liquid) to ensure correct HS code classification.

- Certifications Required: Some surfactants may require environmental or safety certifications (e.g., REACH, RoHS, etc.), depending on the destination country.

- Unit Price and Packaging: Be clear on unit price and packaging type, as this can affect customs valuation and duty calculation.

✅ Proactive Advice:

- Double-check the product’s chemical structure and intended use to ensure the correct HS code is applied.

- Consult with a customs broker or tax authority if the product is a blend or derivative of multiple materials.

- Keep updated records of product specifications and documentation to avoid delays in customs clearance.

Let me know if you need help with HS code selection or tariff calculation for a specific product.

Customer Reviews

No reviews yet.