| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4016993550 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4006901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4009110000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4001300055 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4016993550 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Natural rubber rubber tubing, based on the provided HS codes and tax details:

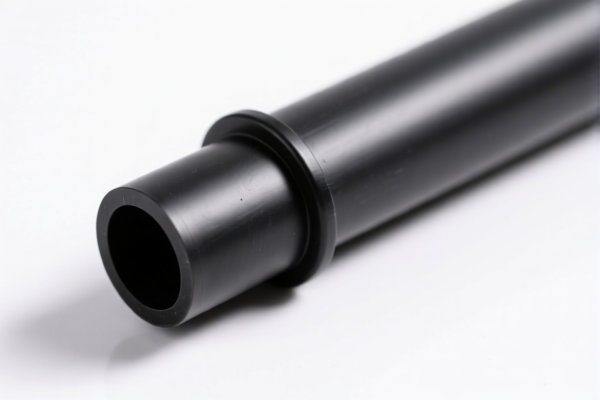

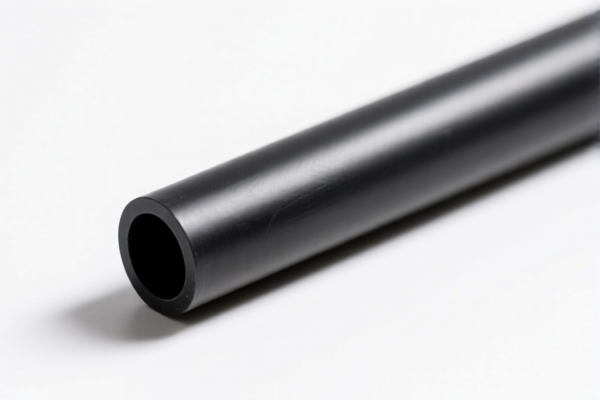

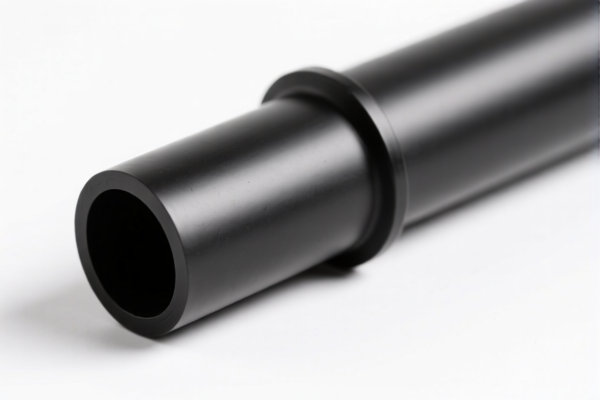

✅ Product Classification: Natural Rubber Rubber Tubing

🔍 HS CODE: 4009110000

Description:

- Sulfurized rubber tubes, tubes and hoses, not reinforced or combined with other materials, without fittings

- This is the most accurate HS code for natural rubber tubing that is sulfurized, not reinforced, and without fittings.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and could significantly increase the total tax burden. -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are applicable for this product.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the tubing is sulfurized natural rubber, not reinforced, and without fittings to qualify for HS code 4009110000. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Changes:

Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs. -

Consider Alternative HS Codes:

If the product is not sulfurized or has reinforcements, consider other HS codes like 4006901000 or 4016993550 (if applicable).

📋 Other Possible HS Codes (for reference)

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4006901000 | Unvulcanized rubber in other forms (e.g., rods, tubes, profiles) | 55.0% | For unvulcanized rubber tubing |

| 4016993550 | Other vulcanized rubber products (excluding hard rubber), other natural rubber products | 55.0% | For vulcanized natural rubber products, not tubes |

| 4001300055 | Natural rubber and products (primary form or in sheet, strip, etc.) | 55.0% | For raw natural rubber or sheet form |

✅ Conclusion

For natural rubber tubing that is sulfurized, not reinforced, and without fittings, the correct HS code is 4009110000, with a total tax rate of 57.5% (including the 30.0% special tariff after April 11, 2025). Ensure your product meets the classification criteria and prepare for potential tariff increases. Here is the structured classification and tariff information for Natural rubber rubber tubing, based on the provided HS codes and tax details:

✅ Product Classification: Natural Rubber Rubber Tubing

🔍 HS CODE: 4009110000

Description:

- Sulfurized rubber tubes, tubes and hoses, not reinforced or combined with other materials, without fittings

- This is the most accurate HS code for natural rubber tubing that is sulfurized, not reinforced, and without fittings.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and could significantly increase the total tax burden. -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are applicable for this product.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the tubing is sulfurized natural rubber, not reinforced, and without fittings to qualify for HS code 4009110000. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Changes:

Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs. -

Consider Alternative HS Codes:

If the product is not sulfurized or has reinforcements, consider other HS codes like 4006901000 or 4016993550 (if applicable).

📋 Other Possible HS Codes (for reference)

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4006901000 | Unvulcanized rubber in other forms (e.g., rods, tubes, profiles) | 55.0% | For unvulcanized rubber tubing |

| 4016993550 | Other vulcanized rubber products (excluding hard rubber), other natural rubber products | 55.0% | For vulcanized natural rubber products, not tubes |

| 4001300055 | Natural rubber and products (primary form or in sheet, strip, etc.) | 55.0% | For raw natural rubber or sheet form |

✅ Conclusion

For natural rubber tubing that is sulfurized, not reinforced, and without fittings, the correct HS code is 4009110000, with a total tax rate of 57.5% (including the 30.0% special tariff after April 11, 2025). Ensure your product meets the classification criteria and prepare for potential tariff increases.

Customer Reviews

No reviews yet.