| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916903000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916100000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

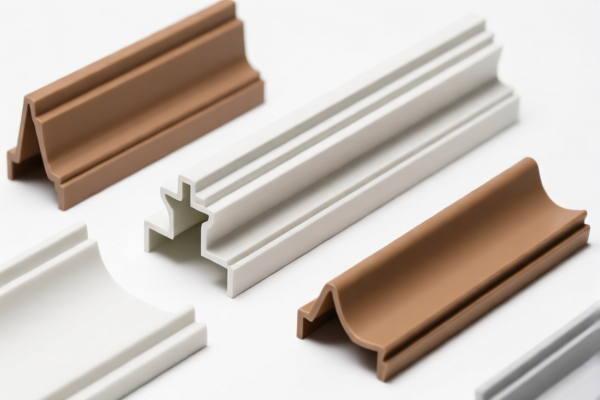

Here is the structured analysis and customs compliance guidance for the "Other plastic profile shapes for building decoration" product, based on the provided HS codes and tariff details:

✅ HS CODE: 3916903000

Description: Plastic monofilaments, rods, sticks, and profiles with a cross-section exceeding 1 mm, not otherwise processed.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for general plastic profiles, not specifically for building decoration. Ensure the product is not more specifically classified under another HS code.

✅ HS CODE: 3916100000

Description: Polyethylene plastic profiles for building use.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Notes: This is a more specific code for polyethylene profiles used in construction. If your product is made of polyethylene and used for building decoration, this may be the most accurate classification.

✅ HS CODE: 3918901000

Description: Plastic wall or ceiling coverings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for decorative wall or ceiling coverings made of plastic. If your product is used for interior decoration (e.g., wall panels), this may be the correct classification.

✅ HS CODE: 3926400090

Description: Other items made of plastic or other materials, classified under "statues and other decorative articles."

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 35.3%

- Notes: This is for decorative items such as statues or ornaments. If your product is more of a decorative item than a structural profile, this may apply.

✅ HS CODE: 3926903500

Description: Other plastic products, including decorative accessories, not otherwise specified.

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 44.0%

- Notes: This is a catch-all code for plastic decorative accessories not covered by more specific codes. It may be suitable if your product is a decorative profile but not clearly classified elsewhere.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact material (e.g., polyethylene, PVC) and whether it is used for structural or decorative purposes.

- Check for Certifications: Some products may require certifications (e.g., fire resistance, environmental compliance) depending on the destination country.

- Review HS Code Specificity: Ensure the product is not more specifically classified under a different HS code (e.g., 3916100000 for polyethylene).

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all listed codes. If your shipment is scheduled after this date, the additional 30% will apply.

- Consider Anti-Dumping Duties: Although not listed here, be aware that anti-dumping duties may apply to certain plastic products (especially if imported from countries with known dumping practices).

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured analysis and customs compliance guidance for the "Other plastic profile shapes for building decoration" product, based on the provided HS codes and tariff details:

✅ HS CODE: 3916903000

Description: Plastic monofilaments, rods, sticks, and profiles with a cross-section exceeding 1 mm, not otherwise processed.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for general plastic profiles, not specifically for building decoration. Ensure the product is not more specifically classified under another HS code.

✅ HS CODE: 3916100000

Description: Polyethylene plastic profiles for building use.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Notes: This is a more specific code for polyethylene profiles used in construction. If your product is made of polyethylene and used for building decoration, this may be the most accurate classification.

✅ HS CODE: 3918901000

Description: Plastic wall or ceiling coverings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for decorative wall or ceiling coverings made of plastic. If your product is used for interior decoration (e.g., wall panels), this may be the correct classification.

✅ HS CODE: 3926400090

Description: Other items made of plastic or other materials, classified under "statues and other decorative articles."

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 35.3%

- Notes: This is for decorative items such as statues or ornaments. If your product is more of a decorative item than a structural profile, this may apply.

✅ HS CODE: 3926903500

Description: Other plastic products, including decorative accessories, not otherwise specified.

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 44.0%

- Notes: This is a catch-all code for plastic decorative accessories not covered by more specific codes. It may be suitable if your product is a decorative profile but not clearly classified elsewhere.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact material (e.g., polyethylene, PVC) and whether it is used for structural or decorative purposes.

- Check for Certifications: Some products may require certifications (e.g., fire resistance, environmental compliance) depending on the destination country.

- Review HS Code Specificity: Ensure the product is not more specifically classified under a different HS code (e.g., 3916100000 for polyethylene).

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all listed codes. If your shipment is scheduled after this date, the additional 30% will apply.

- Consider Anti-Dumping Duties: Although not listed here, be aware that anti-dumping duties may apply to certain plastic products (especially if imported from countries with known dumping practices).

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.