| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tax information for "Other Plastic Ceiling Boards" based on the provided HS codes and tariff details:

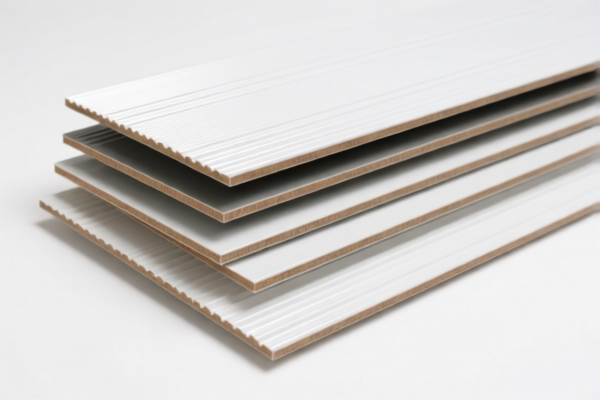

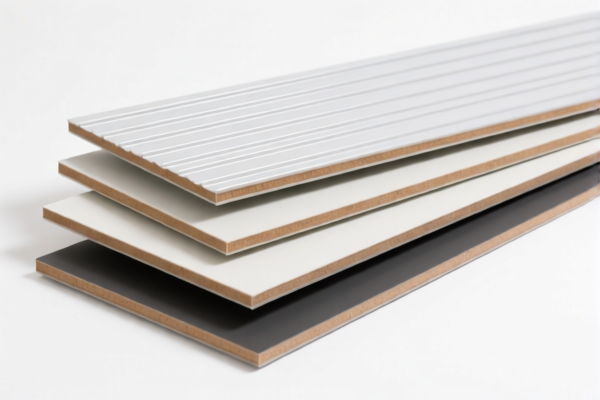

📦 Product Classification: Other Plastic Ceiling Boards

🔍 HS CODE: 3918905000

- Description: Plastic ceiling panels (tiles)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic ceiling tiles, not full ceiling boards.

🔍 HS CODE: 3920995000

- Description: Plastic ceiling boards (other)

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for plastic ceiling boards not covered by more specific codes.

🔍 HS CODE: 3918901000

- Description: Plastic ceiling boards (other)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic ceiling boards with specific material or design features.

🔍 HS CODE: 3921905050

- Description: Plastic sheets (other)

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic sheets, not specifically ceiling boards. Use with caution.

🔍 HS CODE: 3920100000

- Description: Plastic sheets (other)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic sheets, not specifically ceiling boards. Use with caution.

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

Not applicable for plastic products unless specified by the importing country (e.g., China may impose anti-dumping duties on certain plastic imports from specific countries). -

Certifications Required:

Verify if your product requires import permits, product certifications, or environmental compliance documents (e.g., REACH, RoHS, etc.), depending on the destination country.

✅ Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is correctly classified based on material type (e.g., PVC, ABS, etc.) and intended use (e.g., ceiling board vs. decorative panel). -

Check for Certifications:

Confirm if your product requires customs documentation, product safety certifications, or environmental compliance for the target market. -

Monitor Tariff Updates:

Keep track of tariff changes after April 11, 2025, as they may significantly impact your import costs.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tax information for "Other Plastic Ceiling Boards" based on the provided HS codes and tariff details:

📦 Product Classification: Other Plastic Ceiling Boards

🔍 HS CODE: 3918905000

- Description: Plastic ceiling panels (tiles)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic ceiling tiles, not full ceiling boards.

🔍 HS CODE: 3920995000

- Description: Plastic ceiling boards (other)

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for plastic ceiling boards not covered by more specific codes.

🔍 HS CODE: 3918901000

- Description: Plastic ceiling boards (other)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic ceiling boards with specific material or design features.

🔍 HS CODE: 3921905050

- Description: Plastic sheets (other)

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic sheets, not specifically ceiling boards. Use with caution.

🔍 HS CODE: 3920100000

- Description: Plastic sheets (other)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic sheets, not specifically ceiling boards. Use with caution.

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

Not applicable for plastic products unless specified by the importing country (e.g., China may impose anti-dumping duties on certain plastic imports from specific countries). -

Certifications Required:

Verify if your product requires import permits, product certifications, or environmental compliance documents (e.g., REACH, RoHS, etc.), depending on the destination country.

✅ Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is correctly classified based on material type (e.g., PVC, ABS, etc.) and intended use (e.g., ceiling board vs. decorative panel). -

Check for Certifications:

Confirm if your product requires customs documentation, product safety certifications, or environmental compliance for the target market. -

Monitor Tariff Updates:

Keep track of tariff changes after April 11, 2025, as they may significantly impact your import costs.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.