| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 9018390040 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

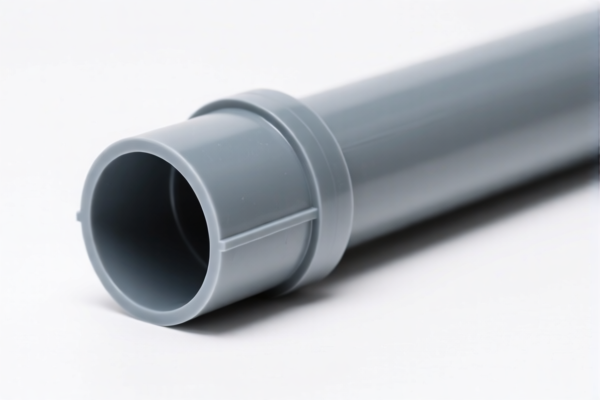

Here is the structured analysis and classification for the product "Other Plastic Rigid Conduit" based on the provided HS codes and tariff details:

✅ HS CODE: 3917320050

Product Description: Plastic rigid conduit

Total Tax Rate: 58.1%

Breakdown of Tariffs:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is the most heavily taxed option among the listed HS codes.

- The high additional tariff suggests this may be a targeted product under current trade policies.

✅ HS CODE: 3917390050

Product Description: Plastic fittings (other types)

Total Tax Rate: 33.1%

Breakdown of Tariffs:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- Lower base tax compared to 3917320050.

- No additional tariff currently, but will be affected by the April 11, 2025, special tariff.

✅ HS CODE: 9018390040

Product Description: Rigid conduit (hard tube type)

Total Tax Rate: 30.0%

Breakdown of Tariffs:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- No base or additional tariffs currently.

- This may be a more favorable option if the product is correctly classified under this code.

✅ HS CODE: 3926909987

Product Description: Rigid plastic conduit

Total Tax Rate: 42.8%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- Moderate tax rate with a combination of base and additional tariffs.

- The 2025.4.2 special tariff will increase the total tax significantly.

✅ HS CODE: 3917210000

Product Description: Polyethylene rigid plastic conduit

Total Tax Rate: 58.1%

Breakdown of Tariffs:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- Same tax structure as 3917320050.

- This is likely for a specific type of rigid conduit made from polyethylene.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly classified based on material (e.g., polyethylene, PVC, etc.) and unit price.

- Check Required Certifications: Some products may require specific certifications (e.g., fire resistance, electrical safety) for import.

- Monitor April 11, 2025, Policy Changes: The special tariff of 30% will apply to all listed codes after this date, significantly increasing costs.

- Consider HS Code 9018390040: If the product is correctly classified under this code, it may offer the lowest tax burden.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured analysis and classification for the product "Other Plastic Rigid Conduit" based on the provided HS codes and tariff details:

✅ HS CODE: 3917320050

Product Description: Plastic rigid conduit

Total Tax Rate: 58.1%

Breakdown of Tariffs:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is the most heavily taxed option among the listed HS codes.

- The high additional tariff suggests this may be a targeted product under current trade policies.

✅ HS CODE: 3917390050

Product Description: Plastic fittings (other types)

Total Tax Rate: 33.1%

Breakdown of Tariffs:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- Lower base tax compared to 3917320050.

- No additional tariff currently, but will be affected by the April 11, 2025, special tariff.

✅ HS CODE: 9018390040

Product Description: Rigid conduit (hard tube type)

Total Tax Rate: 30.0%

Breakdown of Tariffs:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- No base or additional tariffs currently.

- This may be a more favorable option if the product is correctly classified under this code.

✅ HS CODE: 3926909987

Product Description: Rigid plastic conduit

Total Tax Rate: 42.8%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- Moderate tax rate with a combination of base and additional tariffs.

- The 2025.4.2 special tariff will increase the total tax significantly.

✅ HS CODE: 3917210000

Product Description: Polyethylene rigid plastic conduit

Total Tax Rate: 58.1%

Breakdown of Tariffs:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- Same tax structure as 3917320050.

- This is likely for a specific type of rigid conduit made from polyethylene.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly classified based on material (e.g., polyethylene, PVC, etc.) and unit price.

- Check Required Certifications: Some products may require specific certifications (e.g., fire resistance, electrical safety) for import.

- Monitor April 11, 2025, Policy Changes: The special tariff of 30% will apply to all listed codes after this date, significantly increasing costs.

- Consider HS Code 9018390040: If the product is correctly classified under this code, it may offer the lowest tax burden.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.