| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

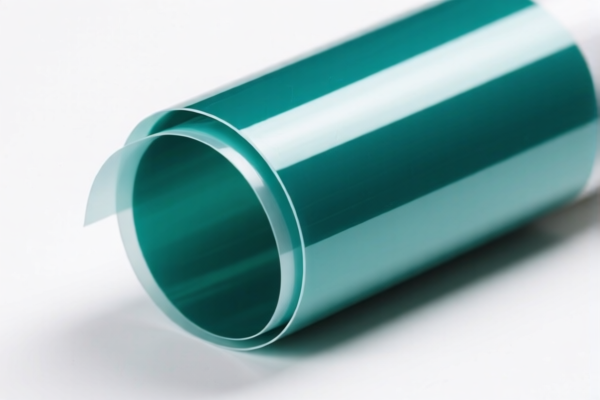

Product Classification: Other Polyimide Films

HS CODE: 3920920000 (for most entries; note that 3908907000 is for polyamide films, not polyimide)

🔍 Classification Summary

- Product Type: Polyimide films (also referred to as polyimide plastic films, composite films, etc.)

- HS Code: 3920920000 (for polyimide films and related composite materials)

- Alternative HS Code: 3908907000 (for polyamide films, which is a different material)

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 2, 2025. Ensure your import timeline is aligned with this change.

📌 Key Considerations

- Material Verification: Confirm that the product is indeed polyimide film and not polyamide (which falls under a different HS code: 3908907000).

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for customs clearance.

- Composite Materials: If the film is a composite (e.g., polyimide composite film), ensure it is correctly classified under 3920920000 and not misclassified under a different HS code.

- Anti-Dumping Duties: Currently, no specific anti-dumping duties are listed for polyimide films, but this may change depending on trade policies.

📅 Time-Sensitive Policy Alert

- April 2, 2025: A 30.0% additional tariff will be imposed on this product. This is a critical date for import planning and cost estimation.

✅ Proactive Advice

- Double-check the product composition to ensure it is correctly classified under 3920920000.

- Consult with customs brokers or trade advisors to confirm the latest HS code and tariff rates.

- Keep records of product specifications (e.g., thickness, composition, application) for customs documentation.

Let me know if you need help with HS code verification or tariff calculation for a specific shipment.

Product Classification: Other Polyimide Films

HS CODE: 3920920000 (for most entries; note that 3908907000 is for polyamide films, not polyimide)

🔍 Classification Summary

- Product Type: Polyimide films (also referred to as polyimide plastic films, composite films, etc.)

- HS Code: 3920920000 (for polyimide films and related composite materials)

- Alternative HS Code: 3908907000 (for polyamide films, which is a different material)

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 2, 2025. Ensure your import timeline is aligned with this change.

📌 Key Considerations

- Material Verification: Confirm that the product is indeed polyimide film and not polyamide (which falls under a different HS code: 3908907000).

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for customs clearance.

- Composite Materials: If the film is a composite (e.g., polyimide composite film), ensure it is correctly classified under 3920920000 and not misclassified under a different HS code.

- Anti-Dumping Duties: Currently, no specific anti-dumping duties are listed for polyimide films, but this may change depending on trade policies.

📅 Time-Sensitive Policy Alert

- April 2, 2025: A 30.0% additional tariff will be imposed on this product. This is a critical date for import planning and cost estimation.

✅ Proactive Advice

- Double-check the product composition to ensure it is correctly classified under 3920920000.

- Consult with customs brokers or trade advisors to confirm the latest HS code and tariff rates.

- Keep records of product specifications (e.g., thickness, composition, application) for customs documentation.

Let me know if you need help with HS code verification or tariff calculation for a specific shipment.

Customer Reviews

No reviews yet.