| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411922000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411936000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411136000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411921000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411939010 | Doc | 58.9% | CN | US | 2025-05-12 |

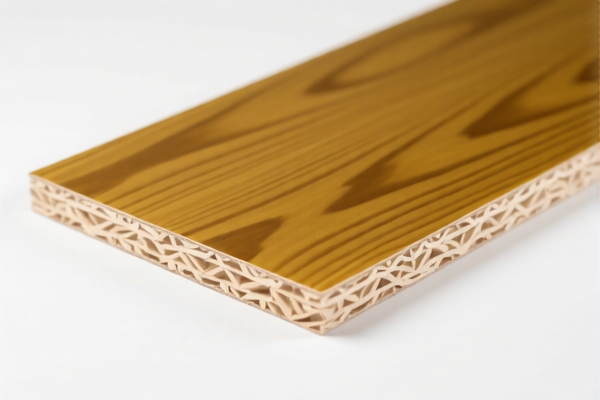

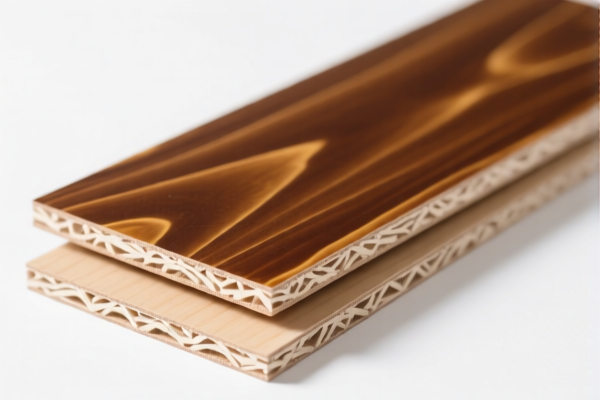

Product Name: Oil Treated High Density Fiberboard

Classification HS Codes and Tax Details:

- HS CODE: 4411922000

- Description: High Density Fiberboard (Oil Treated)

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411936000

- Description: Oil Treated Wood Fiberboard

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411136000

- Description: Special Oil Treated Wood Fiberboard

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411936000 (Alternative Description)

- Description: High Density Fiberboard Raw Material

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411921000

- Description: Industrial Grade High Density Fiberboard

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411939010

- Description: High Density Fiberboard Molding Panel

- Total Tax Rate: 58.9%

-

Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411139090

- Description: High Strength Fiberboard

- Total Tax Rate: 58.9%

- Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Base Tariff:

Most of the HS codes have a base tariff of 0.0%, except for 4411939010 and 4411139090, which have a base tariff of 3.9%. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to confirm with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations.

✅ Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is indeed oil-treated high-density fiberboard and not a different type of fiberboard or composite material, which may fall under a different HS code. -

Check Required Certifications:

Confirm if any certifications (e.g., environmental, safety, or import permits) are required for the product in the destination country. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and tax calculation. Product Name: Oil Treated High Density Fiberboard

Classification HS Codes and Tax Details: -

HS CODE: 4411922000

- Description: High Density Fiberboard (Oil Treated)

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411936000

- Description: Oil Treated Wood Fiberboard

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411136000

- Description: Special Oil Treated Wood Fiberboard

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411936000 (Alternative Description)

- Description: High Density Fiberboard Raw Material

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411921000

- Description: Industrial Grade High Density Fiberboard

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411939010

- Description: High Density Fiberboard Molding Panel

- Total Tax Rate: 58.9%

-

Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411139090

- Description: High Strength Fiberboard

- Total Tax Rate: 58.9%

- Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Base Tariff:

Most of the HS codes have a base tariff of 0.0%, except for 4411939010 and 4411139090, which have a base tariff of 3.9%. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to confirm with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations.

✅ Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is indeed oil-treated high-density fiberboard and not a different type of fiberboard or composite material, which may fall under a different HS code. -

Check Required Certifications:

Confirm if any certifications (e.g., environmental, safety, or import permits) are required for the product in the destination country. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and tax calculation.

Customer Reviews

The information is there, but I wish there were more examples of how to apply these tariffs in real-world scenarios. Still, it's a good starting point.

Great resource for HS codes related to fiberboard. The different descriptions for the same HS code were really informative and clarified things for me.

The breakdown of the tariff rates was helpful, especially the note about the special 30% tariff after April 11, 2025. Makes planning easier.

Clear details on HS Code 4411922000. Very useful for exporting oil-treated high-density fiberboard to the US.