| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5404121000 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5404129000 | Doc | 61.9% | CN | US | 2025-05-12 |

| 3916903000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5607909000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 7312109090 | Doc | 105.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for "Other plastic monofilament for agricultural tying" based on the provided HS codes and tax details:

📦 Product Classification Overview

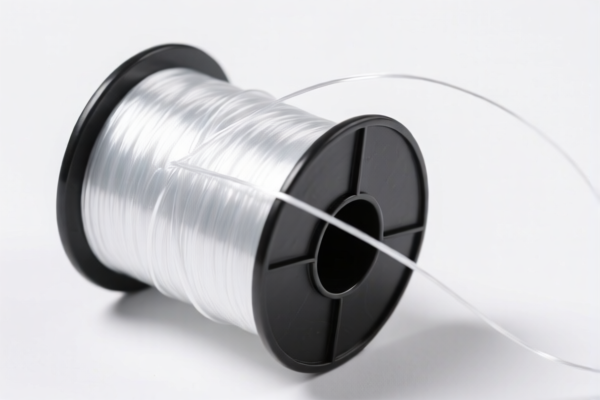

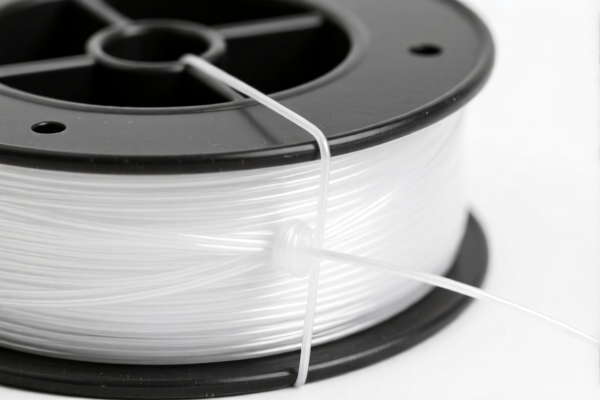

Product Name: Other plastic monofilament for agricultural tying

Common HS Codes and Descriptions:

- 5404.12.10.00 – Polypropylene monofilament for agricultural tying

- 5404.12.90.00 – PP plastic monofilament binding rope

- 3916.90.30.00 – Plastic monofilament rope

- 5607.90.90.00 – Agricultural binding rope (general)

- 7312.10.90.90 – Agricultural steel rope (note: this is for metal, not plastic)

📊 Tariff Summary (as of now)

All the listed HS codes have the following base and additional tariffs:

- Base Tariff Rate: 6.3% to 6.9% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0% (applies to all listed HS codes)

- Steel, Aluminum, and Copper Products: Additional 50% (only applies to 7312.10.90.90)

📌 Total Tax Rates

| HS Code | Total Tax Rate | Notes |

|---|---|---|

| 5404121000 | 61.9% | Polypropylene monofilament |

| 5404129000 | 61.9% | PP plastic monofilament |

| 3916903000 | 61.5% | Plastic monofilament rope |

| 5607909000 | 61.3% | General agricultural binding rope |

| 7312109090 | 105.0% | Steel rope (metal, not plastic) |

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed on all listed HS codes.

- Steel, Aluminum, and Copper Products: If your product is made of these materials, an additional 50% tariff will apply (only for 7312.10.90.90).

🛠️ Proactive Advice for Importers

- Verify Material: Ensure the product is plastic monofilament and not metal (e.g., steel rope), as this will change the HS code and applicable tariffs.

- Check Unit Price: Tariff calculations depend on the FOB price and product classification.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., product standards, origin certificates) are needed for import.

- Consult Local Customs: For the most up-to-date HS code and tariff information, always verify with local customs authorities or a customs broker.

Let me know if you need help determining the correct HS code for your specific product or if you need assistance with customs documentation. Here is the structured classification and tariff information for "Other plastic monofilament for agricultural tying" based on the provided HS codes and tax details:

📦 Product Classification Overview

Product Name: Other plastic monofilament for agricultural tying

Common HS Codes and Descriptions:

- 5404.12.10.00 – Polypropylene monofilament for agricultural tying

- 5404.12.90.00 – PP plastic monofilament binding rope

- 3916.90.30.00 – Plastic monofilament rope

- 5607.90.90.00 – Agricultural binding rope (general)

- 7312.10.90.90 – Agricultural steel rope (note: this is for metal, not plastic)

📊 Tariff Summary (as of now)

All the listed HS codes have the following base and additional tariffs:

- Base Tariff Rate: 6.3% to 6.9% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0% (applies to all listed HS codes)

- Steel, Aluminum, and Copper Products: Additional 50% (only applies to 7312.10.90.90)

📌 Total Tax Rates

| HS Code | Total Tax Rate | Notes |

|---|---|---|

| 5404121000 | 61.9% | Polypropylene monofilament |

| 5404129000 | 61.9% | PP plastic monofilament |

| 3916903000 | 61.5% | Plastic monofilament rope |

| 5607909000 | 61.3% | General agricultural binding rope |

| 7312109090 | 105.0% | Steel rope (metal, not plastic) |

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed on all listed HS codes.

- Steel, Aluminum, and Copper Products: If your product is made of these materials, an additional 50% tariff will apply (only for 7312.10.90.90).

🛠️ Proactive Advice for Importers

- Verify Material: Ensure the product is plastic monofilament and not metal (e.g., steel rope), as this will change the HS code and applicable tariffs.

- Check Unit Price: Tariff calculations depend on the FOB price and product classification.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., product standards, origin certificates) are needed for import.

- Consult Local Customs: For the most up-to-date HS code and tariff information, always verify with local customs authorities or a customs broker.

Let me know if you need help determining the correct HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.