| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3912900090 | Doc | 60.2% | CN | US | 2025-05-12 |

| 3912900090 | Doc | 60.2% | CN | US | 2025-05-12 |

| 3912900090 | Doc | 60.2% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

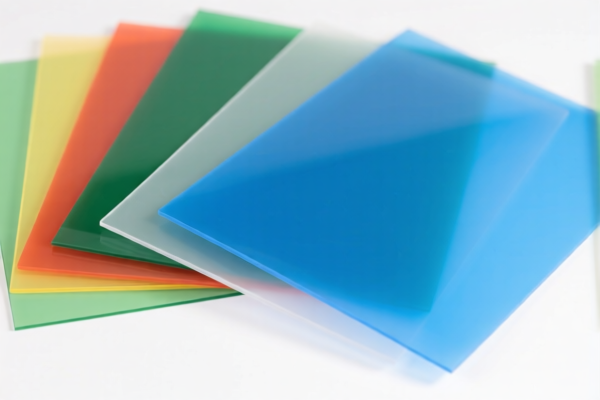

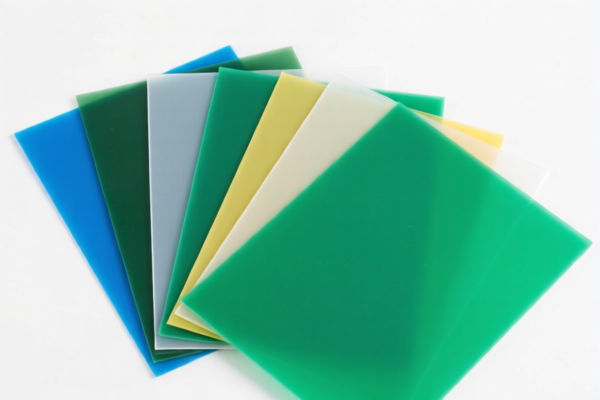

Here is the structured classification and tariff information for "Other cellulose derivative plastic sheets" based on the provided HS codes and tax details:

✅ HS CODE: 3912120000

Product Name: Cellulose Acetate Plastic Sheets

Total Tax Rate: 60.6%

Breakdown:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific code for acetate cellulose plastic sheets.

✅ HS CODE: 3912900090

Product Name: Other Cellulose Derivative Mixtures / Fillers / Aqueous Solutions

Total Tax Rate: 60.2%

Breakdown:

- Base Tariff Rate: 5.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to various forms of cellulose derivatives, including mixtures, fillers, and aqueous solutions.

✅ HS CODE: 3921902550

Product Name: Plastic and Cellulose Composite Films

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for composite films combining plastic and cellulose.

📌 Key Notes and Recommendations:

- Time-sensitive policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your import timeline aligns with this to avoid unexpected costs.

-

Material Verification:

-

Confirm the exact composition of the product (e.g., acetate vs. other cellulose derivatives) to ensure correct HS code classification.

-

Certifications:

-

Check if any customs certifications or product compliance documents are required for import (e.g., Material Safety Data Sheets, origin certificates).

-

Unit Price Consideration:

- The total tax rate is applied to the FOB or CIF value, so ensure accurate unit pricing is used for tax calculation.

🛑 Proactive Advice:

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or trade compliance experts for complex or high-value shipments.

- Monitor policy updates after April 11, 2025, as additional tariffs may change or expand.

Let me know if you need help with HS code selection or customs documentation! Here is the structured classification and tariff information for "Other cellulose derivative plastic sheets" based on the provided HS codes and tax details:

✅ HS CODE: 3912120000

Product Name: Cellulose Acetate Plastic Sheets

Total Tax Rate: 60.6%

Breakdown:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific code for acetate cellulose plastic sheets.

✅ HS CODE: 3912900090

Product Name: Other Cellulose Derivative Mixtures / Fillers / Aqueous Solutions

Total Tax Rate: 60.2%

Breakdown:

- Base Tariff Rate: 5.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to various forms of cellulose derivatives, including mixtures, fillers, and aqueous solutions.

✅ HS CODE: 3921902550

Product Name: Plastic and Cellulose Composite Films

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for composite films combining plastic and cellulose.

📌 Key Notes and Recommendations:

- Time-sensitive policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your import timeline aligns with this to avoid unexpected costs.

-

Material Verification:

-

Confirm the exact composition of the product (e.g., acetate vs. other cellulose derivatives) to ensure correct HS code classification.

-

Certifications:

-

Check if any customs certifications or product compliance documents are required for import (e.g., Material Safety Data Sheets, origin certificates).

-

Unit Price Consideration:

- The total tax rate is applied to the FOB or CIF value, so ensure accurate unit pricing is used for tax calculation.

🛑 Proactive Advice:

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or trade compliance experts for complex or high-value shipments.

- Monitor policy updates after April 11, 2025, as additional tariffs may change or expand.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.