| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 9403993010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9403993005 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

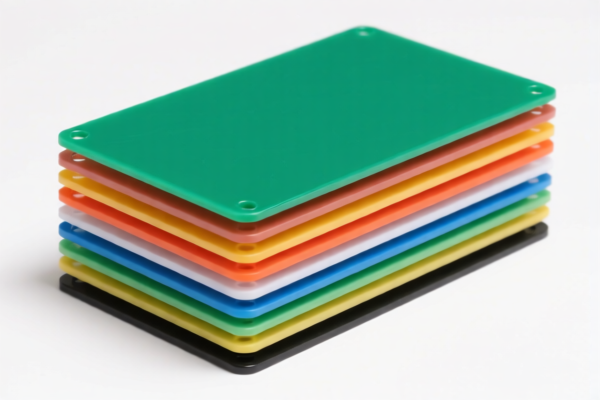

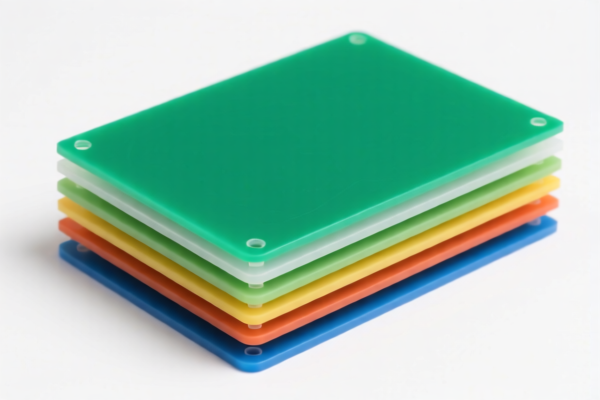

Here is the structured analysis and classification for the declared product "Other plastic multilayer boards" based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description: Multilayer composite textile plastic board

Total Tax Rate: 59.4%

Tax Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is classified under plastic sheets, plates, and strips, and is subject to the April 11, 2025 special tariff.

✅ HS CODE: 3921190090

Product Description: Plastic porous board

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is also subject to the April 11, 2025 special tariff.

✅ HS CODE: 9403993010

Product Description: Multilayer plastic fence panel

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is classified under furniture and parts thereof, and is subject to the April 11, 2025 special tariff.

✅ HS CODE: 9403993005

Product Description: Multilayer plastic baby bed support panel

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is also subject to the April 11, 2025 special tariff.

✅ HS CODE: 3921905050

Product Description: Plastic plastic board (likely a duplicate or misclassified entry)

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is classified under plastic sheets, plates, and strips, and is subject to the April 11, 2025 special tariff.

- Caution: The product name appears to be a duplicate or misclassified entry. Verify the actual product description and ensure the correct HS code is used.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly described and that the HS code matches the actual composition and use of the product.

- Check Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) depending on the end use.

- Monitor April 11, 2025, Tariff Changes: The 30.0% additional tariff will apply after this date, so plan accordingly for cost estimation and compliance.

- Consult a Customs Broker: For complex or high-value shipments, it is recommended to consult a customs broker or compliance expert to ensure accurate classification and avoid delays.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured analysis and classification for the declared product "Other plastic multilayer boards" based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description: Multilayer composite textile plastic board

Total Tax Rate: 59.4%

Tax Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is classified under plastic sheets, plates, and strips, and is subject to the April 11, 2025 special tariff.

✅ HS CODE: 3921190090

Product Description: Plastic porous board

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is also subject to the April 11, 2025 special tariff.

✅ HS CODE: 9403993010

Product Description: Multilayer plastic fence panel

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is classified under furniture and parts thereof, and is subject to the April 11, 2025 special tariff.

✅ HS CODE: 9403993005

Product Description: Multilayer plastic baby bed support panel

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is also subject to the April 11, 2025 special tariff.

✅ HS CODE: 3921905050

Product Description: Plastic plastic board (likely a duplicate or misclassified entry)

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

- Note: This product is classified under plastic sheets, plates, and strips, and is subject to the April 11, 2025 special tariff.

- Caution: The product name appears to be a duplicate or misclassified entry. Verify the actual product description and ensure the correct HS code is used.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly described and that the HS code matches the actual composition and use of the product.

- Check Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) depending on the end use.

- Monitor April 11, 2025, Tariff Changes: The 30.0% additional tariff will apply after this date, so plan accordingly for cost estimation and compliance.

- Consult a Customs Broker: For complex or high-value shipments, it is recommended to consult a customs broker or compliance expert to ensure accurate classification and avoid delays.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.