| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

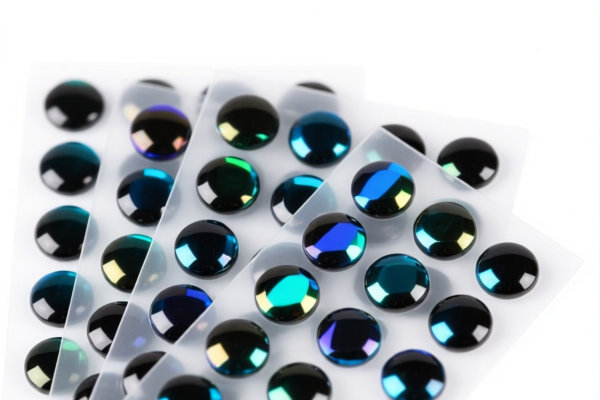

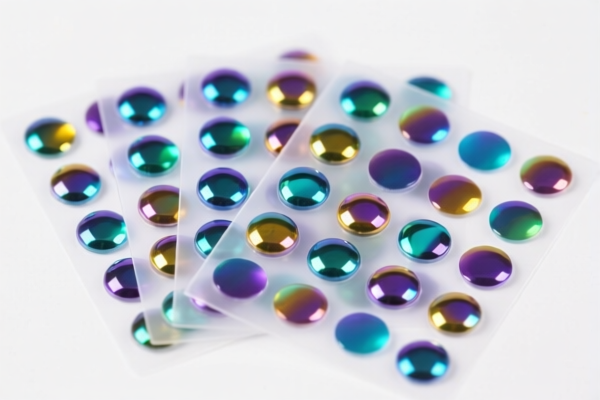

Product Classification and Customs Tariff Analysis for "Night Reflective Glass Bead Self Adhesive Plastic Sheets"

✅ HS CODE: 3919901000

Description:

Applicable to self-adhesive plastic sheets, films, tapes, and rolls with a reflective surface produced by glass beads.

📌 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Alerts:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 2, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for this product category (plastic sheets with reflective glass beads). However, it is advisable to verify if any anti-dumping measures are in place for similar products.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed made of plastic with glass bead reflective surface and not a composite or metal-based product, which may fall under a different HS code. -

Check Unit Price and Packaging:

Customs may assess based on unit price and packaging type (e.g., rolls vs. sheets). This can affect classification and duty calculation. -

Certifications Required:

Confirm if any safety, environmental, or product standard certifications (e.g., CE, RoHS, or reflective performance standards) are required for import into the destination country. -

Consult Local Customs Authority:

For the most up-to-date and region-specific tariff information, always cross-check with your local customs or a qualified customs broker.

📌 Summary of Key Points:

- HS Code: 3919901000

- Total Tax Rate: 61.5% (6.5% base + 25% general + 30% after April 2, 2025)

- Time-sensitive Policy: 30% additional tariff applies after April 2, 2025

- No Anti-dumping duties currently applicable

- Action Required: Verify product composition, packaging, and certifications

Let me know if you need help with customs documentation or further classification details. Product Classification and Customs Tariff Analysis for "Night Reflective Glass Bead Self Adhesive Plastic Sheets"

✅ HS CODE: 3919901000

Description:

Applicable to self-adhesive plastic sheets, films, tapes, and rolls with a reflective surface produced by glass beads.

📌 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Alerts:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 2, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for this product category (plastic sheets with reflective glass beads). However, it is advisable to verify if any anti-dumping measures are in place for similar products.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed made of plastic with glass bead reflective surface and not a composite or metal-based product, which may fall under a different HS code. -

Check Unit Price and Packaging:

Customs may assess based on unit price and packaging type (e.g., rolls vs. sheets). This can affect classification and duty calculation. -

Certifications Required:

Confirm if any safety, environmental, or product standard certifications (e.g., CE, RoHS, or reflective performance standards) are required for import into the destination country. -

Consult Local Customs Authority:

For the most up-to-date and region-specific tariff information, always cross-check with your local customs or a qualified customs broker.

📌 Summary of Key Points:

- HS Code: 3919901000

- Total Tax Rate: 61.5% (6.5% base + 25% general + 30% after April 2, 2025)

- Time-sensitive Policy: 30% additional tariff applies after April 2, 2025

- No Anti-dumping duties currently applicable

- Action Required: Verify product composition, packaging, and certifications

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.