| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5704200090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5702392090 | Doc | 58.6% | CN | US | 2025-05-12 |

| 5702322000 | Doc | 62.0% | CN | US | 2025-05-12 |

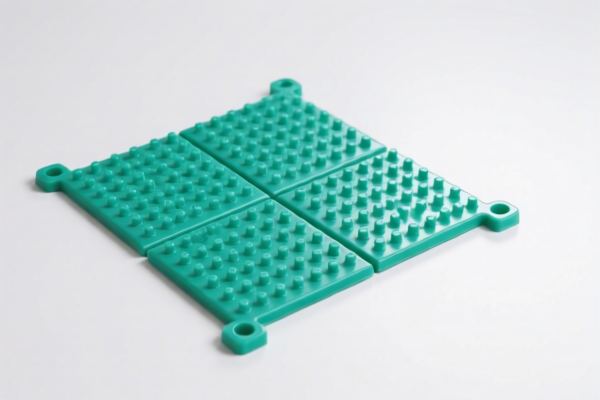

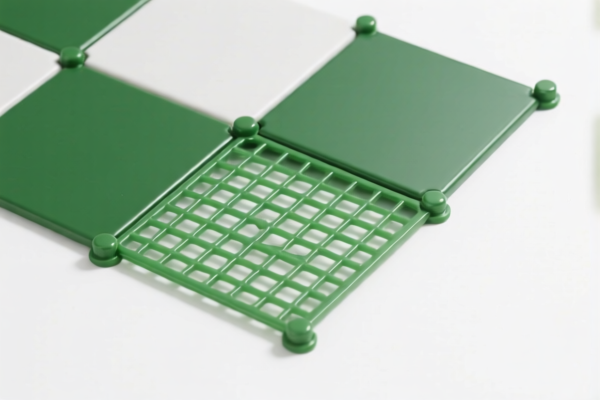

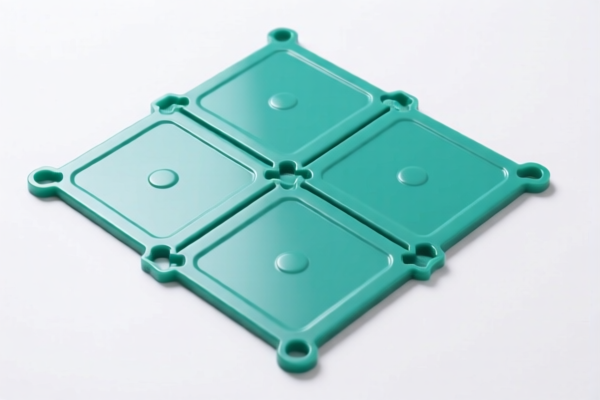

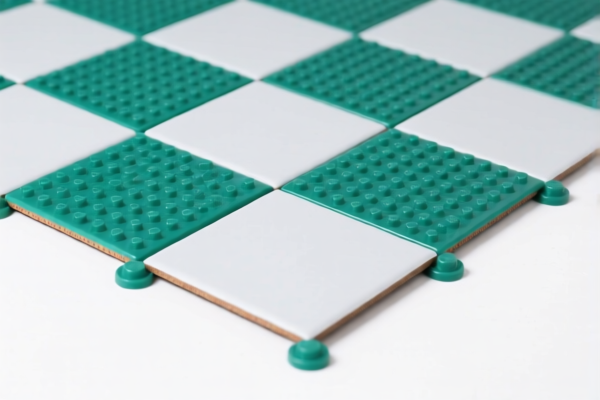

Here is the structured analysis and classification for the declared product "Other plastic floor coverings in tiles Antibacterial" based on the provided HS codes and tax details:

✅ HS CODE: 3918901000

Product Description: Other plastic floor coverings in tiles – Antibacterial

Total Tax Rate: 60.3%

🔍 Tax Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable (plastic product)

- April 11 Special Tariff: Applies after April 11, 2025 (30.0%)

⚠️ Important Notes:

- This is the most relevant HS code for your declared product.

- The antibacterial feature may influence classification, but in this case, it is included in the product description under the same HS code.

- Ensure the material composition and unit price are verified to confirm this classification is accurate.

- Certifications (e.g., antibacterial testing reports) may be required for customs clearance or compliance with local regulations.

📌 Other Possible HS Codes (for reference):

1. HS CODE: 3918102000

Product Description: Plastic composite floor tiles

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This code is for plastic composite tiles, which may differ slightly in composition from your product.

2. HS CODE: 5704200090

Product Description: Antibacterial carpet tiles

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is for carpet tiles, not floor coverings in tiles. Not applicable to your product.

3. HS CODE: 5702392090

Product Description: Antibacterial carpet

Total Tax Rate: 58.6%

- Base Tariff: 3.6%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is for carpets, not floor tiles. Not applicable to your product.

4. HS CODE: 5702322000

Product Description: Antibacterial carpet

Total Tax Rate: 62.0%

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: Again, this is for carpets, not floor tiles. Not applicable to your product.

📌 Proactive Advice:

- Verify the product composition (e.g., is it 100% plastic, or a composite with other materials?).

- Check the unit price to ensure the correct HS code is applied (some codes have price thresholds).

- Confirm if antibacterial certification is required for import or local compliance.

- Monitor the April 11, 2025 deadline for the special tariff increase (30.0%) to plan accordingly.

If you have more details about the product (e.g., material, thickness, use case), I can help refine the classification further. Here is the structured analysis and classification for the declared product "Other plastic floor coverings in tiles Antibacterial" based on the provided HS codes and tax details:

✅ HS CODE: 3918901000

Product Description: Other plastic floor coverings in tiles – Antibacterial

Total Tax Rate: 60.3%

🔍 Tax Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable (plastic product)

- April 11 Special Tariff: Applies after April 11, 2025 (30.0%)

⚠️ Important Notes:

- This is the most relevant HS code for your declared product.

- The antibacterial feature may influence classification, but in this case, it is included in the product description under the same HS code.

- Ensure the material composition and unit price are verified to confirm this classification is accurate.

- Certifications (e.g., antibacterial testing reports) may be required for customs clearance or compliance with local regulations.

📌 Other Possible HS Codes (for reference):

1. HS CODE: 3918102000

Product Description: Plastic composite floor tiles

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This code is for plastic composite tiles, which may differ slightly in composition from your product.

2. HS CODE: 5704200090

Product Description: Antibacterial carpet tiles

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is for carpet tiles, not floor coverings in tiles. Not applicable to your product.

3. HS CODE: 5702392090

Product Description: Antibacterial carpet

Total Tax Rate: 58.6%

- Base Tariff: 3.6%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is for carpets, not floor tiles. Not applicable to your product.

4. HS CODE: 5702322000

Product Description: Antibacterial carpet

Total Tax Rate: 62.0%

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: Again, this is for carpets, not floor tiles. Not applicable to your product.

📌 Proactive Advice:

- Verify the product composition (e.g., is it 100% plastic, or a composite with other materials?).

- Check the unit price to ensure the correct HS code is applied (some codes have price thresholds).

- Confirm if antibacterial certification is required for import or local compliance.

- Monitor the April 11, 2025 deadline for the special tariff increase (30.0%) to plan accordingly.

If you have more details about the product (e.g., material, thickness, use case), I can help refine the classification further.

Customer Reviews

No reviews yet.