| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4811596000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811594040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926909400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4811592000 | Doc | 55.0% | CN | US | 2025-05-12 |

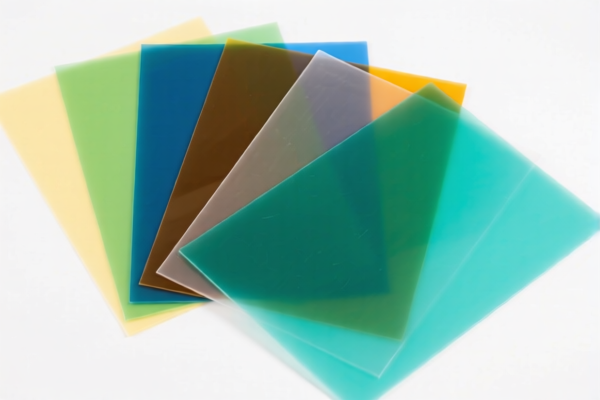

Here is the structured classification and tariff information for "Other laminated plastic sheets" based on the provided HS codes and tax details:

✅ HS CODE: 4811596000

Product Description: Paper and paperboard coated, impregnated, or covered with plastic

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to paper or paperboard with a plastic coating.

✅ HS CODE: 4811594040

Product Description: Paper and paperboard products coated, impregnated, or covered with plastic

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for finished products made from coated paper or paperboard.

✅ HS CODE: 3926909400

Product Description: Cards without holes, for use as or for making embossed cards

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code may apply to laminated plastic cards used for embossing.

✅ HS CODE: 3918905000

Product Description: Plastic wall coverings (e.g., wall claddings)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for plastic wall coverings, which may be relevant if the laminated plastic sheets are used for wall applications.

✅ HS CODE: 4811592000

Product Description: Plastic-coated paper and paperboard, width over 15 cm or rectangular sheets

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for wider sheets of plastic-coated paper or paperboard.

📌 Proactive Advice for Users:

- Verify Material and Unit Price: Confirm whether the product is made of paper or plastic, and check the exact dimensions and specifications.

- Check Required Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for customs clearance.

- Monitor Tariff Changes: The April 11, 2025 tariff increase is significant (30.0% additional), so ensure your import timing aligns with your cost strategy.

- Consult a Customs Broker: For complex classifications or large shipments, it's advisable to seek professional customs advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for "Other laminated plastic sheets" based on the provided HS codes and tax details:

✅ HS CODE: 4811596000

Product Description: Paper and paperboard coated, impregnated, or covered with plastic

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to paper or paperboard with a plastic coating.

✅ HS CODE: 4811594040

Product Description: Paper and paperboard products coated, impregnated, or covered with plastic

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for finished products made from coated paper or paperboard.

✅ HS CODE: 3926909400

Product Description: Cards without holes, for use as or for making embossed cards

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code may apply to laminated plastic cards used for embossing.

✅ HS CODE: 3918905000

Product Description: Plastic wall coverings (e.g., wall claddings)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for plastic wall coverings, which may be relevant if the laminated plastic sheets are used for wall applications.

✅ HS CODE: 4811592000

Product Description: Plastic-coated paper and paperboard, width over 15 cm or rectangular sheets

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for wider sheets of plastic-coated paper or paperboard.

📌 Proactive Advice for Users:

- Verify Material and Unit Price: Confirm whether the product is made of paper or plastic, and check the exact dimensions and specifications.

- Check Required Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for customs clearance.

- Monitor Tariff Changes: The April 11, 2025 tariff increase is significant (30.0% additional), so ensure your import timing aligns with your cost strategy.

- Consult a Customs Broker: For complex classifications or large shipments, it's advisable to seek professional customs advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.