| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920200055 | Doc | 59.2% | CN | US | 2025-05-12 |

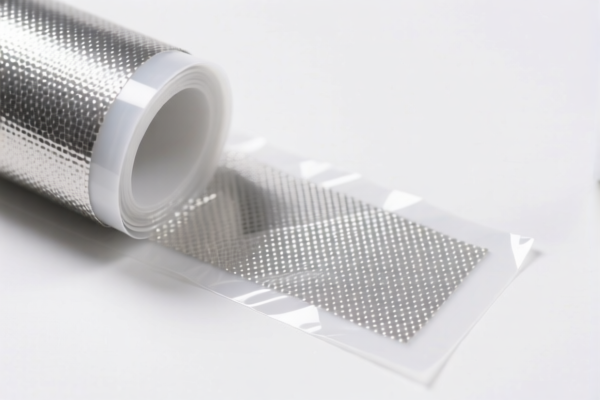

Here is the structured analysis and guidance for the classification "Other plastic film – Conductive film" based on the provided HS codes and tax details:

📦 Product Classification Overview:

- Product Name: Other plastic film – Conductive film

- HS Code Options:

- 3920992000

- 3921904090

- 3921905050

- 3920991000

- 3920200055

📊 Tariff Summary (as of now):

| HS Code | Base Tariff | Additional Tariff | 2025.4.2 After Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3920992000 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921904090 | 4.2% | 0.0% | 30.0% | 34.2% |

| 3921905050 | 4.8% | 0.0% | 30.0% | 34.8% |

| 3920991000 | 6.0% | 25.0% | 30.0% | 61.0% |

| 3920200055 | 4.2% | 25.0% | 30.0% | 59.2% |

⚠️ Key Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your cost planning. -

Anti-dumping duties on iron and aluminum:

Not applicable for this product category (plastic conductive film).

📌 Proactive Advice for Importers:

-

Verify Material and Unit Price:

Confirm the exact composition and specifications of the conductive film (e.g., type of plastic, conductive material used, thickness, etc.) to ensure correct HS code classification. -

Check Required Certifications:

Some HS codes may require specific certifications (e.g., RoHS, REACH, or customs declarations) depending on the end-use and country of import. -

Monitor Tariff Updates:

Keep track of the April 11, 2025 deadline for the additional 30% tariff. This could significantly impact your import costs. -

Consult a Customs Broker:

For complex classifications or high-value shipments, it is advisable to consult a licensed customs broker or a compliance expert.

📌 Recommendation:

If your product is not made of PVC or polyethylene, and is not a coated or laminated film, consider HS code 3921904090 or 3921905050 for potentially lower tax rates. However, always confirm the classification with the actual product details.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured analysis and guidance for the classification "Other plastic film – Conductive film" based on the provided HS codes and tax details:

📦 Product Classification Overview:

- Product Name: Other plastic film – Conductive film

- HS Code Options:

- 3920992000

- 3921904090

- 3921905050

- 3920991000

- 3920200055

📊 Tariff Summary (as of now):

| HS Code | Base Tariff | Additional Tariff | 2025.4.2 After Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3920992000 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921904090 | 4.2% | 0.0% | 30.0% | 34.2% |

| 3921905050 | 4.8% | 0.0% | 30.0% | 34.8% |

| 3920991000 | 6.0% | 25.0% | 30.0% | 61.0% |

| 3920200055 | 4.2% | 25.0% | 30.0% | 59.2% |

⚠️ Key Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your cost planning. -

Anti-dumping duties on iron and aluminum:

Not applicable for this product category (plastic conductive film).

📌 Proactive Advice for Importers:

-

Verify Material and Unit Price:

Confirm the exact composition and specifications of the conductive film (e.g., type of plastic, conductive material used, thickness, etc.) to ensure correct HS code classification. -

Check Required Certifications:

Some HS codes may require specific certifications (e.g., RoHS, REACH, or customs declarations) depending on the end-use and country of import. -

Monitor Tariff Updates:

Keep track of the April 11, 2025 deadline for the additional 30% tariff. This could significantly impact your import costs. -

Consult a Customs Broker:

For complex classifications or high-value shipments, it is advisable to consult a licensed customs broker or a compliance expert.

📌 Recommendation:

If your product is not made of PVC or polyethylene, and is not a coated or laminated film, consider HS code 3921904090 or 3921905050 for potentially lower tax rates. However, always confirm the classification with the actual product details.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.