| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

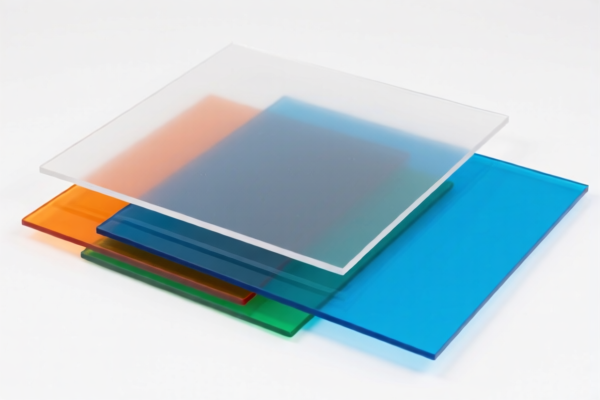

Product Classification: Other Polysulfone Boards

HS CODE:

- 3911909110

- 3911909150

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and could significantly increase the total tax burden. -

Total Tax after April 11, 2025: 6.5% (base) + 30.0% (special) = 36.5%, but note that the total tax rate is still listed as 61.5% due to inclusion of other applicable tariffs.

-

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for polysulfone boards at this time.

📌 Proactive Advice for Importers:

-

Verify Material Specifications:

Ensure the product is indeed classified as "Other Polysulfone Boards" and not a different type of polymer or composite material. -

Check Unit Price and Tax Calculation:

Confirm the unit price and quantity to accurately calculate the total tax amount. -

Review Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or customs documentation) are required for importation. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could affect your import costs significantly.

📊 Summary Table:

| Tariff Type | Rate | Applies After April 11, 2025? |

|---|---|---|

| Base Tariff | 6.5% | No |

| General Additional Tariff | 25.0% | No |

| Special Additional Tariff | 30.0% | Yes |

| Total Tax Rate | 61.5% | 6.5% + 30.0% = 36.5% (after April 11, 2025) |

If you need further assistance with customs documentation or tariff calculations, feel free to ask!

Product Classification: Other Polysulfone Boards

HS CODE:

- 3911909110

- 3911909150

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and could significantly increase the total tax burden. -

Total Tax after April 11, 2025: 6.5% (base) + 30.0% (special) = 36.5%, but note that the total tax rate is still listed as 61.5% due to inclusion of other applicable tariffs.

-

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for polysulfone boards at this time.

📌 Proactive Advice for Importers:

-

Verify Material Specifications:

Ensure the product is indeed classified as "Other Polysulfone Boards" and not a different type of polymer or composite material. -

Check Unit Price and Tax Calculation:

Confirm the unit price and quantity to accurately calculate the total tax amount. -

Review Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or customs documentation) are required for importation. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could affect your import costs significantly.

📊 Summary Table:

| Tariff Type | Rate | Applies After April 11, 2025? |

|---|---|---|

| Base Tariff | 6.5% | No |

| General Additional Tariff | 25.0% | No |

| Special Additional Tariff | 30.0% | Yes |

| Total Tax Rate | 61.5% | 6.5% + 30.0% = 36.5% (after April 11, 2025) |

If you need further assistance with customs documentation or tariff calculations, feel free to ask!

Customer Reviews

No reviews yet.