Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

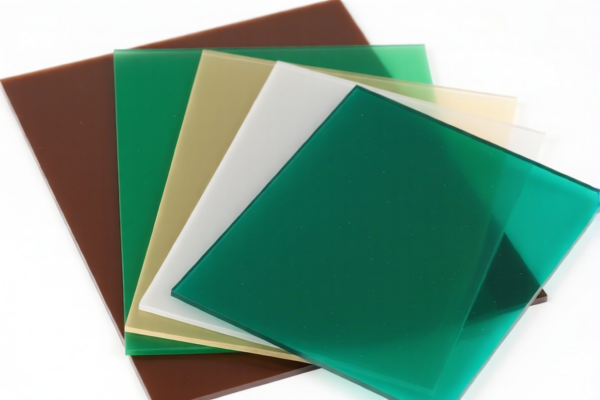

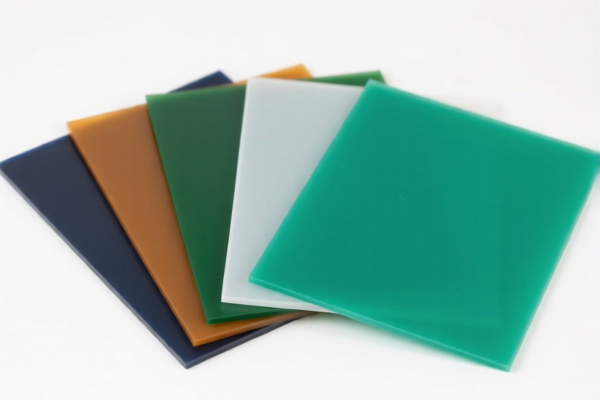

Product Classification: Other Phenolic Resin Sheets

HS CODE: 3920940000

🔍 Classification Overview

- Product Name: Other Phenolic Resin Sheets

- HS Code: 3920940000

- Description: This code applies to various types of phenolic resin sheets, including building boards, composite material boards, and furniture boards.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 11, 2025. Be sure to plan your import schedule accordingly.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of phenolic resin and not a composite or modified version that might fall under a different HS code.

- Unit Price: Ensure the declared unit price aligns with the product classification and tariff rates.

- Certifications: Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

- Documentation: Maintain proper documentation, including material specifications, origin, and any applicable compliance certificates.

📌 Proactive Advice

- Monitor Tariff Updates: Keep track of any changes in tariff rates, especially after April 11, 2025, which could significantly increase your import costs.

- Consult a Customs Broker: For complex or high-value shipments, consider working with a licensed customs broker to ensure full compliance.

- Review Product Description: Ensure the product description on the invoice and customs documents matches the HS code classification to avoid delays or penalties.

Let me know if you need help with HS code verification or customs documentation!

Product Classification: Other Phenolic Resin Sheets

HS CODE: 3920940000

🔍 Classification Overview

- Product Name: Other Phenolic Resin Sheets

- HS Code: 3920940000

- Description: This code applies to various types of phenolic resin sheets, including building boards, composite material boards, and furniture boards.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 11, 2025. Be sure to plan your import schedule accordingly.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of phenolic resin and not a composite or modified version that might fall under a different HS code.

- Unit Price: Ensure the declared unit price aligns with the product classification and tariff rates.

- Certifications: Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

- Documentation: Maintain proper documentation, including material specifications, origin, and any applicable compliance certificates.

📌 Proactive Advice

- Monitor Tariff Updates: Keep track of any changes in tariff rates, especially after April 11, 2025, which could significantly increase your import costs.

- Consult a Customs Broker: For complex or high-value shipments, consider working with a licensed customs broker to ensure full compliance.

- Review Product Description: Ensure the product description on the invoice and customs documents matches the HS code classification to avoid delays or penalties.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.