| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3824829000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

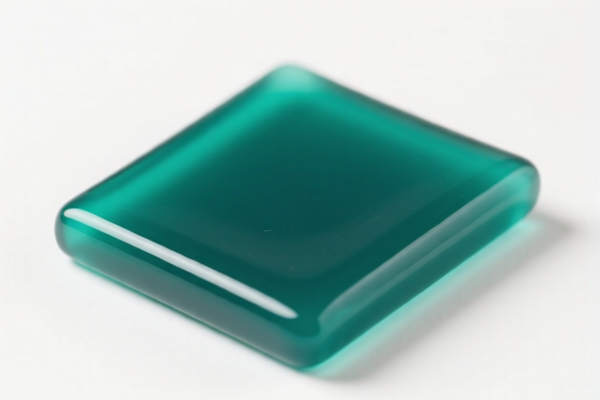

Here is the structured analysis and customs compliance guidance for the declared product "Other Polyester Resin" (Other Polyester Resin), based on the provided HS codes and tax details:

✅ HS CODE: 3907995050

Product Description: Other Polyester Resin

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- The additional tariff will increase from 25.0% to 30.0%.

- This is a time-sensitive policy, so importers must plan accordingly if the goods are scheduled to be imported after this date.

📌 Other Relevant HS Codes for Similar Products:

- HS CODE: 3911909110 – Other Petroleum-Based Resin

- Total Tax Rate: 61.5%

-

Tax Breakdown: Same as above (6.5% base, 25.0% additional, 30.0% after April 11, 2025)

-

HS CODE: 3920690000 – Other Polyester Material Plastic Foil

- Total Tax Rate: 59.2%

-

Tax Breakdown: 4.2% base, 25.0% additional, 30.0% after April 11, 2025

-

HS CODE: 3824829000 – Ester Resin

- Total Tax Rate: 58.7%

-

Tax Breakdown: 3.7% base, 25.0% additional, 30.0% after April 11, 2025

-

HS CODE: 3907290000 – Other Polyether: Other

- Total Tax Rate: 61.5%

- Tax Breakdown: Same as above (6.5% base, 25.0% additional, 30.0% after April 11, 2025)

⚠️ Important Notes for Importers:

- Verify the exact product description and material composition to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs or other customs regulations.

- Review required certifications (e.g., REACH, RoHS, or other product-specific compliance documents) to avoid delays in customs clearance.

- Monitor the April 11, 2025 deadline for tariff changes and adjust your import strategy accordingly.

📌 Proactive Advice:

- If you are importing polyester resin or similar products, consult with a customs broker or compliance expert to confirm the most up-to-date HS code and applicable tariffs.

- Keep records of product specifications, supplier documentation, and certifications to support customs declarations and avoid penalties.

Let me know if you need help with HS code verification or customs documentation! Here is the structured analysis and customs compliance guidance for the declared product "Other Polyester Resin" (Other Polyester Resin), based on the provided HS codes and tax details:

✅ HS CODE: 3907995050

Product Description: Other Polyester Resin

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- The additional tariff will increase from 25.0% to 30.0%.

- This is a time-sensitive policy, so importers must plan accordingly if the goods are scheduled to be imported after this date.

📌 Other Relevant HS Codes for Similar Products:

- HS CODE: 3911909110 – Other Petroleum-Based Resin

- Total Tax Rate: 61.5%

-

Tax Breakdown: Same as above (6.5% base, 25.0% additional, 30.0% after April 11, 2025)

-

HS CODE: 3920690000 – Other Polyester Material Plastic Foil

- Total Tax Rate: 59.2%

-

Tax Breakdown: 4.2% base, 25.0% additional, 30.0% after April 11, 2025

-

HS CODE: 3824829000 – Ester Resin

- Total Tax Rate: 58.7%

-

Tax Breakdown: 3.7% base, 25.0% additional, 30.0% after April 11, 2025

-

HS CODE: 3907290000 – Other Polyether: Other

- Total Tax Rate: 61.5%

- Tax Breakdown: Same as above (6.5% base, 25.0% additional, 30.0% after April 11, 2025)

⚠️ Important Notes for Importers:

- Verify the exact product description and material composition to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs or other customs regulations.

- Review required certifications (e.g., REACH, RoHS, or other product-specific compliance documents) to avoid delays in customs clearance.

- Monitor the April 11, 2025 deadline for tariff changes and adjust your import strategy accordingly.

📌 Proactive Advice:

- If you are importing polyester resin or similar products, consult with a customs broker or compliance expert to confirm the most up-to-date HS code and applicable tariffs.

- Keep records of product specifications, supplier documentation, and certifications to support customs declarations and avoid penalties.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.