| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3923290000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

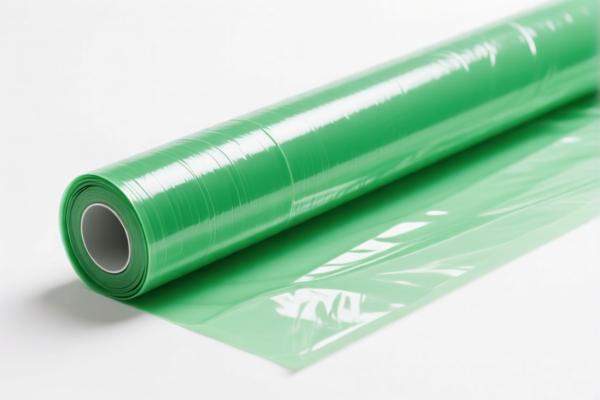

Product Classification: Greenhouse Film (Other Plastic Film)

Based on the provided HS codes and descriptions, the most likely classification for greenhouse film (a type of plastic film) is under HS CODE: 3921905050 or 3921904090, depending on the specific material and characteristics of the film.

HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this is a plastic product)

Key Notes: - This code is suitable for general-purpose plastic films, including greenhouse films, unless the film is specifically designed for packaging or has special features (e.g., self-adhesive, reinforced). - April 11 Special Tariff: A 30% additional tariff will apply after April 11, 2025.

HS CODE: 3921904090

Description: Flexible plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for flexible plastic films, which may be more appropriate for greenhouse films if they are thin, flexible, and not reinforced. - April 11 Special Tariff: A 30% additional tariff will apply after April 11, 2025.

Other Possible Codes (for comparison):

HS CODE: 3923290000

Description: Plastic articles for the transport or packing of goods, including bags and sacks

Total Tax Rate: 58.0%

Breakdown:

- Base Tariff Rate: 3.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for packaging bags, not general-purpose films. Not recommended for greenhouse film unless it is used as a bag.

HS CODE: 3919102055

Description: Self-adhesive sheets, plates, films, foils, tapes, strips and other flat plastic articles, whether or not wound into rolls: of a width not exceeding 20 cm: other: other

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for self-adhesive films, which are not applicable to greenhouse film unless it has self-adhesive properties.

HS CODE: 3920992000

Description: Plastic sheets, plates, films, foils and strips, of non-cellular plastics and not reinforced

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for non-cellular, non-reinforced plastic films. It may be applicable if the greenhouse film is not reinforced and is not flexible.

✅ Proactive Advice:

- Verify the material composition of the greenhouse film (e.g., is it flexible, self-adhesive, reinforced, or used for packaging?).

- Check the unit price to determine if it falls under a different classification (e.g., if it's a high-value product, it may be classified differently).

- Confirm if any certifications (e.g., food-grade, UV-resistant) are required for customs clearance.

- Monitor the April 11, 2025 deadline for additional tariffs—this will significantly increase the total tax rate.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: Greenhouse Film (Other Plastic Film)

Based on the provided HS codes and descriptions, the most likely classification for greenhouse film (a type of plastic film) is under HS CODE: 3921905050 or 3921904090, depending on the specific material and characteristics of the film.

HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this is a plastic product)

Key Notes: - This code is suitable for general-purpose plastic films, including greenhouse films, unless the film is specifically designed for packaging or has special features (e.g., self-adhesive, reinforced). - April 11 Special Tariff: A 30% additional tariff will apply after April 11, 2025.

HS CODE: 3921904090

Description: Flexible plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for flexible plastic films, which may be more appropriate for greenhouse films if they are thin, flexible, and not reinforced. - April 11 Special Tariff: A 30% additional tariff will apply after April 11, 2025.

Other Possible Codes (for comparison):

HS CODE: 3923290000

Description: Plastic articles for the transport or packing of goods, including bags and sacks

Total Tax Rate: 58.0%

Breakdown:

- Base Tariff Rate: 3.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for packaging bags, not general-purpose films. Not recommended for greenhouse film unless it is used as a bag.

HS CODE: 3919102055

Description: Self-adhesive sheets, plates, films, foils, tapes, strips and other flat plastic articles, whether or not wound into rolls: of a width not exceeding 20 cm: other: other

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for self-adhesive films, which are not applicable to greenhouse film unless it has self-adhesive properties.

HS CODE: 3920992000

Description: Plastic sheets, plates, films, foils and strips, of non-cellular plastics and not reinforced

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code is for non-cellular, non-reinforced plastic films. It may be applicable if the greenhouse film is not reinforced and is not flexible.

✅ Proactive Advice:

- Verify the material composition of the greenhouse film (e.g., is it flexible, self-adhesive, reinforced, or used for packaging?).

- Check the unit price to determine if it falls under a different classification (e.g., if it's a high-value product, it may be classified differently).

- Confirm if any certifications (e.g., food-grade, UV-resistant) are required for customs clearance.

- Monitor the April 11, 2025 deadline for additional tariffs—this will significantly increase the total tax rate.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.