| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3907914000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907915000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

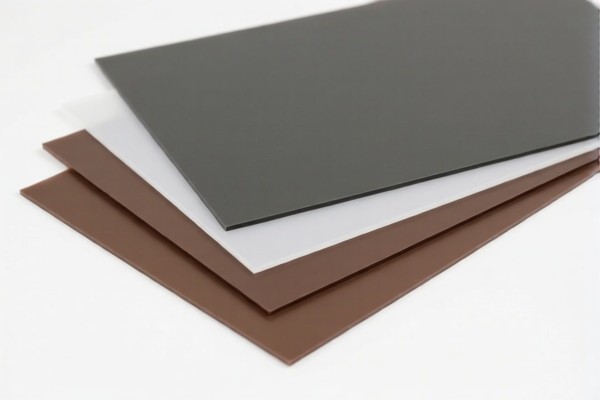

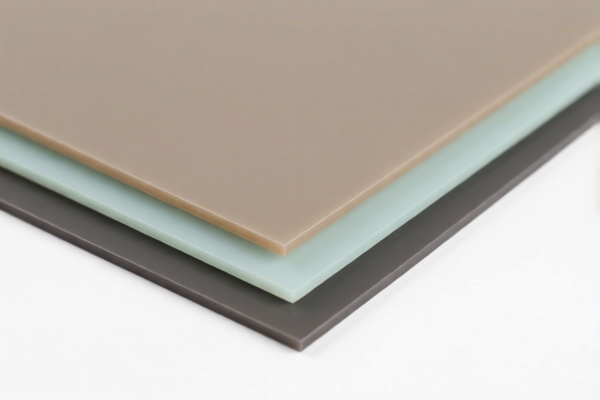

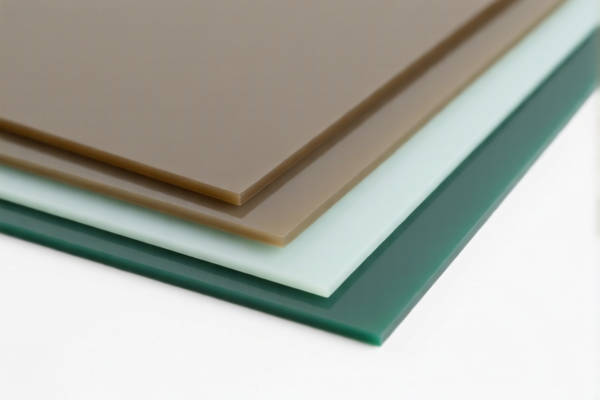

Here is the structured classification and tariff information for "Other Unsaturated Polyester Films" based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

- HS Code 3920632000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3920631000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3907914000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3907915000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all these HS codes after April 2, 2025. This is a time-sensitive policy and must be accounted for in your customs planning. -

No Anti-Dumping Duties Mentioned:

There is no indication of anti-dumping duties on iron or aluminum in the provided data. However, always verify with the latest customs notices or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed classified as "Other Unsaturated Polyester Films" and not misclassified under a different HS code (e.g., for saturated polyester or other polymer films). -

Check Unit Price and Tax Calculation:

The total tax rate is cumulative (base + additional + special). Confirm the correct HS code for your product to avoid overpayment or delays. -

Certifications and Documentation:

Review if any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product, especially if it's being imported into the EU or other regulated markets. -

Monitor Policy Updates:

Stay updated on any changes in customs policies, especially regarding the April 2, 2025 tariff increase, which could significantly impact your import costs.

Let me know if you need help selecting the correct HS code for your specific product or calculating the exact import cost. Here is the structured classification and tariff information for "Other Unsaturated Polyester Films" based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

- HS Code 3920632000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3920631000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3907914000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3907915000

- Description: Other Unsaturated Polyester Films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all these HS codes after April 2, 2025. This is a time-sensitive policy and must be accounted for in your customs planning. -

No Anti-Dumping Duties Mentioned:

There is no indication of anti-dumping duties on iron or aluminum in the provided data. However, always verify with the latest customs notices or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed classified as "Other Unsaturated Polyester Films" and not misclassified under a different HS code (e.g., for saturated polyester or other polymer films). -

Check Unit Price and Tax Calculation:

The total tax rate is cumulative (base + additional + special). Confirm the correct HS code for your product to avoid overpayment or delays. -

Certifications and Documentation:

Review if any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product, especially if it's being imported into the EU or other regulated markets. -

Monitor Policy Updates:

Stay updated on any changes in customs policies, especially regarding the April 2, 2025 tariff increase, which could significantly impact your import costs.

Let me know if you need help selecting the correct HS code for your specific product or calculating the exact import cost.

Customer Reviews

No reviews yet.