| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariffs for "Other Plastic Wall Coverings (Commercial Use)":

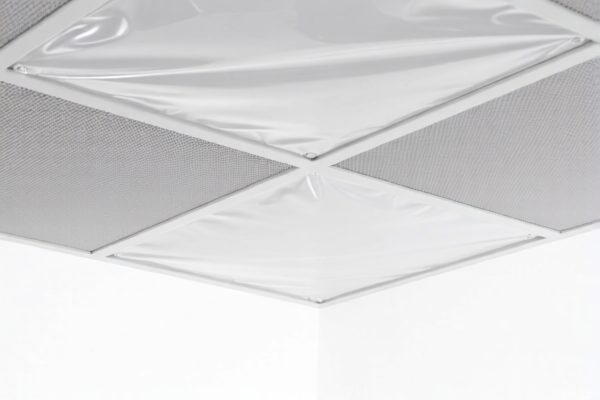

📦 HS CODE: 3918905000

Product Description: Plastic wall coverings (for commercial spaces)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is specifically for commercial use, so ensure the intended use is clearly documented for customs compliance.

📦 HS CODE: 3918901000

Product Description: Plastic wall decoration

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for decorative plastic wall coverings. Confirm if the product is purely decorative or functional, as this may affect classification.

📦 HS CODE: 3924901010

Product Description: Plastic blinds for window covering

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This product is classified under window coverings, not wall coverings. Ensure the product is not misclassified as wall coverings.

📦 HS CODE: 3923900080

Product Description: Plastic cover for home decoration

Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This is for home use, not commercial. If the product is intended for commercial spaces, this may not be the correct classification.

⚠️ Important Reminders:

- Verify Material and Unit Price: Ensure the product is made entirely of plastic and not a composite material, as this can affect classification.

- Check Required Certifications: Some products may require specific certifications (e.g., fire resistance, environmental compliance) for commercial use.

- Confirm Intended Use: Commercial vs. home use can lead to different HS code classifications.

- April 11, 2025, Deadline: Be aware of the special tariff increase after this date. If your shipment is scheduled after this date, the additional 30% tariff will apply.

Let me know if you need help selecting the most appropriate HS code based on your product specifications. Here is the structured and professional breakdown of the HS codes and associated tariffs for "Other Plastic Wall Coverings (Commercial Use)":

📦 HS CODE: 3918905000

Product Description: Plastic wall coverings (for commercial spaces)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is specifically for commercial use, so ensure the intended use is clearly documented for customs compliance.

📦 HS CODE: 3918901000

Product Description: Plastic wall decoration

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for decorative plastic wall coverings. Confirm if the product is purely decorative or functional, as this may affect classification.

📦 HS CODE: 3924901010

Product Description: Plastic blinds for window covering

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This product is classified under window coverings, not wall coverings. Ensure the product is not misclassified as wall coverings.

📦 HS CODE: 3923900080

Product Description: Plastic cover for home decoration

Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This is for home use, not commercial. If the product is intended for commercial spaces, this may not be the correct classification.

⚠️ Important Reminders:

- Verify Material and Unit Price: Ensure the product is made entirely of plastic and not a composite material, as this can affect classification.

- Check Required Certifications: Some products may require specific certifications (e.g., fire resistance, environmental compliance) for commercial use.

- Confirm Intended Use: Commercial vs. home use can lead to different HS code classifications.

- April 11, 2025, Deadline: Be aware of the special tariff increase after this date. If your shipment is scheduled after this date, the additional 30% tariff will apply.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Customer Reviews

No reviews yet.