Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

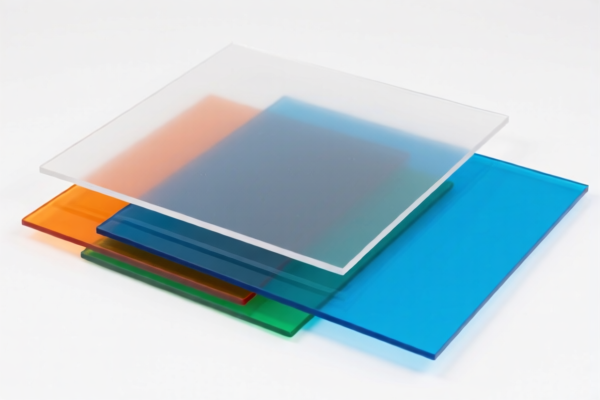

Product Classification: Other Polyimide Boards

HS CODE: 3920920000

🔍 Classification Summary

- HS CODE: 3920920000

- Description: Polyamide (nylon) made plastic sheets, plates, films, foils, and strips (including composite or reinforced materials)

- Note: This code applies to polyamide-based composite or reinforced boards, including polyimide boards.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 59.2%

⏱️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025.

- Impact: This will increase the total tax burden significantly, from 59.2% to 64.2% after the date.

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum Products: Not applicable for polyimide boards.

- Other Materials: No known anti-dumping duties currently apply to polyimide boards.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polyamide or polyimide-based composite materials. Misclassification can lead to penalties.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline and plan your import schedule accordingly.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker or expert for accurate compliance.

📌 Alternative HS Codes (for reference)

- 3908907000 – Primary forms of other polyamides (not suitable for finished boards)

- 3920920000 – Most appropriate for polyimide or polyamide-based composite boards

Let me know if you need help with customs documentation or further clarification on the classification.

Product Classification: Other Polyimide Boards

HS CODE: 3920920000

🔍 Classification Summary

- HS CODE: 3920920000

- Description: Polyamide (nylon) made plastic sheets, plates, films, foils, and strips (including composite or reinforced materials)

- Note: This code applies to polyamide-based composite or reinforced boards, including polyimide boards.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 59.2%

⏱️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025.

- Impact: This will increase the total tax burden significantly, from 59.2% to 64.2% after the date.

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum Products: Not applicable for polyimide boards.

- Other Materials: No known anti-dumping duties currently apply to polyimide boards.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polyamide or polyimide-based composite materials. Misclassification can lead to penalties.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline and plan your import schedule accordingly.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker or expert for accurate compliance.

📌 Alternative HS Codes (for reference)

- 3908907000 – Primary forms of other polyamides (not suitable for finished boards)

- 3920920000 – Most appropriate for polyimide or polyamide-based composite boards

Let me know if you need help with customs documentation or further clarification on the classification.

Customer Reviews

No reviews yet.