| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3812397000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3812396000 | Doc | 61.5% | CN | US | 2025-05-12 |

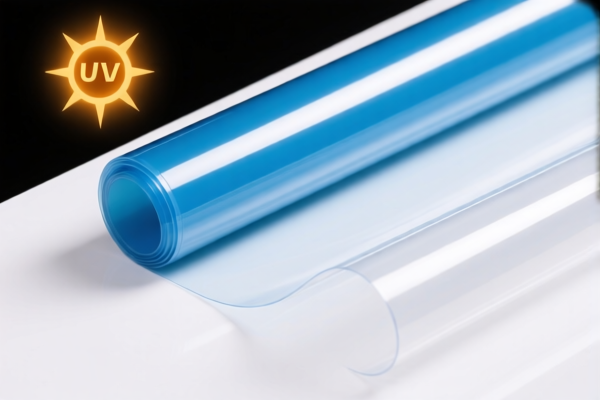

Product Classification: Anti-UV Plastic Film

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3920992000 – Plastic Anti-UV Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 59.2%

-

HS CODE: 3920991000 – Anti-UV Polyethylene Film

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.0%

-

HS CODE: 3921902900 – Anti-UV Textile Plastic Coating

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 59.4%

-

HS CODE: 3812397000 – Plastic UV Inhibitor

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 55.0%

-

HS CODE: 3812396000 – Plastic UV Inhibitor

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all listed HS codes after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material and Certification Requirements:

Verify the material composition (e.g., polyethylene, textile-based) and unit price to ensure correct HS code classification. Some products may require certifications (e.g., UV resistance testing reports) for compliance. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these products in the current data. However, always check for any country-specific anti-dumping measures that may apply. -

Tariff Variability:

The base tariff varies between 0.0% and 6.5%, depending on the product type. This highlights the importance of accurate product classification to avoid overpayment.

✅ Proactive Advice:

- Confirm the exact product description and technical specifications with your supplier.

- Check if certifications (e.g., UV resistance, material safety) are required for import.

- Consider customs broker assistance for accurate HS code selection and tariff calculation.

-

If importing after April 11, 2025, budget for the 30.0% special tariff to avoid unexpected costs. Product Classification: Anti-UV Plastic Film

HS CODEs and Tax Details (April 2025 Update): -

HS CODE: 3920992000 – Plastic Anti-UV Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 59.2%

-

HS CODE: 3920991000 – Anti-UV Polyethylene Film

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.0%

-

HS CODE: 3921902900 – Anti-UV Textile Plastic Coating

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 59.4%

-

HS CODE: 3812397000 – Plastic UV Inhibitor

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 55.0%

-

HS CODE: 3812396000 – Plastic UV Inhibitor

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all listed HS codes after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material and Certification Requirements:

Verify the material composition (e.g., polyethylene, textile-based) and unit price to ensure correct HS code classification. Some products may require certifications (e.g., UV resistance testing reports) for compliance. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these products in the current data. However, always check for any country-specific anti-dumping measures that may apply. -

Tariff Variability:

The base tariff varies between 0.0% and 6.5%, depending on the product type. This highlights the importance of accurate product classification to avoid overpayment.

✅ Proactive Advice:

- Confirm the exact product description and technical specifications with your supplier.

- Check if certifications (e.g., UV resistance, material safety) are required for import.

- Consider customs broker assistance for accurate HS code selection and tariff calculation.

- If importing after April 11, 2025, budget for the 30.0% special tariff to avoid unexpected costs.

Customer Reviews

No reviews yet.