Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

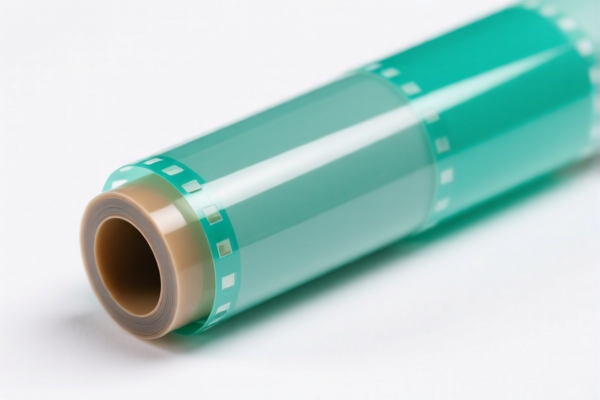

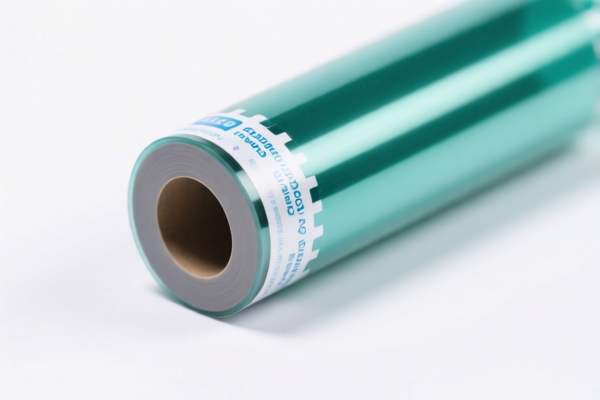

Product Classification: Optical Grade Cellulose Acetate Film

HS CODE: 3920791000

Tariff Overview (as of current regulations):

- Base Tariff Rate: 6.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.2%

Key Notes on Classification and Taxation:

- HS Code 3920791000 applies to cellulose ester films (e.g., cellulose acetate) that are thin (≤0.076 mm) and used in optical applications.

- This classification is distinct from HS code 3920795000, which is for cellulose ester films used in capacitors or other industrial applications, and may have lower tariffs (3.7% base rate).

- Important: Ensure the product is not combined with other materials (e.g., layered or laminated), as this may shift the classification to 3920795000 or another code.

Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025, increasing the total rate to 61.2%. - This is not an anti-dumping duty but a general trade policy adjustment.

Proactive Advice for Importers:

- Verify Material Specifications: Confirm the thickness (must be ≤0.076 mm) and material composition (pure cellulose acetate, not layered or laminated).

- Check Unit Price and Certification: Some customs authorities may require technical specifications or certifications (e.g., optical grade, industrial use).

- Consider Alternative HS Codes: If the film is used in capacitors or industrial applications, HS 3920795000 may be more appropriate with a lower total tax rate (58.7%).

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the 30.0% additional tariff.

Summary Table for Comparison:

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 3920791000 | Optical cellulose acetate film | 6.2% | 25.0% | 30.0% | 61.2% |

| 3920795000 | Capacitor or industrial cellulose film | 3.7% | 25.0% | 30.0% | 58.7% |

If you have further details about the end-use or technical specifications, I can help refine the classification and tax implications further.

Product Classification: Optical Grade Cellulose Acetate Film

HS CODE: 3920791000

Tariff Overview (as of current regulations):

- Base Tariff Rate: 6.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.2%

Key Notes on Classification and Taxation:

- HS Code 3920791000 applies to cellulose ester films (e.g., cellulose acetate) that are thin (≤0.076 mm) and used in optical applications.

- This classification is distinct from HS code 3920795000, which is for cellulose ester films used in capacitors or other industrial applications, and may have lower tariffs (3.7% base rate).

- Important: Ensure the product is not combined with other materials (e.g., layered or laminated), as this may shift the classification to 3920795000 or another code.

Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025, increasing the total rate to 61.2%. - This is not an anti-dumping duty but a general trade policy adjustment.

Proactive Advice for Importers:

- Verify Material Specifications: Confirm the thickness (must be ≤0.076 mm) and material composition (pure cellulose acetate, not layered or laminated).

- Check Unit Price and Certification: Some customs authorities may require technical specifications or certifications (e.g., optical grade, industrial use).

- Consider Alternative HS Codes: If the film is used in capacitors or industrial applications, HS 3920795000 may be more appropriate with a lower total tax rate (58.7%).

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the 30.0% additional tariff.

Summary Table for Comparison:

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 3920791000 | Optical cellulose acetate film | 6.2% | 25.0% | 30.0% | 61.2% |

| 3920795000 | Capacitor or industrial cellulose film | 3.7% | 25.0% | 30.0% | 58.7% |

If you have further details about the end-use or technical specifications, I can help refine the classification and tax implications further.

Customer Reviews

No reviews yet.