| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4823908680 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

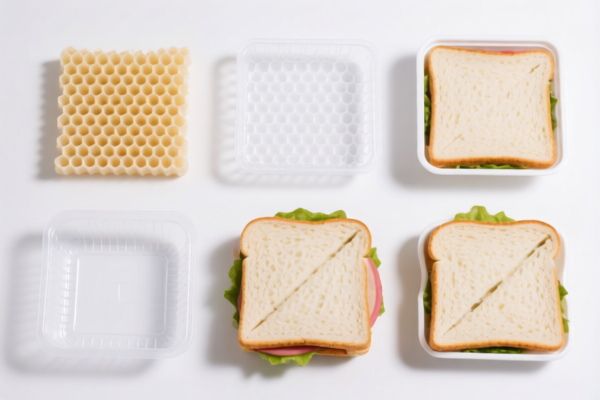

Here is the structured analysis and classification guidance for "Other plastic honeycomb boards" based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Product Description:

Other plastic sheets, plates, films, foils and strips, combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary: - Base Tariff Rate: 4.4% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.4%

Key Notes: - This code applies to plastic honeycomb boards that are combined with other materials and have a weight over 1.492 kg/m². - If your product is not combined with other materials, this code may not be applicable.

✅ HS CODE: 3921902550

Product Description:

Other plastic sheets, plates, films, foils and strips, combined with textile materials, with a weight exceeding 1.492 kg/m², where the textile component contains man-made fibers in greater weight than any other single textile fiber, and the plastic component accounts for more than 70% of the total weight.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code is for plastic honeycomb boards combined with textile materials, with plastic content over 70%. - If your product is not textile-based, this code is not suitable.

✅ HS CODE: 3921190090

Product Description:

Plastic sheets (not elsewhere specified).

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This is a general category for plastic sheets, including honeycomb boards, but not combined with other materials. - If your product is combined with other materials, this code may not be accurate.

✅ HS CODE: 4823908680

Product Description:

Other paper, paperboard, cellulose wadding, and cellulose fiber nets made up into articles.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

Key Notes: - This code is for paper-based products, not plastic honeycomb boards. - Not applicable to your declared product.

✅ HS CODE: 3920435000

Product Description:

Polyvinyl chloride (PVC) plastic sheets, not mentioning honeycomb structure, can be understood as non-cellular.

Tariff Summary: - Base Tariff Rate: 4.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.2%

Key Notes: - This code is for PVC sheets that are not cellular or honeycomb in structure. - If your product is honeycomb, this code is not suitable.

📌 Proactive Advice for Users:

- Verify Material Composition:

- Confirm whether the honeycomb board is combined with other materials (e.g., textiles, paper, etc.).

-

Determine the weight per square meter and plastic content percentage.

-

Check for Certification Requirements:

-

Some products may require customs declarations, product certifications, or environmental compliance documents.

-

Monitor Tariff Changes:

-

April 11, 2025, is a critical date for additional tariffs. Ensure your product classification is correct before this date to avoid unexpected costs.

-

Consider Anti-Dumping Duties:

- If your product contains iron or aluminum components, check for anti-dumping duties that may apply.

📌 Recommended Action:

- If your product is plastic honeycomb board combined with other materials, HS CODE 3921902900 is likely the most accurate.

- If it is not combined with other materials, consider HS CODE 3921190090.

- Always double-check the product description and material composition to ensure correct classification. Here is the structured analysis and classification guidance for "Other plastic honeycomb boards" based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Product Description:

Other plastic sheets, plates, films, foils and strips, combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary: - Base Tariff Rate: 4.4% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.4%

Key Notes: - This code applies to plastic honeycomb boards that are combined with other materials and have a weight over 1.492 kg/m². - If your product is not combined with other materials, this code may not be applicable.

✅ HS CODE: 3921902550

Product Description:

Other plastic sheets, plates, films, foils and strips, combined with textile materials, with a weight exceeding 1.492 kg/m², where the textile component contains man-made fibers in greater weight than any other single textile fiber, and the plastic component accounts for more than 70% of the total weight.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code is for plastic honeycomb boards combined with textile materials, with plastic content over 70%. - If your product is not textile-based, this code is not suitable.

✅ HS CODE: 3921190090

Product Description:

Plastic sheets (not elsewhere specified).

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This is a general category for plastic sheets, including honeycomb boards, but not combined with other materials. - If your product is combined with other materials, this code may not be accurate.

✅ HS CODE: 4823908680

Product Description:

Other paper, paperboard, cellulose wadding, and cellulose fiber nets made up into articles.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

Key Notes: - This code is for paper-based products, not plastic honeycomb boards. - Not applicable to your declared product.

✅ HS CODE: 3920435000

Product Description:

Polyvinyl chloride (PVC) plastic sheets, not mentioning honeycomb structure, can be understood as non-cellular.

Tariff Summary: - Base Tariff Rate: 4.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.2%

Key Notes: - This code is for PVC sheets that are not cellular or honeycomb in structure. - If your product is honeycomb, this code is not suitable.

📌 Proactive Advice for Users:

- Verify Material Composition:

- Confirm whether the honeycomb board is combined with other materials (e.g., textiles, paper, etc.).

-

Determine the weight per square meter and plastic content percentage.

-

Check for Certification Requirements:

-

Some products may require customs declarations, product certifications, or environmental compliance documents.

-

Monitor Tariff Changes:

-

April 11, 2025, is a critical date for additional tariffs. Ensure your product classification is correct before this date to avoid unexpected costs.

-

Consider Anti-Dumping Duties:

- If your product contains iron or aluminum components, check for anti-dumping duties that may apply.

📌 Recommended Action:

- If your product is plastic honeycomb board combined with other materials, HS CODE 3921902900 is likely the most accurate.

- If it is not combined with other materials, consider HS CODE 3921190090.

- Always double-check the product description and material composition to ensure correct classification.

Customer Reviews

No reviews yet.