| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9025112000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9025114000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7323999030 | Doc | 83.4% | CN | US | 2025-05-12 |

| 7013993000 | Doc | 46.5% | CN | US | 2025-05-12 |

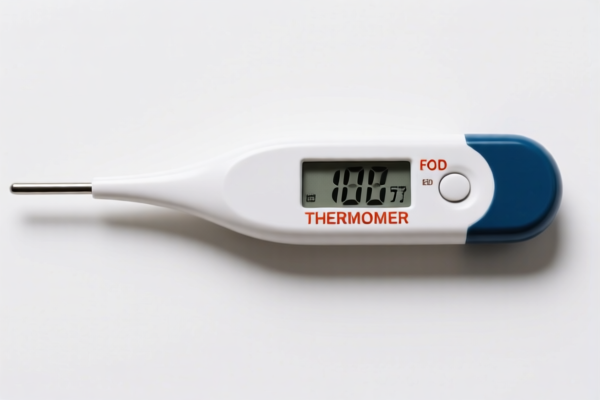

Okay, let's break down the HS codes and tax implications for your declared items – OVEN THERMOMETERS. Here's a structured analysis to help you understand the classification and potential costs:

Understanding HS Codes – A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits can vary by country. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of the product.

- Heading (First 4 digits): More specific classification within the chapter.

- Subheading (First 6 digits): Even more detailed classification.

- Additional Digits: Country-specific for further refinement.

Analysis of Your Declared Items

Let's go through each item individually:

1. Clinical Liquid-Filled Thermometers (HS Code: 9025.11.20.00)

- Chapter 90: Optical, precision, medical, surgical, dental instruments and their parts. This indicates these are considered medical instruments.

- Heading 9025: Instruments and apparatus which measure, check, test or navigate; parts and accessories thereof.

- Subheading 9025.11: Thermometers, pyrometers, barometers, hygrometers and psychrometers, recording or not.

- 9025.11.20.00: Specifically, Liquid-filled thermometers, for direct reading, clinical.

- Tax:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Post April 2, 2025 Additional Duty: 30%

- Total Tax: 30.0%

2. Other Liquid-Filled Thermometers (HS Code: 9025.11.40.00)

- HS Code Breakdown: Similar to the above, but this covers liquid-filled thermometers not specifically classified as clinical.

- Tax:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Post April 2, 2025 Additional Duty: 30%

- Total Tax: 30.0%

3. Kitchen/Tableware (HS Code: 7323.99.90.30)

- Chapter 73: Articles of iron or steel.

- Heading 7323: Table, kitchen or other household articles and parts thereof, of iron or steel.

- Subheading 7323.99: Other.

- 7323.99.90.30: Specifically, Other Kitchen or tableware suitable for food or drink contact.

- Tax:

- Basic Duty: 3.4%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30% (for steel/aluminum products)

- Total Tax: 83.4%

4. Other Glassware (HS Code: 7013.99.30.00)

- Chapter 70: Glass and glassware.

- Heading 7013: Glassware of a kind used for table, kitchen, toilet, office, indoor decoration or similar purposes (other than that of heading 7010 or 7018).

- Subheading 7013.99: Other glassware.

- 7013.99.30.00: Specifically, Smokers' articles; perfume bottles fitted with ground glass stoppers.

- Tax:

- Basic Duty: 9.0%

- Additional Duty: 7.5%

- Post April 2, 2025 Additional Duty: 30%

- Total Tax: 46.5%

Important Considerations & Recommendations:

- Material Composition: For HS Code 7323.99.90.30 (Kitchen/Tableware), the exact material (stainless steel, carbon steel, etc.) is crucial. This can affect the applicable duty rate.

- End Use: Confirm the intended end use of each item. If an item could be classified in multiple headings, the most specific classification based on its function should be used.

- April 2, 2025 Duty Changes: Be aware of the significant duty increases coming into effect on April 2, 2025. Factor this into your import planning.

- Valuation: Ensure accurate valuation of your goods. Customs will assess duties based on the declared value.

- Certifications: Depending on the end use (especially for items contacting food), you may need certifications (e.g., FDA compliance for food contact materials).

- Country of Origin: Confirm the country of origin for each item, as this affects duty rates and potential trade agreements.

Disclaimer: I am an AI assistant and this information is for general guidance only. Customs regulations are complex and subject to change. It is highly recommended to consult with a licensed customs broker or import specialist for accurate classification and compliance advice specific to your situation. They can review your product specifications and provide definitive guidance.

Customer Reviews

The content was useful, but I wish there was a summary of all the duty rates in one place instead of having to read through each item's details.

I was impressed by the clarity of the information. The section on duty changes after April 2, 2025, was a great reminder to plan ahead for my imports.

The detailed explanation of the HS code 7323.99.90.30 was really helpful. I didn't know kitchenware had such a high duty rate, so this saved me from a surprise.

Great breakdown of HS codes for oven thermometers. The 30% tariff rate for clinical thermometers was exactly what I needed for my import planning.