Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

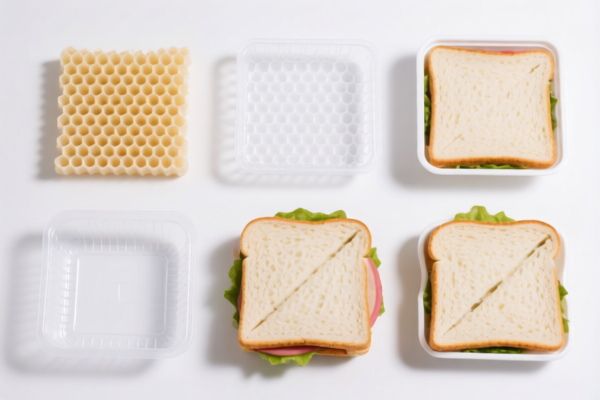

Product Classification: Other Plastic Honeycomb Sandwich Panels

Based on the provided HS codes and tax details, here is a structured breakdown of the classification and tariff implications for "Other Plastic Honeycomb Sandwich Panels":

HS CODE: 3921902900

- Description: Other plastic honeycomb sandwich panels

- Total Tax Rate: 59.4%

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is the most commonly used code for general plastic honeycomb panels.

- The April 11, 2025 special tariff is a significant increase, so monitor the import date to avoid unexpected costs.

HS CODE: 3921902550

- Description: Other plastic honeycomb sandwich panels

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- Slightly higher base tariff than 3921902900.

- Same special tariff applies after April 11, 2025.

HS CODE: 3920632000

- Description: Polycarbonate sandwich panels

- Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is specific to polycarbonate materials.

- Ensure the product is not just a general plastic panel but specifically made of polycarbonate.

HS CODE: 3921190090

- Description: Plastic honeycomb sheets

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for honeycomb sheets, not necessarily sandwich panels.

- Confirm the product structure (sheet vs. panel) to avoid misclassification.

HS CODE: 3921135000

- Description: Polyurethane sandwich panels

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for polyurethane sandwich panels.

- Ensure the core material is polyurethane and not another type of plastic.

Key Tariff Trends (April 11, 2025 onwards)

- All listed codes will face an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so plan your import schedule accordingly.

Proactive Advice for Importers

- Verify the material composition (e.g., polycarbonate, polyurethane, general plastic) to ensure correct HS code selection.

- Check the unit price and total tax impact for each code.

- Confirm required certifications (e.g., RoHS, REACH, or other local compliance standards).

- Review the product structure (sheet vs. panel) to avoid misclassification.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Product Classification: Other Plastic Honeycomb Sandwich Panels

Based on the provided HS codes and tax details, here is a structured breakdown of the classification and tariff implications for "Other Plastic Honeycomb Sandwich Panels":

HS CODE: 3921902900

- Description: Other plastic honeycomb sandwich panels

- Total Tax Rate: 59.4%

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is the most commonly used code for general plastic honeycomb panels.

- The April 11, 2025 special tariff is a significant increase, so monitor the import date to avoid unexpected costs.

HS CODE: 3921902550

- Description: Other plastic honeycomb sandwich panels

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- Slightly higher base tariff than 3921902900.

- Same special tariff applies after April 11, 2025.

HS CODE: 3920632000

- Description: Polycarbonate sandwich panels

- Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is specific to polycarbonate materials.

- Ensure the product is not just a general plastic panel but specifically made of polycarbonate.

HS CODE: 3921190090

- Description: Plastic honeycomb sheets

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for honeycomb sheets, not necessarily sandwich panels.

- Confirm the product structure (sheet vs. panel) to avoid misclassification.

HS CODE: 3921135000

- Description: Polyurethane sandwich panels

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for polyurethane sandwich panels.

- Ensure the core material is polyurethane and not another type of plastic.

Key Tariff Trends (April 11, 2025 onwards)

- All listed codes will face an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so plan your import schedule accordingly.

Proactive Advice for Importers

- Verify the material composition (e.g., polycarbonate, polyurethane, general plastic) to ensure correct HS code selection.

- Check the unit price and total tax impact for each code.

- Confirm required certifications (e.g., RoHS, REACH, or other local compliance standards).

- Review the product structure (sheet vs. panel) to avoid misclassification.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.