| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

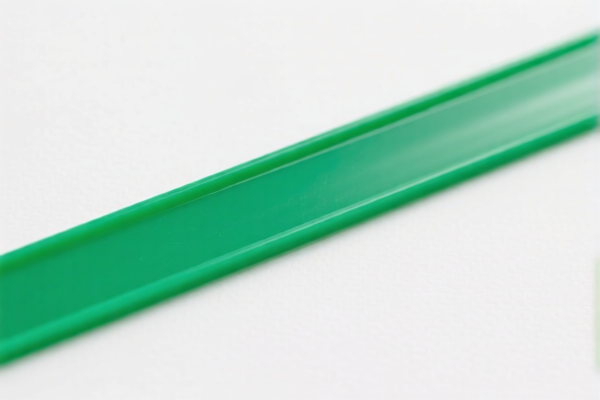

Here is the structured analysis and classification for the declared product "Other Polyvinyl Chloride Plastic Strip (For Decoration)" based on the provided HS codes and tax details:

✅ HS CODE: 3916200091

Product Description: PVC Window Door Strip for Decoration

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is PVC, not metal)

- April 11 Special Tariff: Applies (30.0% added after April 11, 2025)

✅ HS CODE: 3921905050

Product Description: Plastic for home decoration strip

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is PVC, not metal)

- April 11 Special Tariff: Applies (30.0% added after April 11, 2025)

📌 Key Notes and Recommendations:

- Tariff Increase Alert: Both products are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for cost planning.

- Material Verification: Ensure the product is indeed made of PVC (Polyvinyl Chloride) and not a different plastic, as this can affect classification.

- Certifications Required: Confirm if any import permits, environmental certifications, or product safety standards are required for the specific use (e.g., for home decoration).

- Unit Price and Quantity: Verify the unit price and quantity for accurate tax calculation, especially if the product is being imported in bulk.

- Classification Accuracy: Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification penalties.

🛠️ Proactive Advice:

- If you are importing this product regularly, consider pre-clearance with customs to avoid delays.

- Keep updated records of material composition, origin, and intended use to support customs declarations.

- Monitor tariff changes and trade policies for PVC products, especially after April 11, 2025.

Let me know if you need help with a specific import scenario or documentation. Here is the structured analysis and classification for the declared product "Other Polyvinyl Chloride Plastic Strip (For Decoration)" based on the provided HS codes and tax details:

✅ HS CODE: 3916200091

Product Description: PVC Window Door Strip for Decoration

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is PVC, not metal)

- April 11 Special Tariff: Applies (30.0% added after April 11, 2025)

✅ HS CODE: 3921905050

Product Description: Plastic for home decoration strip

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is PVC, not metal)

- April 11 Special Tariff: Applies (30.0% added after April 11, 2025)

📌 Key Notes and Recommendations:

- Tariff Increase Alert: Both products are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for cost planning.

- Material Verification: Ensure the product is indeed made of PVC (Polyvinyl Chloride) and not a different plastic, as this can affect classification.

- Certifications Required: Confirm if any import permits, environmental certifications, or product safety standards are required for the specific use (e.g., for home decoration).

- Unit Price and Quantity: Verify the unit price and quantity for accurate tax calculation, especially if the product is being imported in bulk.

- Classification Accuracy: Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification penalties.

🛠️ Proactive Advice:

- If you are importing this product regularly, consider pre-clearance with customs to avoid delays.

- Keep updated records of material composition, origin, and intended use to support customs declarations.

- Monitor tariff changes and trade policies for PVC products, especially after April 11, 2025.

Let me know if you need help with a specific import scenario or documentation.

Customer Reviews

No reviews yet.