Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

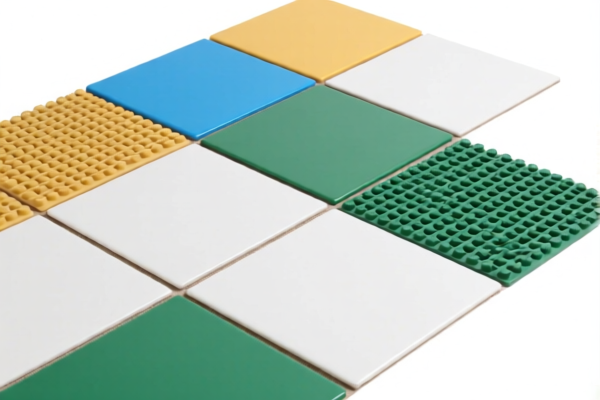

Product Classification: Other Plastic Floor Coverings in Tiles

HS CODE: 3918.90.10.00 (10-digit code)

🔍 Classification Summary

- Product Type: Plastic floor tiles (including indoor, outdoor, wood-patterned, and solid-colored variants)

- HS Code: 3918.90.10.00 (covers all variants listed)

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0% (applies to all listed HS codes)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations

- Material Verification: Confirm the product is made of plastic and not a composite or mixed material (e.g., wood-plastic composites may fall under a different HS code).

- Unit Price: Tariff calculations may depend on the FOB price or unit value of the product.

- Certifications: Check if any import certifications (e.g., CE, ISO, or specific country requirements) are needed for customs clearance.

- Product Use: While the HS code is the same for indoor, outdoor, and decorative variants, ensure the intended use (e.g., commercial vs. residential) is documented for compliance.

📢 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code 3918.90.10.00.

- Monitor the April 11, 2025, deadline for the 30.0% additional tariff.

- Consult a customs broker if the product has special features (e.g., fire-resistant, anti-slip, or eco-friendly materials) that may affect classification.

Let me know if you need help with certification requirements or tariff calculation examples.

Product Classification: Other Plastic Floor Coverings in Tiles

HS CODE: 3918.90.10.00 (10-digit code)

🔍 Classification Summary

- Product Type: Plastic floor tiles (including indoor, outdoor, wood-patterned, and solid-colored variants)

- HS Code: 3918.90.10.00 (covers all variants listed)

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0% (applies to all listed HS codes)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations

- Material Verification: Confirm the product is made of plastic and not a composite or mixed material (e.g., wood-plastic composites may fall under a different HS code).

- Unit Price: Tariff calculations may depend on the FOB price or unit value of the product.

- Certifications: Check if any import certifications (e.g., CE, ISO, or specific country requirements) are needed for customs clearance.

- Product Use: While the HS code is the same for indoor, outdoor, and decorative variants, ensure the intended use (e.g., commercial vs. residential) is documented for compliance.

📢 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code 3918.90.10.00.

- Monitor the April 11, 2025, deadline for the 30.0% additional tariff.

- Consult a customs broker if the product has special features (e.g., fire-resistant, anti-slip, or eco-friendly materials) that may affect classification.

Let me know if you need help with certification requirements or tariff calculation examples.

Customer Reviews

No reviews yet.