| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

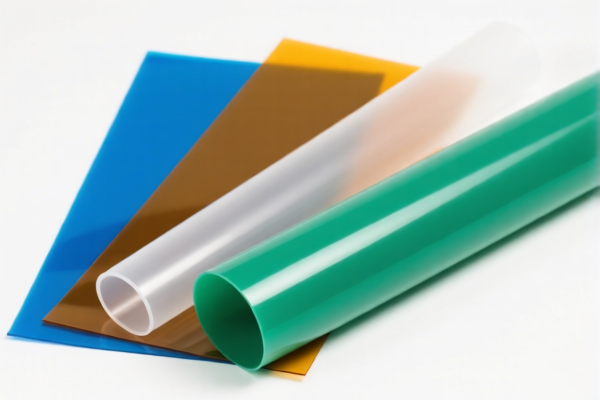

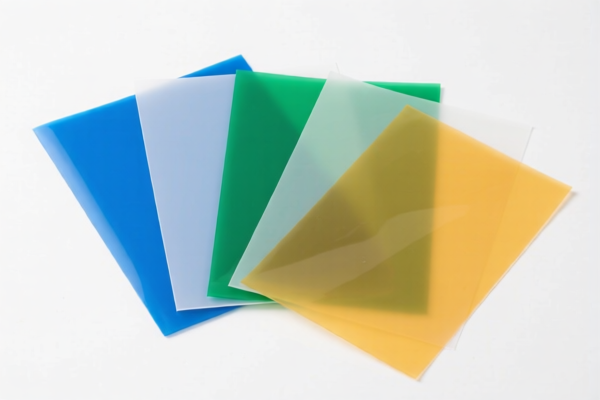

Product Classification: Other Polyetheretherketone Films

HS CODE: 3911902500

🔍 HS Code Interpretation & Tax Details

- HS CODE: 3911902500

- Description: Polyetheretherketone (PEEK) resins, polyetheretherketone copolymers, and other polyetheretherketone materials in primary form.

- Tariff Summary: 61.1% total tax rate.

📊 Tariff Breakdown

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This additional tariff applies after April 11, 2025, and is likely related to trade policy adjustments or anti-dumping measures.

⚠️ Important Notes & Alerts

- Time-Sensitive Policy:

-

The 30.0% additional tariff will be applied after April 11, 2025. Ensure your customs clearance is planned accordingly to avoid unexpected costs.

-

Anti-Dumping Duties:

- While not explicitly stated, PEEK materials may be subject to anti-dumping duties depending on the country of origin and specific trade agreements. Verify with customs or a trade compliance expert if applicable.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm that the product is indeed in primary form (not finished goods or processed items), as this affects classification.

- Check Unit Price & Certification: Some PEEK materials may require technical certifications or safety documentation, especially for industrial or medical applications.

- Consult Customs Authority: For precise classification and to confirm whether your product falls under 3911902500 or another HS code (e.g., 3907290000 for other polyether materials).

- Monitor Tariff Updates: Stay informed about April 11, 2025, and any potential changes in trade policies that may affect your import costs.

📋 Alternative HS Codes for Reference

- 3907290000 – Other polyether materials in primary form (61.5% total tax)

- 3907210000 – Polyether resins in primary form (61.5% total tax)

These codes may apply if the product is not specifically PEEK but another type of polyether material.

Let me know if you need help determining the exact HS code for your specific product or if you need assistance with customs documentation.

Product Classification: Other Polyetheretherketone Films

HS CODE: 3911902500

🔍 HS Code Interpretation & Tax Details

- HS CODE: 3911902500

- Description: Polyetheretherketone (PEEK) resins, polyetheretherketone copolymers, and other polyetheretherketone materials in primary form.

- Tariff Summary: 61.1% total tax rate.

📊 Tariff Breakdown

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This additional tariff applies after April 11, 2025, and is likely related to trade policy adjustments or anti-dumping measures.

⚠️ Important Notes & Alerts

- Time-Sensitive Policy:

-

The 30.0% additional tariff will be applied after April 11, 2025. Ensure your customs clearance is planned accordingly to avoid unexpected costs.

-

Anti-Dumping Duties:

- While not explicitly stated, PEEK materials may be subject to anti-dumping duties depending on the country of origin and specific trade agreements. Verify with customs or a trade compliance expert if applicable.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm that the product is indeed in primary form (not finished goods or processed items), as this affects classification.

- Check Unit Price & Certification: Some PEEK materials may require technical certifications or safety documentation, especially for industrial or medical applications.

- Consult Customs Authority: For precise classification and to confirm whether your product falls under 3911902500 or another HS code (e.g., 3907290000 for other polyether materials).

- Monitor Tariff Updates: Stay informed about April 11, 2025, and any potential changes in trade policies that may affect your import costs.

📋 Alternative HS Codes for Reference

- 3907290000 – Other polyether materials in primary form (61.5% total tax)

- 3907210000 – Polyether resins in primary form (61.5% total tax)

These codes may apply if the product is not specifically PEEK but another type of polyether material.

Let me know if you need help determining the exact HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.