| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 8480300000 | Doc | 57.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

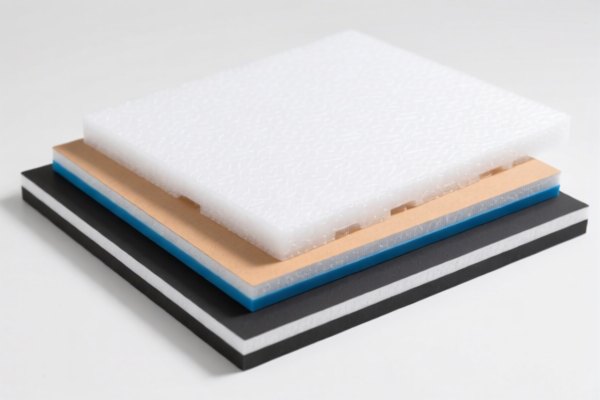

Here is the structured classification and tariff information for "Other plastic molded foam boards" based on the provided HS codes and tax details:

✅ HS CODE: 3921110000

Product Description: Other plastic boards, sheets, films, foils and strips: honeycomb: made of polystyrene polymers

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies specifically to polystyrene-based honeycomb plastic boards.

✅ HS CODE: 3921190090

Product Description: Other plastic boards, sheets, films, foils and strips: porous: other plastics: other

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code covers porous plastic foam boards made from other plastics (not polystyrene).

✅ HS CODE: 3903110000

Product Description: Primary forms of expanded polystyrene

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies to raw, unprocessed expanded polystyrene, not finished foam boards.

✅ HS CODE: 8480300000

Product Description: Molds used in metal casting, including those made of rubber or plastic

- Base Tariff Rate: 2.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.8%

- Notes: This code is for molds, not the foam boards themselves. Not applicable unless the product is a mold.

✅ HS CODE: 3921125000

Product Description: PVC foam plastic boards

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is specific to PVC foam boards.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is made of the correct plastic (e.g., polystyrene, PVC, or other plastics) to match the correct HS code.

- Check Unit Price and Packaging: Tariff rates may vary based on the product's classification and whether it's considered "finished" or "primary form."

- Confirm Certification Requirements: Some plastic products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so ensure your import plans are adjusted accordingly.

- Consult Customs Broker: For complex classifications or large shipments, it's advisable to consult a customs broker or compliance expert.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for "Other plastic molded foam boards" based on the provided HS codes and tax details:

✅ HS CODE: 3921110000

Product Description: Other plastic boards, sheets, films, foils and strips: honeycomb: made of polystyrene polymers

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies specifically to polystyrene-based honeycomb plastic boards.

✅ HS CODE: 3921190090

Product Description: Other plastic boards, sheets, films, foils and strips: porous: other plastics: other

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code covers porous plastic foam boards made from other plastics (not polystyrene).

✅ HS CODE: 3903110000

Product Description: Primary forms of expanded polystyrene

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies to raw, unprocessed expanded polystyrene, not finished foam boards.

✅ HS CODE: 8480300000

Product Description: Molds used in metal casting, including those made of rubber or plastic

- Base Tariff Rate: 2.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.8%

- Notes: This code is for molds, not the foam boards themselves. Not applicable unless the product is a mold.

✅ HS CODE: 3921125000

Product Description: PVC foam plastic boards

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is specific to PVC foam boards.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is made of the correct plastic (e.g., polystyrene, PVC, or other plastics) to match the correct HS code.

- Check Unit Price and Packaging: Tariff rates may vary based on the product's classification and whether it's considered "finished" or "primary form."

- Confirm Certification Requirements: Some plastic products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so ensure your import plans are adjusted accordingly.

- Consult Customs Broker: For complex classifications or large shipments, it's advisable to consult a customs broker or compliance expert.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.