| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9506598060 | Doc | 41.5% | CN | US | 2025-05-12 |

| 9506594040 | Doc | 35.6% | CN | US | 2025-05-12 |

| 6402993115 | Doc | 36.0% | CN | US | 2025-05-12 |

| 6402191561 | Doc | 42.6% | CN | US | 2025-05-12 |

| 6404117990 | Doc | 90¢/pr. + 37.5%+37.5% | CN | US | 2025-05-12 |

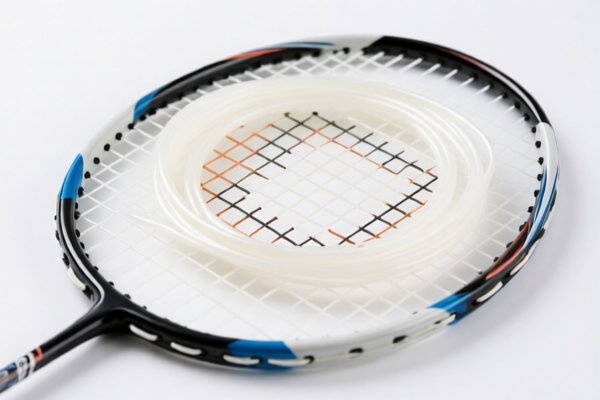

Based on the product name "Other plastic badminton racket strings", the most appropriate HS code classification would be 9506.59.80.60 or 9506.59.40.40, depending on the specific composition and structure of the racket strings. However, since the product is "other plastic badminton racket strings", and not a "badminton racket handle" (which is what the listed HS codes refer to), we need to consider the correct classification for racket strings.

✅ Recommended HS Code:

9506.59.80.60 – Other badminton rackets and parts thereof

- This code is more likely to apply to badminton racket strings, especially if they are made of plastic and are not specifically classified under other categories.

📌 Tax Details for 9506.59.80.60 (Plastic Badminton Racket Strings):

- Base Tariff Rate: 4.0%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 41.5%

📌 Additional Notes:

- Anti-dumping duties: Not applicable unless the product is specifically identified as being subject to anti-dumping measures (e.g., on steel or aluminum products).

- April 11 Special Tariff: Applies to all goods imported after April 11, 2025, and is 30.0% for this product.

- Material and Certification: Ensure the product is clearly labeled as plastic and not made of metal (e.g., steel or aluminum), which would fall under different HS codes and potentially higher tariffs.

- Unit Price and Quantity: If the product is priced per unit (e.g., per string or per set), this may affect the total tax calculation. Confirm with customs if the product is being imported in bulk or as individual units.

📌 Proactive Advice:

- Verify the exact composition of the racket strings (e.g., plastic type, whether it contains any metal components).

- Check if the product is classified under a different HS code if it is a replacement part or custom-made.

- Consult with customs or a compliance expert if the product is being imported in large quantities or under a specific trade agreement (e.g., RCEP, CPTPP).

- Keep documentation such as product specifications, invoices, and certificates of origin to support the classification and tax calculation.

Let me know if you need help with a specific import scenario or documentation. Based on the product name "Other plastic badminton racket strings", the most appropriate HS code classification would be 9506.59.80.60 or 9506.59.40.40, depending on the specific composition and structure of the racket strings. However, since the product is "other plastic badminton racket strings", and not a "badminton racket handle" (which is what the listed HS codes refer to), we need to consider the correct classification for racket strings.

✅ Recommended HS Code:

9506.59.80.60 – Other badminton rackets and parts thereof

- This code is more likely to apply to badminton racket strings, especially if they are made of plastic and are not specifically classified under other categories.

📌 Tax Details for 9506.59.80.60 (Plastic Badminton Racket Strings):

- Base Tariff Rate: 4.0%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 41.5%

📌 Additional Notes:

- Anti-dumping duties: Not applicable unless the product is specifically identified as being subject to anti-dumping measures (e.g., on steel or aluminum products).

- April 11 Special Tariff: Applies to all goods imported after April 11, 2025, and is 30.0% for this product.

- Material and Certification: Ensure the product is clearly labeled as plastic and not made of metal (e.g., steel or aluminum), which would fall under different HS codes and potentially higher tariffs.

- Unit Price and Quantity: If the product is priced per unit (e.g., per string or per set), this may affect the total tax calculation. Confirm with customs if the product is being imported in bulk or as individual units.

📌 Proactive Advice:

- Verify the exact composition of the racket strings (e.g., plastic type, whether it contains any metal components).

- Check if the product is classified under a different HS code if it is a replacement part or custom-made.

- Consult with customs or a compliance expert if the product is being imported in large quantities or under a specific trade agreement (e.g., RCEP, CPTPP).

- Keep documentation such as product specifications, invoices, and certificates of origin to support the classification and tax calculation.

Let me know if you need help with a specific import scenario or documentation.

Customer Reviews

No reviews yet.