Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917400030 | Doc | 60.3% | CN | US | 2025-05-12 |

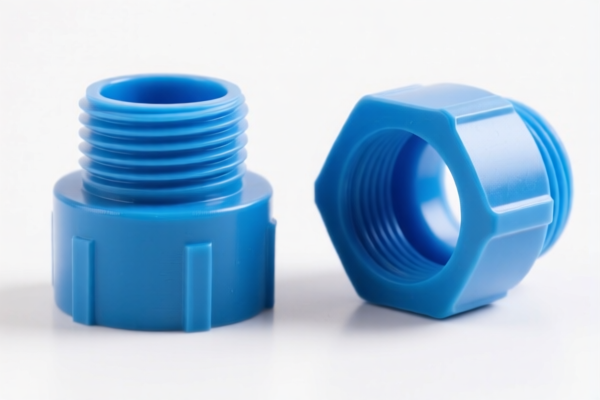

- HS CODE : 3903300000

- Description : Applicable to ABS plastic fittings, parts, decorative pieces, etc., classified as primary forms of acrylonitrile-butadiene-styrene (ABS) copolymers.

-

Tariff Rate : 61.5%

- Base Tariff : 6.5%

- Additional Tariff : 25.0%

- Special Tariff after April 11, 2025 : 30.0%

-

HS CODE : 3917400030

- Description : Applicable to non-pressure rated ABS plastic drainage pipe fittings, classified as non-pressure drainage/waste/ventilation pipe fittings.

-

Tariff Rate : 60.3%

- Base Tariff : 5.3%

- Additional Tariff : 25.0%

- Special Tariff after April 11, 2025 : 30.0%

-

Note : Both HS codes are applicable to ABS plastic fittings, but the classification differs based on the product's primary form (3903300000) or specific application (3917400030).

-

Important Reminders :

- Verify the product's material and unit price to ensure correct classification.

- Check if any certifications (e.g., CE, RoHS) are required for import.

- Be aware of the April 11, 2025, special tariff which may increase the total tax burden by 5 percentage points.

- No anti-dumping duties are currently applicable for ABS plastic fittings.

- HS CODE : 3903300000

- Description : Applicable to ABS plastic fittings, parts, decorative pieces, etc., classified as primary forms of acrylonitrile-butadiene-styrene (ABS) copolymers.

-

Tariff Rate : 61.5%

- Base Tariff : 6.5%

- Additional Tariff : 25.0%

- Special Tariff after April 11, 2025 : 30.0%

-

HS CODE : 3917400030

- Description : Applicable to non-pressure rated ABS plastic drainage pipe fittings, classified as non-pressure drainage/waste/ventilation pipe fittings.

-

Tariff Rate : 60.3%

- Base Tariff : 5.3%

- Additional Tariff : 25.0%

- Special Tariff after April 11, 2025 : 30.0%

-

Note : Both HS codes are applicable to ABS plastic fittings, but the classification differs based on the product's primary form (3903300000) or specific application (3917400030).

-

Important Reminders :

- Verify the product's material and unit price to ensure correct classification.

- Check if any certifications (e.g., CE, RoHS) are required for import.

- Be aware of the April 11, 2025, special tariff which may increase the total tax burden by 5 percentage points.

- No anti-dumping duties are currently applicable for ABS plastic fittings.

Customer Reviews

No reviews yet.