| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920200055 | Doc | 59.2% | CN | US | 2025-05-12 |

| 8534000070 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811906090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811592000 | Doc | 55.0% | CN | US | 2025-05-12 |

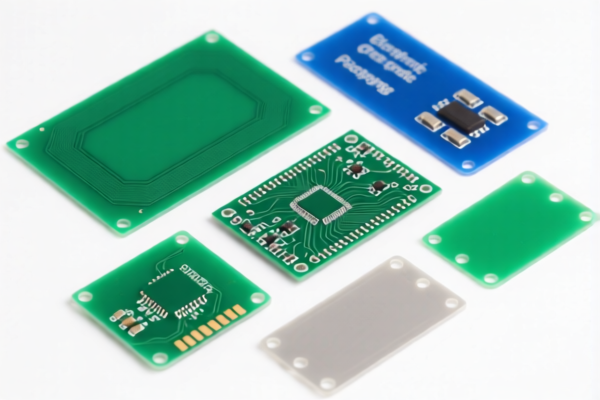

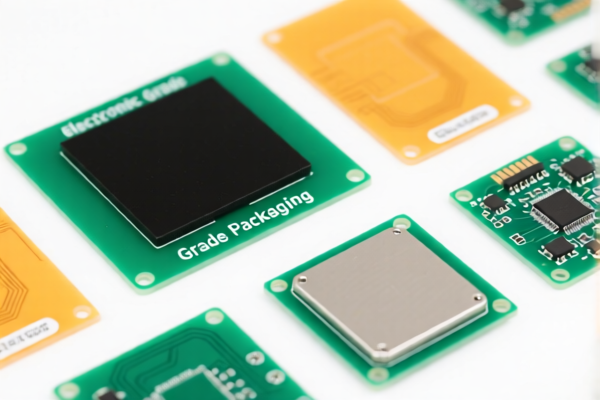

Here is the structured analysis and customs compliance guidance for the declared product "Other plastic electronic grade packaging boards" based on the provided HS codes and tariff details:

✅ HS CODE: 3920200055

Product Description:

- Plastic boards made of polypropylene (丙烯塑料电子包装板), not reinforced, not laminated, not combined with other materials.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes: - This code is specific to plastic boards made of polypropylene, not combined with other materials. - Tariff increases apply after April 11, 2025, so be mindful of the timing of your import.

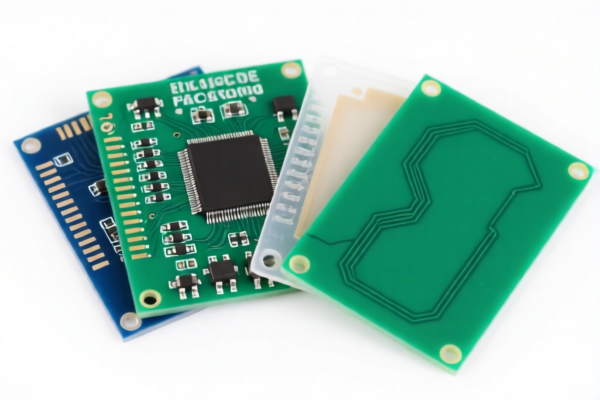

✅ HS CODE: 8534000070

Product Description:

- Plastic boards used in electronic equipment, such as printed circuit boards (PCBs), non-flexible, impregnated with plastic.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for electronic components, not just packaging. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

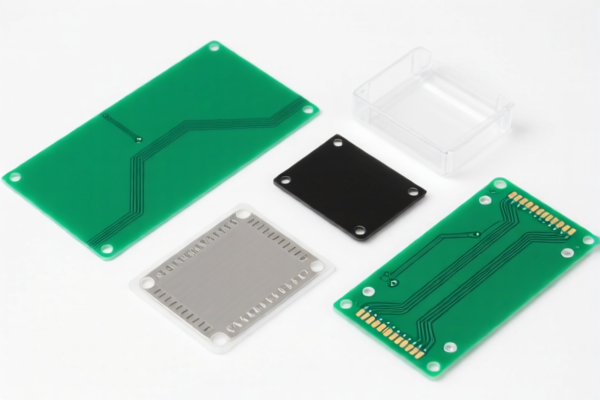

✅ HS CODE: 4811906090

Product Description:

- Coated, impregnated, or decorated paper or paperboard for packaging, including printed paper.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for paper-based packaging materials, not plastic. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

✅ HS CODE: 4807009400

Product Description:

- Composite paperboard sheets used for packaging electronics, not coated or impregnated, in sheet form.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for composite paperboard used in electronic packaging. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

✅ HS CODE: 4811592000

Product Description:

- Plastic-coated paper or paperboard for packaging, with specific size requirements (e.g., width >15 cm).

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for plastic-coated paper used in packaging, with specific size criteria. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material Composition:

-

Ensure the product is plastic-based and not paper or composite, to avoid misclassification.

-

Check Unit Price and Material Specifications:

-

Confirm whether the product is impregnated, coated, or laminated with other materials, as this affects HS code selection.

-

Review Certification Requirements:

-

Some HS codes may require customs declarations, product certifications, or environmental compliance documents.

-

Monitor Tariff Changes After April 11, 2025:

-

Be aware that additional tariffs will increase from 25% to 30% after this date.

-

Consult with Customs Brokers or Experts:

- For complex classifications, seek professional advice to avoid penalties or delays.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools. Here is the structured analysis and customs compliance guidance for the declared product "Other plastic electronic grade packaging boards" based on the provided HS codes and tariff details:

✅ HS CODE: 3920200055

Product Description:

- Plastic boards made of polypropylene (丙烯塑料电子包装板), not reinforced, not laminated, not combined with other materials.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes: - This code is specific to plastic boards made of polypropylene, not combined with other materials. - Tariff increases apply after April 11, 2025, so be mindful of the timing of your import.

✅ HS CODE: 8534000070

Product Description:

- Plastic boards used in electronic equipment, such as printed circuit boards (PCBs), non-flexible, impregnated with plastic.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for electronic components, not just packaging. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

✅ HS CODE: 4811906090

Product Description:

- Coated, impregnated, or decorated paper or paperboard for packaging, including printed paper.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for paper-based packaging materials, not plastic. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

✅ HS CODE: 4807009400

Product Description:

- Composite paperboard sheets used for packaging electronics, not coated or impregnated, in sheet form.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for composite paperboard used in electronic packaging. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

✅ HS CODE: 4811592000

Product Description:

- Plastic-coated paper or paperboard for packaging, with specific size requirements (e.g., width >15 cm).

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for plastic-coated paper used in packaging, with specific size criteria. - No base tariff, but additional tariffs apply. - Tariff increases apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material Composition:

-

Ensure the product is plastic-based and not paper or composite, to avoid misclassification.

-

Check Unit Price and Material Specifications:

-

Confirm whether the product is impregnated, coated, or laminated with other materials, as this affects HS code selection.

-

Review Certification Requirements:

-

Some HS codes may require customs declarations, product certifications, or environmental compliance documents.

-

Monitor Tariff Changes After April 11, 2025:

-

Be aware that additional tariffs will increase from 25% to 30% after this date.

-

Consult with Customs Brokers or Experts:

- For complex classifications, seek professional advice to avoid penalties or delays.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Customer Reviews

No reviews yet.