| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4409290655 | Doc | 58.2% | CN | US | 2025-05-12 |

| 4418741000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

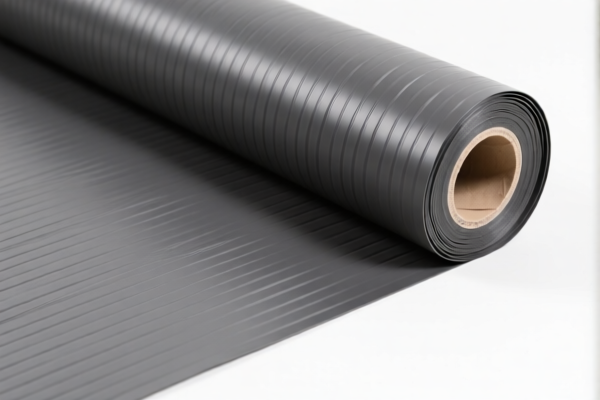

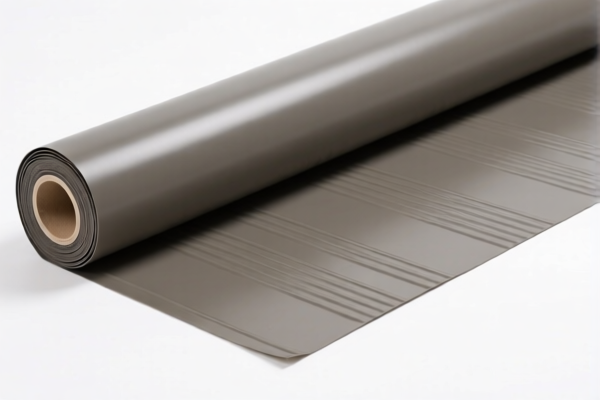

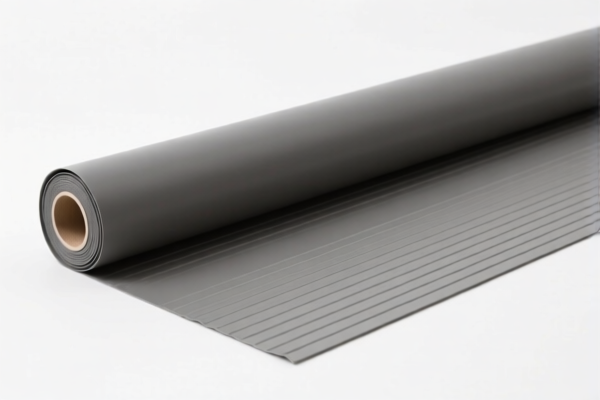

Product Classification: Other plastic floor coverings in rolls with a matte surface

Based on the provided HS codes and descriptions, the most accurate classification for "Other plastic floor coverings in rolls with a matte surface" is:

✅ HS CODE: 3918101020

Description: Plastic floor coverings, especially those made of polyvinyl chloride (PVC) polymer, in rolls — this description aligns well with your product, especially if it is made of PVC and has a matte surface.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy — ensure your import timeline is planned accordingly.

- No Anti-dumping duties are listed for this product category.

- No specific anti-dumping duties on iron or aluminum apply here, as this is a plastic product.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm that the product is indeed made of PVC or another polymer, as this affects classification.

- Check Unit Price and Packaging: Ensure the product is in rolls and not cut or pre-finished, as this may affect the HS code.

- Certifications Required: Some countries may require certifications (e.g., fire resistance, VOC emissions) for plastic floor coverings — check local regulations.

- Consult a Customs Broker: For complex or high-value shipments, a customs broker can help ensure compliance and avoid delays.

🔄 Alternative HS Codes (for reference):

- 3918901000 – Plastic floor coverings, whether self-adhesive or not, in rolls or tiles (general category, may apply if not specifically PVC).

- 4409290655 – Wooden floorboards (not relevant for plastic products).

- 4418741000 – Wood-based building products (not relevant for plastic products).

If you have more details about the product (e.g., thickness, composition, intended use), I can help refine the classification further. Product Classification: Other plastic floor coverings in rolls with a matte surface

Based on the provided HS codes and descriptions, the most accurate classification for "Other plastic floor coverings in rolls with a matte surface" is:

✅ HS CODE: 3918101020

Description: Plastic floor coverings, especially those made of polyvinyl chloride (PVC) polymer, in rolls — this description aligns well with your product, especially if it is made of PVC and has a matte surface.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy — ensure your import timeline is planned accordingly.

- No Anti-dumping duties are listed for this product category.

- No specific anti-dumping duties on iron or aluminum apply here, as this is a plastic product.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm that the product is indeed made of PVC or another polymer, as this affects classification.

- Check Unit Price and Packaging: Ensure the product is in rolls and not cut or pre-finished, as this may affect the HS code.

- Certifications Required: Some countries may require certifications (e.g., fire resistance, VOC emissions) for plastic floor coverings — check local regulations.

- Consult a Customs Broker: For complex or high-value shipments, a customs broker can help ensure compliance and avoid delays.

🔄 Alternative HS Codes (for reference):

- 3918901000 – Plastic floor coverings, whether self-adhesive or not, in rolls or tiles (general category, may apply if not specifically PVC).

- 4409290655 – Wooden floorboards (not relevant for plastic products).

- 4418741000 – Wood-based building products (not relevant for plastic products).

If you have more details about the product (e.g., thickness, composition, intended use), I can help refine the classification further.

Customer Reviews

No reviews yet.