Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 7304598035 | Doc | 30.0% | CN | US | 2025-05-12 |

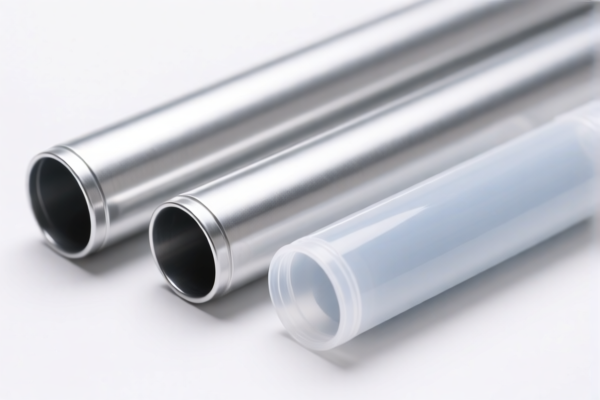

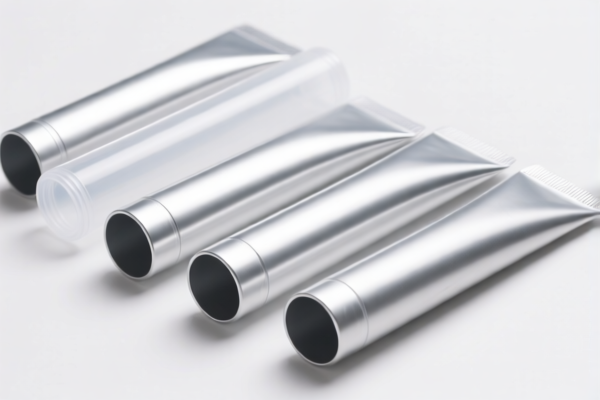

Product Classification: Other Plastic Rigid Silver Tubes

Based on the provided HS codes and descriptions, the product "Other Plastic Rigid Silver Tubes" can be classified under several HS codes. Below is a structured breakdown of the relevant HS codes, their tax rates, and key considerations.

1. HS CODE: 3917320050

- Description: Other plastic rigid tubes, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is suitable if the tubes are made of rigid plastic, not reinforced, and without fittings.

- Proactive Advice: Confirm the material composition and whether the tubes are reinforced or combined with other materials.

2. HS CODE: 3917220000

- Description: Other plastic rigid tubes, not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is similar to 3917320050 but may apply to a slightly different category of rigid plastic tubes.

- Proactive Advice: Verify the exact product description and compare with the HS code definitions.

3. HS CODE: 3917390050

- Description: Other plastic fittings, not reinforced or combined with other materials.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code applies to other plastic fittings, which may include tubes if they are considered fittings.

- Proactive Advice: Clarify whether the tubes are considered as fittings or standalone items.

4. HS CODE: 3917210000

- Description: Other plastic rigid tubes, not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is similar to 3917220000 and may apply to rigid plastic tubes.

- Proactive Advice: Confirm the product's exact description and ensure it matches the HS code definition.

5. HS CODE: 7304598035

- Description: Other iron or steel tubes, pipes, and hollow profiles, not of heading 7304.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is for metal tubes, not plastic.

- Proactive Advice: Ensure the product is not made of metal. If it is, this code would be incorrect.

Key Tax Rate Changes (April 11, 2025 Special Tariff)

- All applicable HS codes will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy and must be considered in customs planning.

Proactive Advice Summary

- Verify Material: Ensure the product is plastic, not metal or composite.

- Check Unit Price: High-value items may be subject to additional scrutiny.

- Confirm Product Description: Ensure the product is not classified as a fitting or combined with other materials.

- Review Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Dates: Be aware of the April 11, 2025 deadline for the special tariff.

Let me know if you need help with HS code selection or customs documentation.

Product Classification: Other Plastic Rigid Silver Tubes

Based on the provided HS codes and descriptions, the product "Other Plastic Rigid Silver Tubes" can be classified under several HS codes. Below is a structured breakdown of the relevant HS codes, their tax rates, and key considerations.

1. HS CODE: 3917320050

- Description: Other plastic rigid tubes, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is suitable if the tubes are made of rigid plastic, not reinforced, and without fittings.

- Proactive Advice: Confirm the material composition and whether the tubes are reinforced or combined with other materials.

2. HS CODE: 3917220000

- Description: Other plastic rigid tubes, not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is similar to 3917320050 but may apply to a slightly different category of rigid plastic tubes.

- Proactive Advice: Verify the exact product description and compare with the HS code definitions.

3. HS CODE: 3917390050

- Description: Other plastic fittings, not reinforced or combined with other materials.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code applies to other plastic fittings, which may include tubes if they are considered fittings.

- Proactive Advice: Clarify whether the tubes are considered as fittings or standalone items.

4. HS CODE: 3917210000

- Description: Other plastic rigid tubes, not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is similar to 3917220000 and may apply to rigid plastic tubes.

- Proactive Advice: Confirm the product's exact description and ensure it matches the HS code definition.

5. HS CODE: 7304598035

- Description: Other iron or steel tubes, pipes, and hollow profiles, not of heading 7304.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is for metal tubes, not plastic.

- Proactive Advice: Ensure the product is not made of metal. If it is, this code would be incorrect.

Key Tax Rate Changes (April 11, 2025 Special Tariff)

- All applicable HS codes will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy and must be considered in customs planning.

Proactive Advice Summary

- Verify Material: Ensure the product is plastic, not metal or composite.

- Check Unit Price: High-value items may be subject to additional scrutiny.

- Confirm Product Description: Ensure the product is not classified as a fitting or combined with other materials.

- Review Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Dates: Be aware of the April 11, 2025 deadline for the special tariff.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.