| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4418920000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 6907221005 | Doc | 65.0% | CN | US | 2025-05-12 |

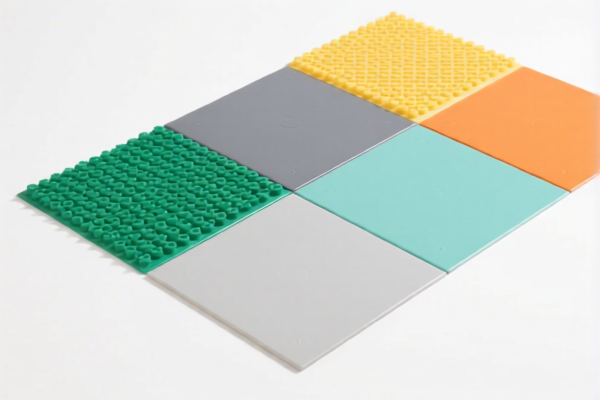

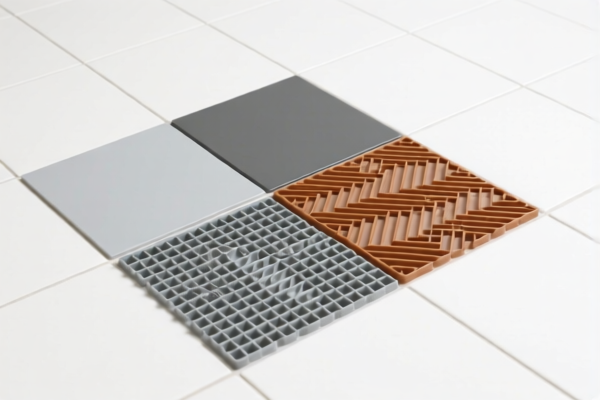

Product Classification: Other plastic floor coverings in tiles – Easy to clean type

Here is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 3918901000

Product Description: Plastic floor coverings – easy to clean type

Total Tax Rate: 60.3%

🔍 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic product)

- Other Additional Tariffs: None specified

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- Material Verification: Ensure the product is 100% plastic and not mixed with other materials (e.g., wood or ceramic), as this could affect classification.

- Certifications: Confirm if any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

📌 Proactive Advice:

- Check Material Composition: Confirm that the product is made entirely of plastic and not a composite or hybrid material.

- Review Unit Price: The total tax rate is 60.3%, which is relatively high. Consider the impact on your final pricing.

- Consult Customs Broker: For accurate classification and to avoid delays, it's recommended to consult a customs broker or use a customs compliance tool.

📌 Alternative HS Codes (for reference):

- 3918101030 – Plastic floor tiles (similar product, but may differ in size or design)

- 3921905050 – Plastic floor (not in tiles, may not apply)

- 4418920000 – Wooden easy-to-clean floor (not applicable for plastic products)

- 6907221005 – Ceramic tiles (not applicable for plastic products)

If you have more details about the product (e.g., thickness, size, composition), I can help refine the classification further. Product Classification: Other plastic floor coverings in tiles – Easy to clean type

Here is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 3918901000

Product Description: Plastic floor coverings – easy to clean type

Total Tax Rate: 60.3%

🔍 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic product)

- Other Additional Tariffs: None specified

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- Material Verification: Ensure the product is 100% plastic and not mixed with other materials (e.g., wood or ceramic), as this could affect classification.

- Certifications: Confirm if any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

📌 Proactive Advice:

- Check Material Composition: Confirm that the product is made entirely of plastic and not a composite or hybrid material.

- Review Unit Price: The total tax rate is 60.3%, which is relatively high. Consider the impact on your final pricing.

- Consult Customs Broker: For accurate classification and to avoid delays, it's recommended to consult a customs broker or use a customs compliance tool.

📌 Alternative HS Codes (for reference):

- 3918101030 – Plastic floor tiles (similar product, but may differ in size or design)

- 3921905050 – Plastic floor (not in tiles, may not apply)

- 4418920000 – Wooden easy-to-clean floor (not applicable for plastic products)

- 6907221005 – Ceramic tiles (not applicable for plastic products)

If you have more details about the product (e.g., thickness, size, composition), I can help refine the classification further.

Customer Reviews

No reviews yet.