Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for "Other plastic film roll" based on the provided HS codes and tax details:

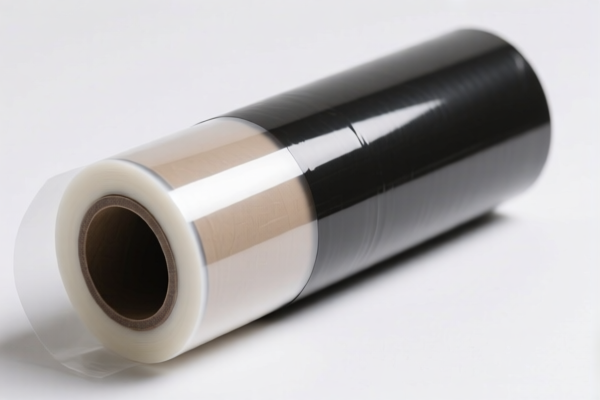

📦 Product Classification: Other Plastic Film Roll

🔍 HS Code 3920995000

- Description: Other plastic film roll

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has the highest total tax rate due to the combination of base and additional tariffs.

🔍 HS Code 3921905050

- Description: Other plastic film roll

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower base tariff and no additional tariff, but still faces the 30% special tariff after April 11, 2025.

🔍 HS Code 3920992000

- Description: Other plastic film roll

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff than 3920995000, but still subject to the same additional and special tariffs.

🔍 HS Code 3921902550

- Description: Other plastic film roll

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Highest total tax rate among all four codes due to the highest base tariff.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All four codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Material Verification: Confirm the material composition of the plastic film (e.g., polyethylene, polypropylene, etc.) to ensure correct classification.

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH, or import permits) are required for customs clearance.

- Tariff Optimization: Consider tariff classification reviews or preferential trade agreements if applicable to reduce the overall tax burden.

✅ Proactive Advice:

- Double-check the HS code based on the exact product description and material.

- Consult a customs broker or tax expert for accurate duty calculation and compliance.

- Monitor policy updates related to import tariffs, especially after April 11, 2025.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured classification and tariff information for "Other plastic film roll" based on the provided HS codes and tax details:

📦 Product Classification: Other Plastic Film Roll

🔍 HS Code 3920995000

- Description: Other plastic film roll

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has the highest total tax rate due to the combination of base and additional tariffs.

🔍 HS Code 3921905050

- Description: Other plastic film roll

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower base tariff and no additional tariff, but still faces the 30% special tariff after April 11, 2025.

🔍 HS Code 3920992000

- Description: Other plastic film roll

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff than 3920995000, but still subject to the same additional and special tariffs.

🔍 HS Code 3921902550

- Description: Other plastic film roll

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Highest total tax rate among all four codes due to the highest base tariff.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All four codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Material Verification: Confirm the material composition of the plastic film (e.g., polyethylene, polypropylene, etc.) to ensure correct classification.

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH, or import permits) are required for customs clearance.

- Tariff Optimization: Consider tariff classification reviews or preferential trade agreements if applicable to reduce the overall tax burden.

✅ Proactive Advice:

- Double-check the HS code based on the exact product description and material.

- Consult a customs broker or tax expert for accurate duty calculation and compliance.

- Monitor policy updates related to import tariffs, especially after April 11, 2025.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.