| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

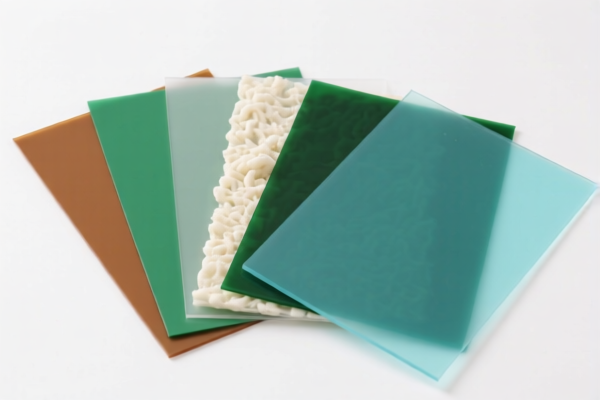

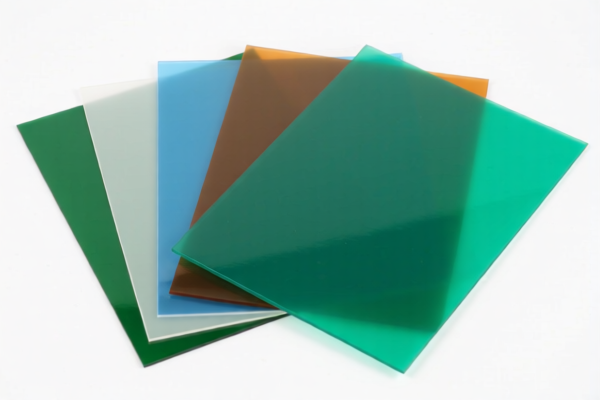

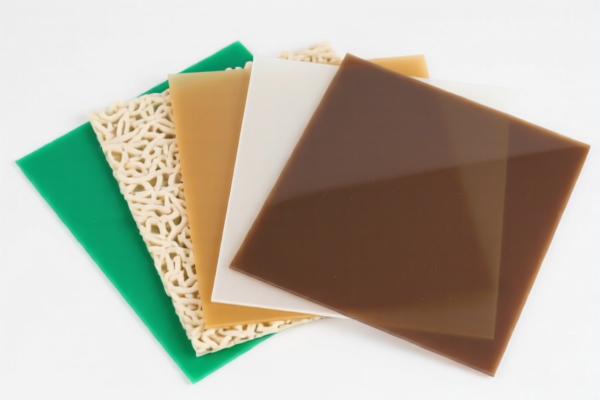

Product Name: Other cellulose derivative laminated plastic sheets

Classification HS Code: 3920795000

🔍 HS Code Details:

- HS CODE: 3920795000

- Description: Fiber cellulose ester composite plastic sheets

- Total Tax Rate: 58.7%

📊 Tariff Breakdown:

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a significant increase from the current 25.0% additional tariff.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made from cellulose derivatives and not misclassified as a different type of composite material (e.g., synthetic fiber-based).

- Check Unit Price and Certification: Confirm the unit price and whether any specific certifications (e.g., environmental, safety, or quality standards) are required for import.

- Monitor Tariff Updates: Keep track of any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

- Consult Customs Broker: For accurate classification and compliance, consider working with a customs broker or a customs compliance expert.

🔄 Alternative HS Codes (for Reference):

- 3921905050 – Plastic composite sheets (general category)

- Total Tax: 34.8%

- Base Tariff: 4.8%

- Additional Tariff (after April 11, 2025): 30.0%

-

Note: This code may apply to similar products but not specifically to cellulose derivatives.

-

3921902550 – Synthetic fiber-based plastic composite sheets (e.g., polyester fiber)

- Total Tax: 61.5%

- Base Tariff: 6.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Note: Higher tax rate due to synthetic fiber content.

✅ Conclusion:

For "Other cellulose derivative laminated plastic sheets", the most accurate HS code is 3920795000, with a total tax rate of 58.7%. Be mindful of the 30.0% additional tariff after April 11, 2025, and ensure proper classification to avoid penalties or delays in customs clearance.

Product Name: Other cellulose derivative laminated plastic sheets

Classification HS Code: 3920795000

🔍 HS Code Details:

- HS CODE: 3920795000

- Description: Fiber cellulose ester composite plastic sheets

- Total Tax Rate: 58.7%

📊 Tariff Breakdown:

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a significant increase from the current 25.0% additional tariff.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made from cellulose derivatives and not misclassified as a different type of composite material (e.g., synthetic fiber-based).

- Check Unit Price and Certification: Confirm the unit price and whether any specific certifications (e.g., environmental, safety, or quality standards) are required for import.

- Monitor Tariff Updates: Keep track of any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

- Consult Customs Broker: For accurate classification and compliance, consider working with a customs broker or a customs compliance expert.

🔄 Alternative HS Codes (for Reference):

- 3921905050 – Plastic composite sheets (general category)

- Total Tax: 34.8%

- Base Tariff: 4.8%

- Additional Tariff (after April 11, 2025): 30.0%

-

Note: This code may apply to similar products but not specifically to cellulose derivatives.

-

3921902550 – Synthetic fiber-based plastic composite sheets (e.g., polyester fiber)

- Total Tax: 61.5%

- Base Tariff: 6.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Note: Higher tax rate due to synthetic fiber content.

✅ Conclusion:

For "Other cellulose derivative laminated plastic sheets", the most accurate HS code is 3920795000, with a total tax rate of 58.7%. Be mindful of the 30.0% additional tariff after April 11, 2025, and ensure proper classification to avoid penalties or delays in customs clearance.

Customer Reviews

No reviews yet.