| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5704200090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

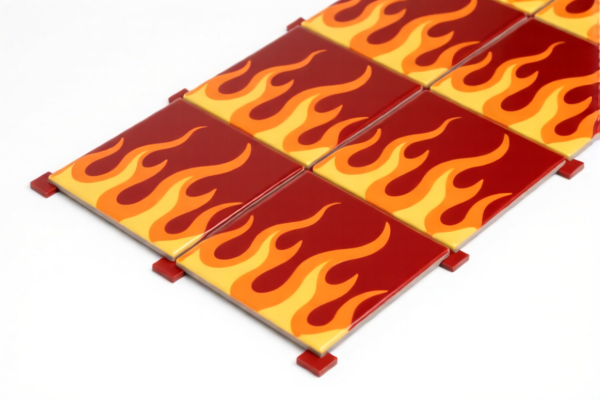

Product Classification: Other Plastic Floor Coverings in Tiles (Flame Retardant)

Based on your input, the product falls under plastic floor coverings in tiles, and the following HS codes and tariff details are relevant:

✅ HS CODE: 3918901000

Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 3918101030

Description: Plastic floor coverings in sheets or tiles, made of rigid foam polymer core as per Chapter Note 2, vinyl tiles

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 3918101040

Description: Stone plastic floor tiles, made of polyvinyl chloride polymer, not being vinyl tiles with rigid solid or rigid foam core

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ HS CODE: 5704200090 (Not directly applicable, but for reference)

Description: Carpets or other textile carpets, not tufted or flocked, with surface area >0.3 m² but ≤1 m²

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ HS CODE: 3920992000 (Not directly applicable, but for reference)

Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, backed or otherwise combined with other materials

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 Key Notes and Recommendations:

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the product (e.g., PVC, rigid foam core, flame retardant additives) to ensure correct HS code classification. -

Certifications Required:

Flame-retardant products may require specific certifications (e.g., fire safety standards) depending on the importing country. Verify local requirements. -

Unit Price and Packaging:

Customs may assess based on unit price and packaging. Ensure documentation reflects the actual product value and specifications. -

Anti-Dumping Duty:

No specific anti-dumping duties are mentioned for this product category, but always check for any country-specific duties or trade agreements that may apply.

✅ Proactive Action Checklist:

- Confirm the exact HS code based on product composition and form (tiles, self-adhesive, etc.).

- Check for flame retardant certifications and compliance with local safety standards.

- Plan customs clearance before April 11, 2025, to avoid the 30% special tariff.

- Review importer documentation for accurate product description and pricing.

Let me know if you need help with HS code selection or customs documentation!

Product Classification: Other Plastic Floor Coverings in Tiles (Flame Retardant)

Based on your input, the product falls under plastic floor coverings in tiles, and the following HS codes and tariff details are relevant:

✅ HS CODE: 3918901000

Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 3918101030

Description: Plastic floor coverings in sheets or tiles, made of rigid foam polymer core as per Chapter Note 2, vinyl tiles

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 3918101040

Description: Stone plastic floor tiles, made of polyvinyl chloride polymer, not being vinyl tiles with rigid solid or rigid foam core

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ HS CODE: 5704200090 (Not directly applicable, but for reference)

Description: Carpets or other textile carpets, not tufted or flocked, with surface area >0.3 m² but ≤1 m²

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ HS CODE: 3920992000 (Not directly applicable, but for reference)

Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, backed or otherwise combined with other materials

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 Key Notes and Recommendations:

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the product (e.g., PVC, rigid foam core, flame retardant additives) to ensure correct HS code classification. -

Certifications Required:

Flame-retardant products may require specific certifications (e.g., fire safety standards) depending on the importing country. Verify local requirements. -

Unit Price and Packaging:

Customs may assess based on unit price and packaging. Ensure documentation reflects the actual product value and specifications. -

Anti-Dumping Duty:

No specific anti-dumping duties are mentioned for this product category, but always check for any country-specific duties or trade agreements that may apply.

✅ Proactive Action Checklist:

- Confirm the exact HS code based on product composition and form (tiles, self-adhesive, etc.).

- Check for flame retardant certifications and compliance with local safety standards.

- Plan customs clearance before April 11, 2025, to avoid the 30% special tariff.

- Review importer documentation for accurate product description and pricing.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.