Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

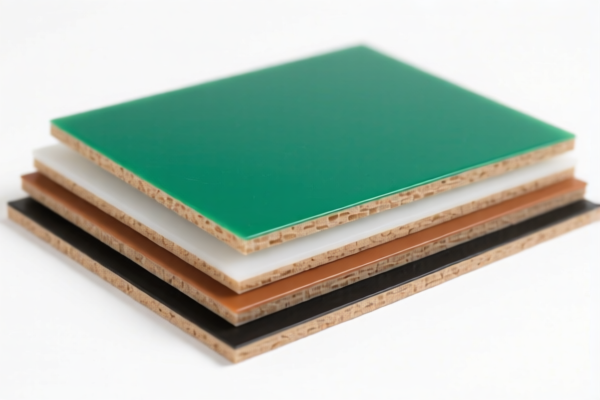

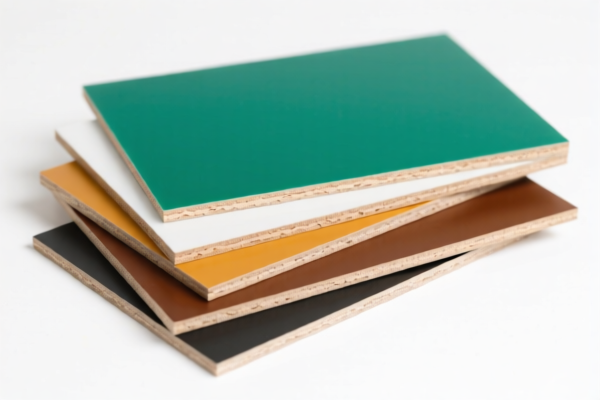

Product Classification: Other Phenolic Resin Boards

HS CODE: 3920940000

🔍 Classification Overview

- Product Name: Other Phenolic Resin Boards

- HS Code: 3920940000

- Description: This code applies to a variety of phenolic resin boards, including building boards, composite material boards, and furniture boards, as long as they are not specifically excluded under other HS codes.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 11, 2025. Be sure to plan your import schedule accordingly.

📌 Key Considerations

- Material Verification: Confirm that the product is indeed made of phenolic resin and not a composite or modified version that might fall under a different HS code.

- Unit Price and Certification: Check the unit price and ensure that any required certifications (e.g., safety, environmental compliance) are in place.

- Customs Declaration: Accurate product description is essential to avoid misclassification and potential penalties.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

📌 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code 3920940000.

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with customs brokers or legal advisors if the product is part of a larger composite or has special uses (e.g., industrial, construction).

Let me know if you need help with customs documentation or further classification details.

Product Classification: Other Phenolic Resin Boards

HS CODE: 3920940000

🔍 Classification Overview

- Product Name: Other Phenolic Resin Boards

- HS Code: 3920940000

- Description: This code applies to a variety of phenolic resin boards, including building boards, composite material boards, and furniture boards, as long as they are not specifically excluded under other HS codes.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 11, 2025. Be sure to plan your import schedule accordingly.

📌 Key Considerations

- Material Verification: Confirm that the product is indeed made of phenolic resin and not a composite or modified version that might fall under a different HS code.

- Unit Price and Certification: Check the unit price and ensure that any required certifications (e.g., safety, environmental compliance) are in place.

- Customs Declaration: Accurate product description is essential to avoid misclassification and potential penalties.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

📌 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code 3920940000.

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with customs brokers or legal advisors if the product is part of a larger composite or has special uses (e.g., industrial, construction).

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.